TL;DR

- Forward Industries holds 6.9M SOL, facing a 46% unrealized loss.

- Multiple firms report millions in unrealized losses on their SOL holdings.

- Despite losses, large-scale selling hasn’t occurred; Solana staking ratios are high.

Companies that adopted Solana (SOL) as a digital treasury asset face mounting pressure after price weakness in January forced a halt in new purchases and expanded unrealized losses across corporate balance sheets. The downturn tested the resilience of treasury strategies built around direct exposure to volatile crypto assets.

Among the most exposed firms stands Forward Industries, which holds the largest known SOL position within the corporate treasury segment. Market data indicates that the company controls more than 6.9 million SOL, equal to roughly 1.12% of total supply.

Forward Industries acquired the tokens at an aggregate cost near $1.59 billion. With SOL trading close to $128, the current valuation falls near $885 million, leaving unrealized losses above $700 million, or a decline of about 46%.

“Since inception, the Company’s validator infrastructure has generated 6.73% gross annual percentage yield (APY) before fees, outperforming top peer validators. Nearly all of the Company’s SOL holdings are currently staked,” Forward Industries reported.

The scale of the drawdown explains the decision to pause additional SOL accumulation. Even so, the company has not reduced its position. Part of the impact is offset by validator income. Since launching its Solana treasury plan in September 2025, Forward Industries has generated over 133,450 SOL in staking rewards. The firm reports a 6.73% gross annual yield before fees, exceeding several peer validators. Still, the reward flow remains small compared with the size of current losses.

The decline in SOL also weighed on FWDI shares

Since the company disclosed its SOL purchases, the stock has dropped more than 80%, reflecting investor concern over balance-sheet risk tied to token prices. Similar stress appears across other firms that adopted the digital asset treasury model.

Upexi reports unrealized losses of more than $47 million, equal to 15.5%. Sharps Technology faces losses exceeding $133 million, around 34%. Galaxy Digital Holdings shows unrealized losses above $52 million, or 38%. Together, the figures highlight how price volatility can weaken corporate financial positions in short order.

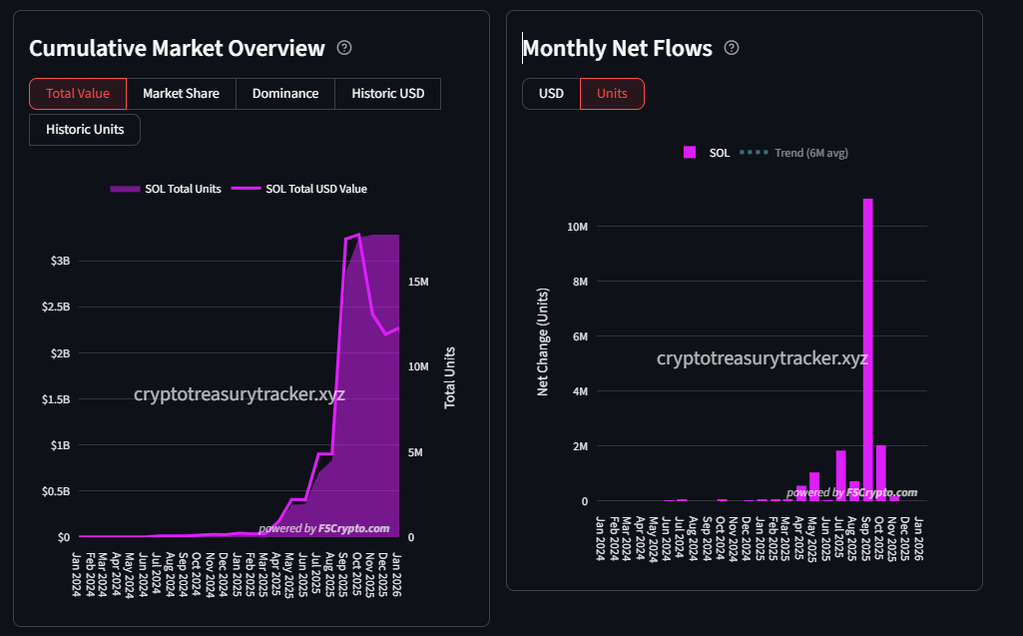

A sustained break below $120, a long-standing support area, could open a move toward $70. Such a decline would sharply expand unrealized losses across treasuries. Recent flow data supports caution. Solana-linked ETFs posted their first outflows in several weeks, while corporate accumulation stalled near 17.7 million SOL over the past two months.

Forward Industries continues to express confidence in Solana’s long-term value and points to an aggressive technical upgrade schedule spanning consensus and infrastructure. Management frames the plan as a bid to position Solana as a high-throughput financial network capable of supporting institutional workloads.

Token Terminal reports a staking ratio near 70%, the highest level on record, with total staked value close to $60 billion. High participation in staking strengthens network security and reduces liquid supply, factors that may temper immediate selling pressure.

SOL price action over the coming weeks will clarify whether treasury firms maintain the pause or reenter the market. For now, the episode underscores the exposure embedded in crypto-based treasury models during downturns, even when operational metrics across the network remain strong.