TL;DR

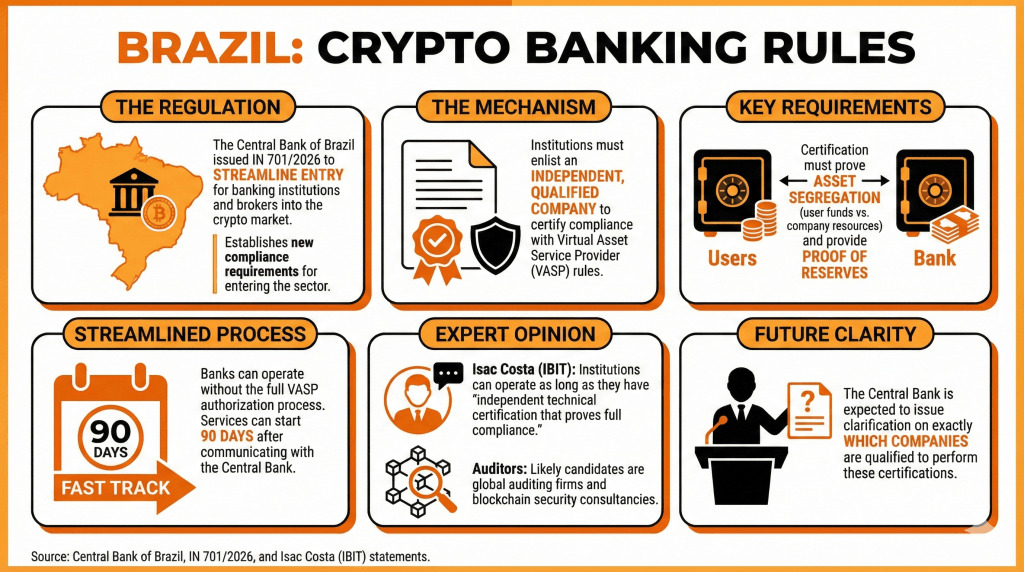

- Brazil’s Central Bank issued new rules (IN 701/2026) for banks entering crypto.

- Institutions can now use external certification to bypass a full authorization process.

- They can start operations 90 days after notifying the regulator with certification.

Brazil moves closer to a clearer institutional crypto framework after the Central Bank of Brazil released Normative Instruction 701/2026, a rule set that reshapes how banks and brokers enter digital asset services. The regulation narrows attention to operational controls, custody standards, and verified reserves, while reducing administrative friction for traditional financial players.

Under IN 701/2026, banks and brokerage firms must hire an independent and qualified certifier before offering crypto-related products. The certifier verifies compliance with requirements applied to virtual asset service providers.

The core obligation centers on asset segregation, a rule that keeps client funds separate from company capital. The Central Bank also demands proof of reserves covering all digital assets held on behalf of users and the institution itself.

Institutions can start operations after 90 days of formal notice to the Central Bank, as long as an external technical certification accompanies the request. Oversight remains in place, yet the first compliance review shifts to specialized auditors. As a result, regulated entities gain faster access without bypassing control standards.

External audits shape crypto banking access

Isac Costa, professor and director of the Brazilian Institute of Technology and Innovation, explained that the certification model allows banks to operate without completing the full authorization process required for standard crypto service providers. Costa stated that experienced auditors will likely handle verification duties, including custody controls, system security, and reserve checks.

The regulation does not name eligible certifying firms

Market analysis points toward global audit firms with crypto practices, security consultancies focused on blockchain custody, and regulatory advisors with proven technical capacity. The Central Bank may release further guidance to clarify who can certify institutions, a step that would add consistency during onboarding.