TL;DR:

- Bitwise has registered a legal trust in Delaware under the name Bitwise Uniswap ETF, paving the way for a future exchange-traded fund.

- This move follows the conclusion of the SEC investigation into Uniswap Labs in February 2025, clearing a portion of the regulatory landscape.

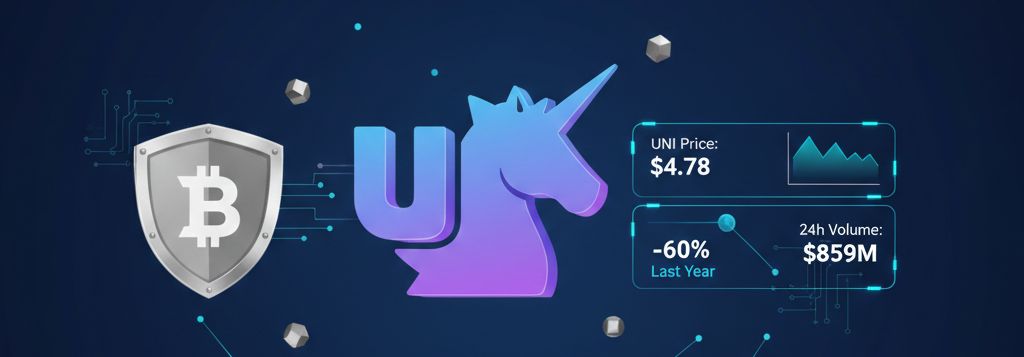

- Despite institutional interest, the UNI token faces governance challenges and a 60% price decline over the past year.

Bitwise recently registered a statutory trust in Delaware under the name Bitwise Uniswap ETF. This legal action serves as a preparatory vehicle that will allow the firm to move toward a formal application with the SEC.

🚨 UPDATE: Bitwise registers for a $UNI ETF in Delaware, indicating filing may come soon. pic.twitter.com/4ObJo38PBv

— CW (@CW8900) January 28, 2026

It is worth noting that such registrations are standard procedural moves within the financial industry. At times, these entities remain dormant for months or even years until market conditions and regulations favor an official launch.

This institutional progress comes nearly a year after the SEC closed its investigation into Uniswap Labs in February 2025. With doubts regarding the protocol’s legality resolved, the current debate focuses on the liquidity and pricing mechanisms required for such a financial product.

Governance Challenges and Market Performance for UNI

However, the path toward a Bitwise Uniswap ETF is not without technical and operational hurdles. Uniswap’s decentralized structure presents challenges for regulatory oversight, especially following the recent unification of the Uniswap Foundation with Uniswap Labs.

On the other hand, UNI token performance has shown weakness, trading near $4.78 with a significant loss in market capitalization. Despite the bearish pressure, network activity remains robust, processing transaction volumes exceeding $850 million daily.

In summary, analysts suggest that the current extreme pessimism surrounding UNI could precede a technical rebound. Meanwhile, Bitwise’s registration positions Uniswap at the center of institutional interest, pending further clarity on the DeFi market structure in the United States.