TL;DR

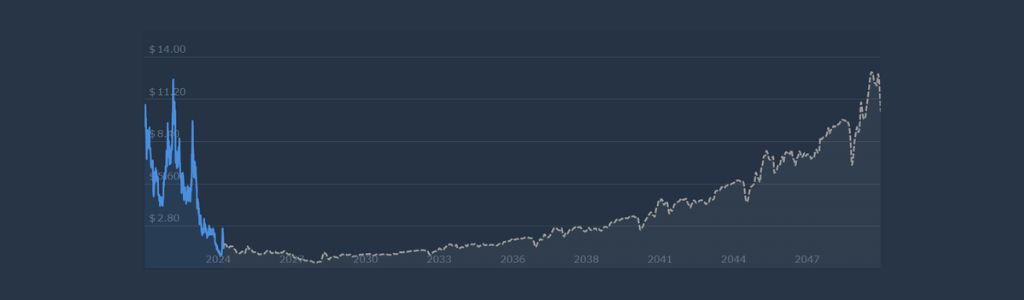

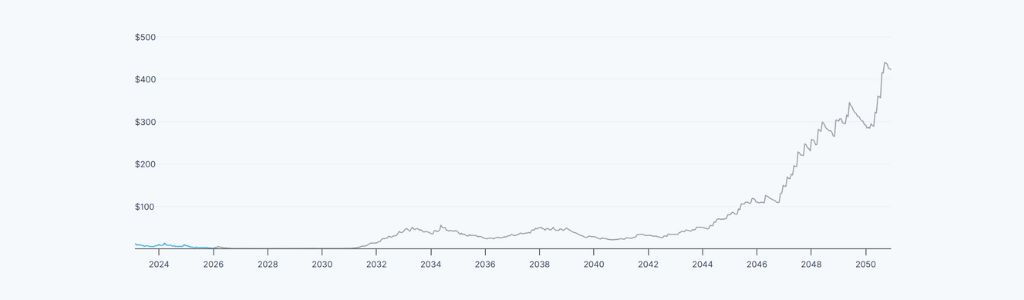

- Market Outlook: AXS shows mixed long‑term projections, ranging from consolidation phases to strong upside scenarios depending on sentiment and liquidity.

- Technical Models: Forecasts vary widely, with some predicting modest ranges while others outline substantial growth potential through 2032.

- Key Drivers: Adoption trends, ecosystem updates, and broader crypto cycles will ultimately shape AXS performance over the coming years.

Axie Infinity stands as one of the most recognizable names in blockchain gaming, blending digital ownership with strategic gameplay through its creature‑based battle system. Built on a play‑to‑earn foundation, the project became a landmark example of how Web3 mechanics can reshape user engagement. Its universe revolves around collectible creatures known as Axies, each represented as a unique NFT that players can breed, trade, and use in competitive modes. This structure helped Axie Infinity evolve from a niche experiment into a global gaming economy supported by an active community and a robust marketplace.

The Role of AXS Within the Network

At the center of this ecosystem lies AXS, the governance and utility token that powers Axie Infinity’s economic framework. AXS enables players to participate in key decisions, access breeding mechanics, and engage with various in‑game and staking features. Its dual function as both a governance asset and a reward mechanism has positioned it as a critical component of the platform’s long‑term sustainability. As Axie Infinity continues refining its infrastructure and expanding its game modes, AXS remains the primary driver of value exchange, community incentives, and ecosystem growth.

Setting the Stage for Long‑Term Forecasts

With ongoing updates, evolving tokenomics, and renewed interest in Web3 gaming, AXS has entered a phase where long‑term valuation models gain relevance. Market sentiment, adoption trends, and broader crypto cycles will all influence its trajectory over the coming years. With this context established, we can now examine how these elements may shape AXS performance across the 2026‑2032 period.

Axie Infinity (AXS) 2026 – 2032 Price Prediction

2026 Axie Infinity: Early‑Cycle Market Outlook

Early projections for 2026 from CoinCodex suggest that the token could experience a relatively narrow trading corridor, with estimates placing its movement between $0.9755 and $1.58. This range points to an annual average near $1.25, a level that aligns with a modest recovery phase for the asset. If market conditions remain stable and user activity maintains a steady pace, this scenario could translate into a potential return on investment of 12.40%.

Youtubers Price Prediction for AXS

A separate set of technical evaluations paints a more expansive picture, projecting a minimum valuation of around $1.71 and a possible peak of $3.27. Under this model, the average trading cost for the year is expected to hover close to $2.41, suggesting stronger momentum if broader crypto sentiment turns favorable.

