TL;DR

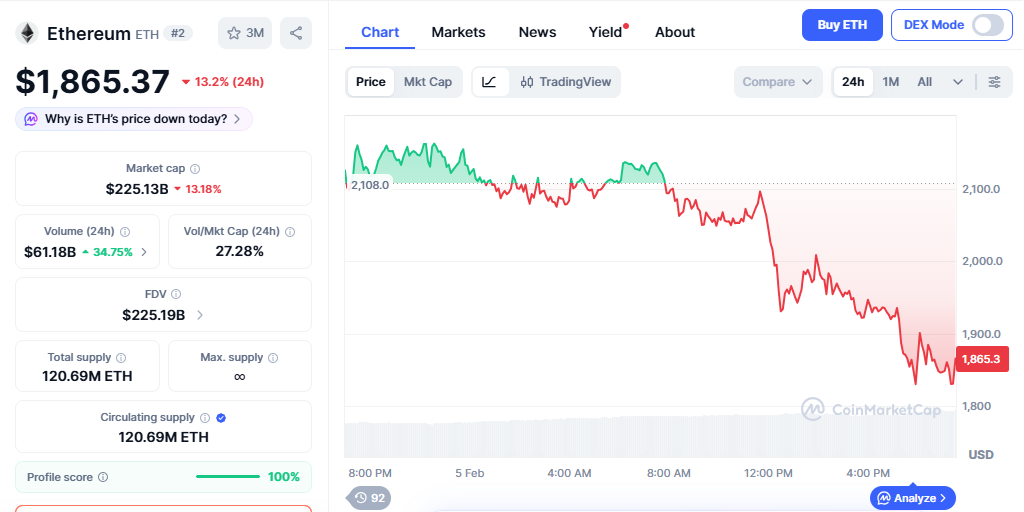

- Ethereum dropped below $2,000, trading near $1,865 with a 13.2% decline in the last 24 hours, reflecting broad risk-off sentiment across global markets.

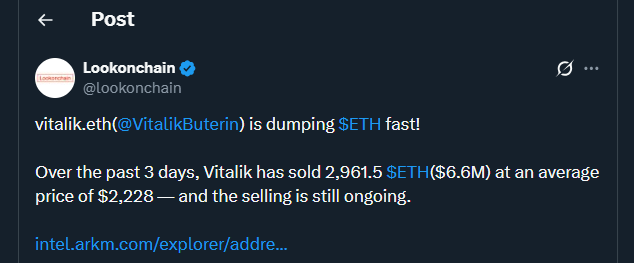

- Vitalik Buterin sold 2,961.5 ETH for around $6.6 million, adding short-term supply pressure.

- Liquidations surpassed $1.44B and ETF outflows indicated cautious institutional positioning amid wider market turbulence.

Ethereum fell under $2,000 on Feb. 5 as a broad crypto sell-off extended to traditional markets. ETH reached $1,865, its lowest level since mid-2025, marking a 13.2% drop in 24 hours and weekly losses close to 30%. Analysts attributed the decline to global deleveraging after investors recalibrated expectations for U.S. monetary policy and economic growth.

Market observers described the downturn as a synchronized move away from risk assets rather than a structural issue in blockchain networks. Equities, commodities, and high-yield bonds also weakened, showing crypto’s correlation with wider liquidity trends. On-chain activity in decentralized finance and stablecoin transfers remained steady, indicating ongoing network usage despite price declines.

Data from Lookonchain showed Ethereum co-founder Vitalik Buterin sold 2,961.5 ETH over three days at an average price near $2,228. Worth roughly $6.6M, the sales were viewed as routine treasury management, though traders reacted nervously in a thin order book. Past instances of similar sales had limited long-term impact once volatility subsided.

Market Pressure Pushes Ethereum Lower

Bitcoin dropped to $65,700, and most altcoins followed the decline. BNB traded near $646, XRP at $1.24, and Solana around $82. Total crypto market capitalization fell to $2.33T with daily trading volume of $259.5B. Some smaller tokens, including Rain and MYX Finance, posted modest gains, showing selective demand amid the broader sell-off.

Ethereum remains highly liquid and often absorbs selling first. Developers continued deploying layer-two upgrades, and transaction fees stayed low despite the price drop. Cheaper ETH could attract new participants to staking and decentralized applications, reinforcing long-term network growth.

Liquidations And ETF Flows Intensify

Over $1.44B in leveraged positions were liquidated within 24 hours, with long positions accounting for $1.23B. Ethereum liquidations reached $338M, Bitcoin $738M, and Solana $77M, affecting more than 304,000 traders.

Spot Bitcoin ETFs saw $544.9M in net outflows on Feb. 4, Ethereum ETFs $79.5M, and Solana ETFs $6.7M. XRP ETFs gained $4.8M in net inflows. The pattern suggested institutions trimmed exposure rather than exiting the market.

Political uncertainty in Washington and weak U.S. tech stocks added pressure. Gold dropped 1.3% and silver 9% after recent highs, reinforcing risk-off behavior across markets.