TL;DR:

- 2018 emails link Jeffrey Epstein to former SEC Chair Gary Gensler, suggesting potential academic and political influences.

- 2014 documents indicate that Ripple was labeled a “threat” to the Bitcoin ecosystem by investors tied to Epstein.

- Ripple CTO David Schwartz suggests these revelations might only be the tip of the iceberg of a larger conspiracy.

The new leaks from the “Epstein Files” have shaken the crypto community. These files suggest an alleged link between Jeffrey Epstein and former SEC Chair Gary Gensler. With these revelations, new doubts arise regarding impartiality in the Ripple vs. SEC case, suggesting that certain projects may have been deliberately targeted.

In the newly leaked emails dated 2018, Epstein reportedly described Gensler as “pretty smart” and mentioned his political ambitions and interest in digital currencies. Although Gensler took over as head of the SEC after Epstein’s death, academic connections at MIT have raised suspicions about potential external pressures.

Furthermore, the correspondence reveals that in 2014, both Stellar and Ripple were categorized as “bad for the ecosystem” by figures related to Blockstream. This narrative reinforces the theory that Ripple was not a marginal experiment but a real threat to the dominant Bitcoin infrastructure at that time.

Ripple as a Threat and the Impact on Market Perception

Regarding the matter, Ripple’s Chief Technology Officer, David Schwartz, took to social media to express his concern. He warned that these leaks might only be the start of a deeper plot. For many XRP followers, this confirms that regulatory persecution could have had competitive motivations rather than purely legal ones.

🚨 EXPOSED: #SEC motives exposed in #EpsteinFiles – Gary Gensler used as Pawn

— ᙢinus ᙡells (@MinusWells) February 1, 2026

In the shadowy symphony of elite entanglements, Jeffrey Epstein allegedly played puppet master, scoring Gary Gensler a plum MIT perch under Joichi Ito, all courtesy of their mutual Clinton confab… https://t.co/zMCRg08wks pic.twitter.com/WigBWp8gJ1

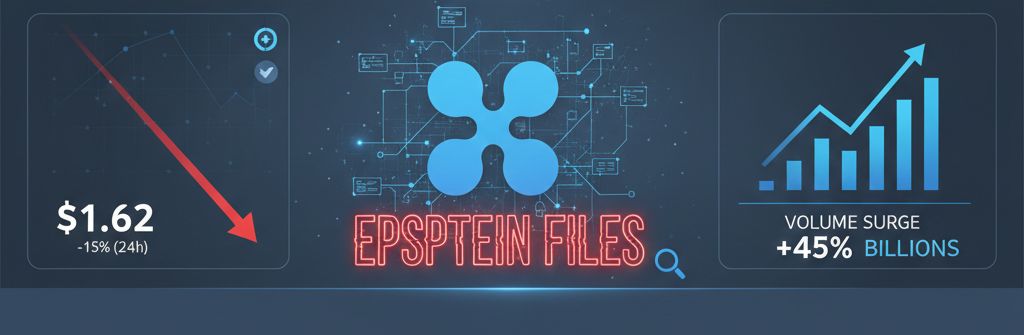

Despite the conspiracy theories, the investor community’s reaction was one of optimism regarding XRP’s long-term potential. However, the token’s price dropped 15% in the last 24 hours, trading near $1.62 amid general market volatility.

In summary, the Ripple vs. SEC case is entering a phase of unprecedented public scrutiny due to these indirect connections to Epstein. Analysts are now waiting for more documents that could clarify whether these influences truly shaped the regulatory policy that has affected the industry for years.