Crypto4Light Market shared a video on his YouTube Channel where he analyzes AXS’ price action to determine whether or not the token can break past $40 in 2026.

2027 Axie Infinity: Mid‑Term Growth Expectations

Forecasts derived from prior‑year pricing patterns from Changelly suggest that the token may enter 2027 with a relatively contained valuation range. According to these projections, the asset could maintain a minimum level near $1.40, while potential upside may reach approximately $1.64. Under this scenario, the average trading value would sit close to $1.45, indicating a year shaped by gradual movement rather than aggressive volatility.

A more technical interpretation from market analysts points to a significantly wider performance band for 2027, outlining a minimum expectation of around $3.35 and a possible high of $6.87. With an estimated average trading cost of $4.91, this model suggests a stronger acceleration phase if broader market sentiment turns favorable.

2028 Axie Infinity: Adoption Trends and Price Momentum

Early projections from DigitalCoinPrice for 2028 present an unusual setup, with some models suggesting the token could open the year near $0.0837 before stabilizing around $0.36. Although these figures appear disconnected from prior performance, they still represent a notable improvement compared to the previous cycle.

A separate technical outlook offers a far more expansive scenario, estimating a minimum valuation close to $7 and a potential peak reaching $13.59. Under this framework, the average trading level would likely settle near $9.94, pointing to a stronger momentum phase if macro conditions favor risk‑on assets.

2029 Axie Infinity: Evaluating Long‑Range Market Drivers

Forecast models from CoinDataFlow for 2029 indicate that the token could enter a phase of accelerated growth, with experimental projections suggesting a potential increase of 361.76% under favorable conditions. In this scenario, the asset may approach a peak near $6.46, while the lower boundary of expectations sits around $1.42.

A more technically grounded analysis outlines a significantly higher performance band, estimating a minimum valuation close to $13.79 and a possible high reaching $25.55. With an average trading level projected around $19.08, this model suggests a more assertive upward trajectory if macroeconomic conditions support risk‑oriented assets.

2030 Axie Infinity: Strategic Forecast for a Mature Ecosystem

Projections for 2030 suggest that the token could face a period of notable contraction, with estimates placing its trading activity between $0.5924 and $0.9472. Under this model, the average annual price would settle near $0.7458, signaling a challenging phase for long‑term holders. A return on investment of ‑33.76% reflects a scenario where market sentiment may lean toward caution.

A more optimistic technical outlook, however, presents a sharply contrasting picture. Analysts project a minimum valuation of around $25.83 and a potential high reaching $45.95, with an average trading level of $34.95. This model implies that 2030 could also evolve into a year of renewed strength if risk‑on conditions return and ecosystem‑driven demand increases.

2031 Axie Infinity: Late‑Cycle Valuation Scenarios

Expectations for 2031 point toward a relatively contained trading range, with early forecasts suggesting the token may fluctuate between $8.89 and $10.18. Under this model, the average cost for the year would hover near $9.19, indicating a period of measured movement rather than aggressive expansion.

A different analytical perspective introduces a much wider performance band, projecting a minimum valuation of around $0.41 and a potential high reaching $11.35. Within this framework, the token is also expected to surpass $5.34, signaling the possibility of renewed upward pressure if market sentiment strengthens.

2032 Axie Infinity: Long‑Horizon Price Projection Overview

Outlooks for 2032 suggest that Axie Infinity (AXS) could enter a phase of pronounced upward momentum, with experimental models pointing to a potential rise of 310.47% under the most favorable conditions. In this scenario, the asset may approach a high of $5.86, while the lower boundary of expectations sits around $1.80.

A more technically driven analysis presents a dramatically higher valuation spectrum, estimating a minimum level close to $79.94 and a potential peak reaching $133. With an average trading cost projected at around $104, this model implies a scenario where strong market participation and favorable macro conditions could fuel substantial appreciation.

Conclusion

AXS price projections from 2026 to 2032 reveal a landscape shaped by shifting sentiment, evolving tokenomics, and contrasting analytical models. While some scenarios point to consolidation, others highlight strong upside potential. Ultimately, the token’s long‑term trajectory will depend on market conditions, ecosystem progress, and broader crypto cycles.

The Price Predictions published in this article are based on estimates made by industry professionals; they are not investment recommendations, and it should be understood that these predictions may not occur as described.

The content of this article should only be taken as a guide, and you should always carry out your own analysis before making any investment.