TL;DR

- Active USDC addresses on Ethereum hit a record high of 186,000.

- The surge occurs amid a broader crypto correction and declining risk appetite.

- Investors rotate capital from volatile assets into stablecoins to preserve nominal value.

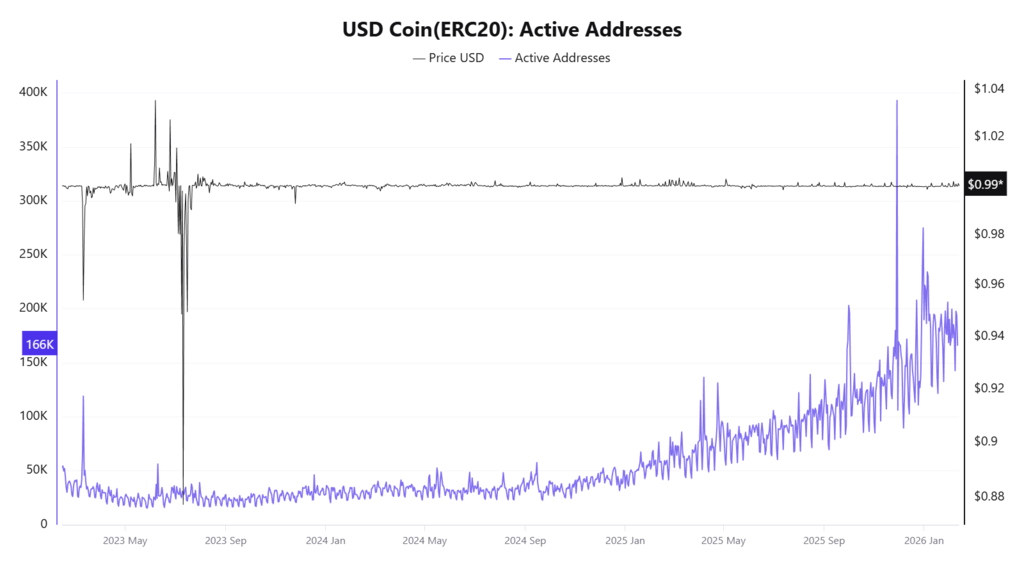

CryptoQuant reports that the 30-day Simple Moving Average of active USD Coin (ERC-20) addresses reaches a new all-time high of 186,000, marking a sharp rise in on-chain stablecoin activity. The increase unfolds while the broader crypto market records price declines and lower risk appetite.

Investors rotate capital into USDC as digital asset valuations weaken. As a result, blockchain data reflects a defensive allocation pattern rather than speculative positioning. Traders reduce exposure to volatile tokens and park liquidity in dollar-pegged instruments to preserve nominal value. Moreover, the steady climb in active addresses signals sustained demand instead of a short-lived spike.

Market participants often treat stablecoins as temporary cash equivalents during corrections. Consequently, rising USDC usage tends to coincide with drawdowns in Bitcoin and altcoins. Current data reinforces that correlation. The magnitude of address growth points to large holders and professional trading desks reallocating funds, not only small retail accounts adjusting portfolios.

Capital rotates toward stablecoins during volatility

Institutional investors frequently prefer USD Coin because issuers publish reserve attestations and operate within established regulatory frameworks. Therefore, sophisticated DeFi participants and centralized trading firms deploy USDC as a liquidity bridge across platforms. Increased wallet interaction suggests active repositioning across exchanges, lending protocols, and derivatives venues.

On-chain metrics provide real-time insight into capital behavior. In contrast to price charts alone, address activity reveals how market actors structure exposure beneath surface volatility. The climb to 186,000 active addresses indicates coordinated capital preservation across multiple venues.

Stablecoin flows often precede renewed risk allocation. However, traders still prioritize liquidity and capital defense in current conditions. If risk appetite returns, capital parked in USDC can quickly rotate back into higher-beta assets. For now, blockchain data confirms a clear risk-off environment anchored by record USDC network activity.