The crypto payments sector is entering a new phase in 2026, shaped by regulatory clarity, stablecoin growth, and shifting user expectations. While Ripple played a central role in establishing the original cross-border payments narrative, newer platforms are now exploring consumer-focused models that blend traditional finance and blockchain infrastructure.

Within this context, Digitap ($TAP) has emerged as an early-stage payments platform positioned around everyday usage rather than institutional settlement. As interest grows around PayFi and stablecoin-based transactions, market participants are increasingly comparing established networks like XRP with newer banking-oriented crypto projects.

This article outlines how Ripple and Digitap represent two different stages and strategies within the crypto payments landscape.

Ripple (XRP): Early Infrastructure for Cross-Border Payments

XRP remains one of the most established digital assets associated with cross-border payments. Built to support fast settlement and liquidity for financial institutions, the Ripple ecosystem has focused primarily on bank integrations and enterprise-level payment rails.

A recent development within the Ripple ecosystem is the introduction of its stablecoin, RLUSD. This move reflects a broader industry trend, as stablecoins increasingly become the preferred medium for on-chain payments and settlement. Ripple’s expansion beyond its original ledger highlights how payment infrastructure is adapting to changes in market demand.

From a market perspective, XRP operates within a mature valuation range and is widely distributed across global exchanges. This places it in a different category from early-stage payment projects, particularly as stablecoins reduce reliance on intermediary settlement tokens for some use cases.

What Is Digitap ($TAP)?

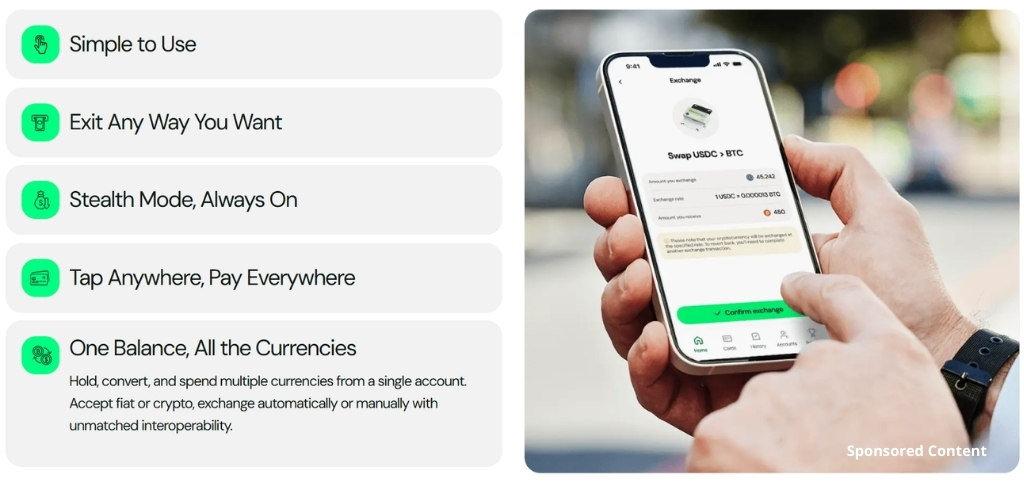

Digitap is an early-stage omni-banking platform designed to integrate fiat and crypto within a single application. Its stated goal is to simplify how users manage digital assets and traditional currencies by offering a unified interface rather than separate tools for banking and crypto activity.

The platform supports multiple cryptocurrencies and fiat currencies, enabling users to hold, transfer, and convert funds across borders. Its core design centers on multi-rail settlement, combining traditional banking infrastructure with blockchain networks. This approach reflects a shift toward consumer-oriented financial tools rather than institution-only payment systems.

Digitap has reported early funding participation during its presale phase, which the project describes as support for product development and ecosystem growth rather than immediate market trading.

Product Design and Network Integrations

A key feature of Digitap’s platform is its emphasis on usability. By offering a single dashboard for both fiat and crypto balances, the system aims to reduce friction commonly associated with managing assets across multiple applications.

Digitap also includes card-based payment functionality through established payment networks such as Visa, allowing users to spend digital assets in traditional commerce environments without requiring separate off-ramping processes.

More recently, the platform announced support for deposits via the Solana network. This integration allows users to access faster settlement times and lower transaction costs for supported assets, aligning with broader trends toward scalable blockchain infrastructure for payments.

Token Utility and Platform Economics

The $TAP token functions as an internal utility asset within the Digitap ecosystem. According to project documentation, it is intended to support staking participation, fee structures, and incentive mechanisms tied to platform usage.

Digitap has outlined a model in which a portion of platform revenue may be allocated toward token-related mechanisms, such as staking rewards or supply management. These features are positioned as part of the platform’s long-term sustainability rather than short-term market performance.

As with any early-stage crypto project, the practical impact of these mechanisms will depend on adoption levels, regulatory developments, and continued product execution.

Digitap and XRP: Different Roles in the Payments Market

Ripple and Digitap address payments from different angles. XRP was developed primarily to serve institutional settlement needs and interbank transfers. Digitap, by contrast, focuses on consumer-facing financial access, emphasizing usability, stablecoins, and everyday transaction flows.

These distinctions reflect a broader evolution within crypto payments. While early networks concentrated on infrastructure for financial institutions, newer platforms are experimenting with user-centric financial products that resemble digital banking applications.

Rather than replacing established networks, projects like Digitap illustrate how the payments sector continues to diversify as blockchain adoption expands into new user segments.

Conclusion

The crypto payments market in 2026 is no longer defined by a single model. Established assets like XRP continue to play a role in institutional settlement and cross-border infrastructure, while emerging platforms such as Digitap explore consumer-focused approaches built around stablecoins, usability, and integrated financial services.

Digitap represents an early attempt to combine crypto and traditional banking features within a single platform. Its long-term relevance will depend on regulatory alignment, product adoption, and execution consistency rather than short-term market dynamics.

As the payments sector evolves, comparisons between legacy networks and newer platforms offer insight into how blockchain-based finance is adapting to real-world use cases.

More Information

Presale: https://presale.digitap.app

Website: https://digitap.app

Socials: https://linktr.ee/digitap.app

This article contains information about a cryptocurrency presale. Crypto Economy is not associated with the project. As with any initiative within the crypto ecosystem, we encourage users to do their own research before participating, carefully considering both the potential and the risks involved. This content is for informational purposes only and does not constitute investment advice.