TL;DR

- Crypto attacks in January reached nearly $400 million, with phishing and social engineering causing the majority of losses.

- DeFi protocols and Layer 1 platforms also experienced attacks, but these were smaller in scale.

- Recovery of stolen funds remains limited, with only about $4.4 million returned to victims, highlighting ongoing challenges in securing both user wallets and protocol infrastructure.

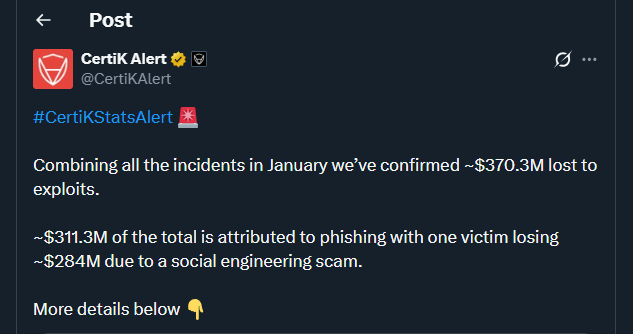

Blockchain security incidents surged at the start of 2026, making January one of the most costly months for crypto users and platforms in recent years. CertiK’s aggregated data reports confirmed losses from exploits, phishing, and scams at roughly $398 million. While protocol-level attacks continued, the majority of damage now stems from user-targeted strategies. Experts note that this trend reflects attackers increasingly leveraging social media platforms, messaging apps, and fake customer support channels to deceive victims.

Phishing And Social Engineering Drive Most Losses

Phishing dominated January’s security incidents, accounting for $311.3 million in losses. A single social engineering case alone resulted in approximately $284 million stolen, ranking among the largest individual crypto thefts on record.

Other attack types contributed smaller amounts. DeFi-related exploits caused $50.4 million in losses, address poisoning cost $12.9 million, and Layer 1 protocol vulnerabilities accounted for $6.2 million. Wallet drainers added another $4.7 million in losses. The range of attacks also included sophisticated scam websites and impersonation tactics, indicating that attackers increasingly target human behavior rather than technical flaws, exploiting trust, urgency, and interface deception.

Largest Exploits And Protocol Impacts

January’s incidents were unevenly distributed, with the largest confirmed exploit totaling $27.3 million, followed by another at $26.7 million. Additional high-impact events included $13.3 million, $6.2 million, and $4.2 million losses. Code vulnerabilities contributed $52.4 million, while price manipulation and exit scams had limited impact, around $1 million and under $0.5 million respectively.

Recovery of stolen funds remained minimal, with only $4.4 million returned to victims. The difficulty reflects how quickly assets move through mixers, bridges, or cross-chain swaps. Despite this, many audited protocols remained resilient, and ongoing adoption of wallet protections, multi-layered security measures, and real-time monitoring tools helps reduce long-term risk.

The January data highlights that while protocol security is crucial, safeguarding users is equally important. Stronger wallet practices, transaction verification tools, and education on phishing threats complement audits and monitoring, helping to reduce losses while supporting innovation in the crypto sector.