Q2 and Q3 of 2025 marked the strongest period of the year for crypto markets. Bitcoin surged from its April low of $76,332 to $114,020 by the end of Q3, while Ethereum climbed from $1,474 to $4,146 by September 30.

Source: Coinglass

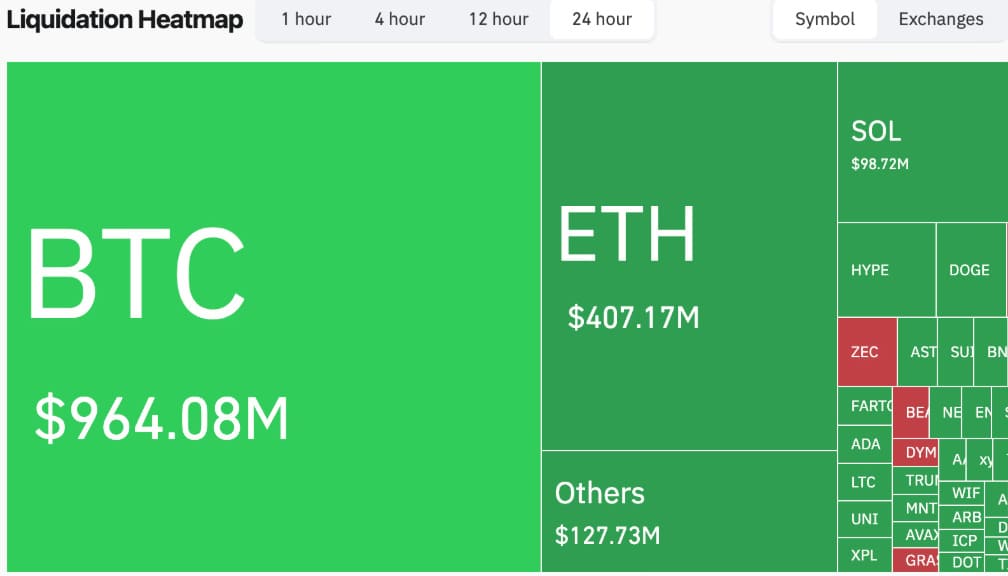

That momentum reversed sharply in Q4. On October 10, the crypto derivatives market experienced a major liquidation event, liquidating over $19 billion in leveraged positions within a single day. Some analysts estimate the real figure may have reached $30 billion, citing underreported liquidations across centralized exchanges.

By mid-November, Bitcoin and other major digital assets were under sustained pressure. Bitcoin accounted for a significant portion of the drawdown when it briefly fell into the low $80,000 range. These declines were accompanied by rapid forced liquidations, frequently exceeding $2 billion in a 24-hour period, largely from long positions unable to withstand accelerating downside momentum.

Ethereum and broader altcoin markets followed a similar pattern. On one day alone, over $407 million in Ethereum long positions were liquidated within 24 hours as the price fell below $2,700.

Source: Coinglass

December Shows a Different Pattern

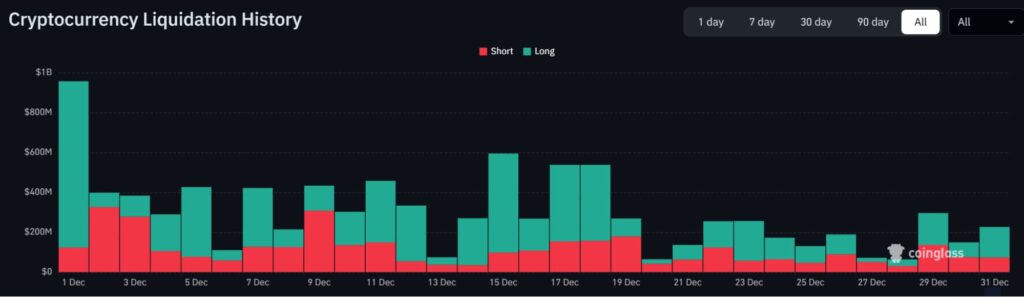

After the heavy liquidations of October and November, market expectations leaned toward a broad withdrawal from crypto derivatives activity in December. Instead, available data suggests a more nuanced shift. Risk exposure declined, but participation did not disappear.

Rather than exiting positions entirely, traders appeared to adopt a more deliberate approach to risk management. Behavioral data supports this interpretation. According to the December report from Leverage.Trading, derivatives traders significantly increased their use of risk-monitoring tools during the month. The publisher recorded a 35–45% rise in liquidation-risk checks in early December, followed by a 20–30% increase in leverage-related activity and a 30–40% rise in futures-related engagement as traders adjusted their exposure.

This behavior aligns with liquidation data from Coinglass, which shows that daily liquidation volumes remained subdued throughout most of December. Unlike the billion-dollar cascades seen in prior months, liquidations across major assets such as Bitcoin and Ethereum generally stayed below $500 million per day. Such levels typically indicate active position management rather than forced deleveraging.

Importantly, liquidation volumes fell to multi-month lows after the first week of December, reinforcing the view that traders were actively reducing risk rather than being pushed out by volatility.

Source: Coinglass

Conclusion

Taken together, the available data suggests that the fourth-quarter drawdown did not lead to a structural withdrawal from crypto derivatives markets. Instead, it appears to have marked a period of recalibration following the elevated leverage conditions observed earlier in the year.

After excess risk was unwound through widespread liquidations in October and November, December reflected a shift toward more measured exposure. Liquidation volumes declined, volatility became less disruptive, and traders appeared to place greater emphasis on monitoring and managing leverage rather than aggressively expanding positions.

While market conditions remain fluid and subject to rapid change, the quieter derivatives environment seen in December points to a transitional phase. Rather than signaling capitulation, it may indicate a market adapting to tighter risk parameters, where capital preservation and disciplined positioning take precedence over maximal leverage.

The information presented in this article is for informational purposes only and should not be interpreted as investment advice. The cryptocurrency market is highly volatile and may involve significant risks. We recommend conducting your own analysis.