Ethereum enters 2026 with a changing market structure. Validator entry and exit queues have largely cleared, allowing ETH to move into and out of staking with minimal delay. As a result, market discussions are shifting from scarcity-driven narratives toward broader valuation frameworks.

At the same time, Zero Knowledge Proof (ZKP) is being evaluated primarily through a technology and privacy lens rather than short-term price movements. Built on zero-knowledge cryptography, the project aims to support privacy-preserving computation for regulated data environments and AI workloads. As capital becomes more selective in 2026, this contrast shapes how different crypto infrastructure models are assessed.

Ethereum Network Activity Reflects Maturity Rather Than Rapid Expansion

The clearing of Ethereum’s staking queues reflects long-term network maturity rather than a short-term anomaly. Key factors shaping Ethereum price outlook include:

- Staking returns near 3%, significantly lower than earlier cycle expectations

- Approximately 30% of ETH supply currently staked, below earlier projections near 50%

- Validator queues near zero, allowing faster exits

- ETH increasingly functioning as a flexible yield instrument rather than a one-way lockup

While staking still limits immediate sell pressure, this weakens the supply-shock thesis that previously supported aggressive upside scenarios.

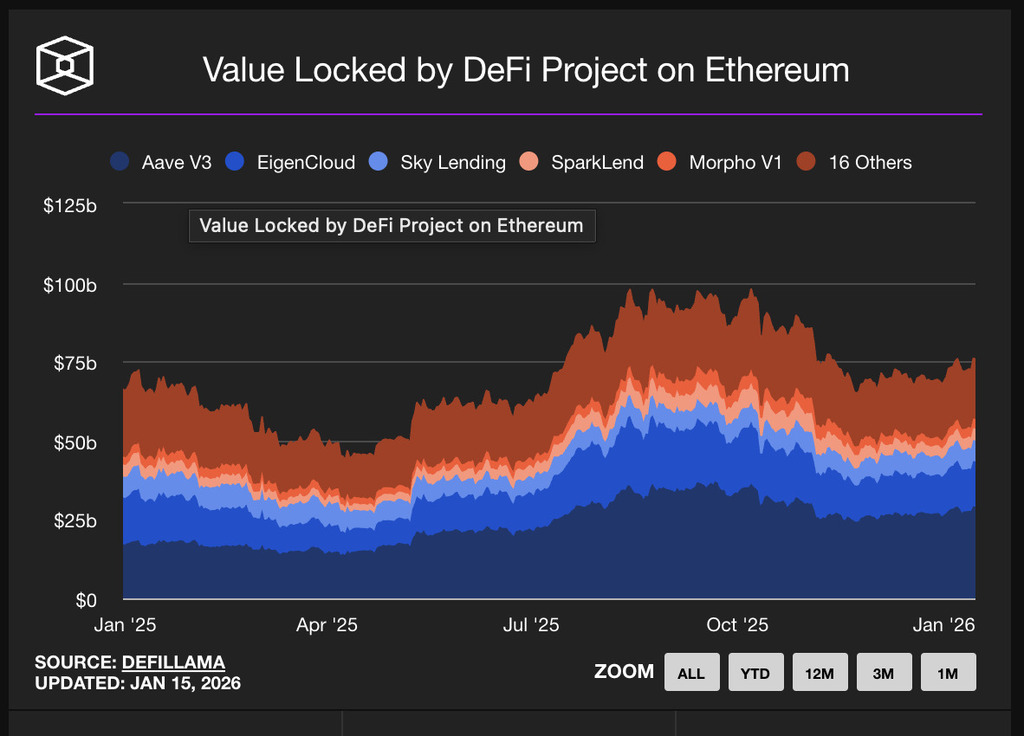

DeFi Value Remains High but Is More Dispersed Across Networks

Ethereum continues to serve as the largest base layer for decentralized finance, with approximately $74 billion in total value locked, though this remains below the $106 billion peak reached in 2021. Meanwhile, daily active addresses have nearly doubled since that period.

However, value capture has become more distributed:

- Ethereum still holds approximately 58% of total DeFi TVL

- Growth is increasingly shared with networks such as Solana, Base, and Bitcoin-based DeFi

- Layer-2 adoption improves usability but dilutes base-layer fee concentration

For Ethereum price outlook models, this dispersion introduces complexity compared to earlier cycles where value capture was more centralized.

Zero Knowledge Proof Emphasizes Privacy-Focused Infrastructure

Rather than competing primarily on transaction speed or fee reductions, Zero Knowledge Proof is structured to enable verifiable computation without exposing underlying data. As regulatory standards tighten and AI systems process increasingly sensitive information, privacy-preserving systems are becoming core infrastructure rather than optional features.

Zero Knowledge Proof reflects this shift by emphasizing:

- Zero-knowledge proofs as a native execution layer

- Privacy-by-design computation models

- Compatibility with regulated and enterprise data workflows

- Technology deployment prior to broad public participation

This positions the project outside conventional layer-1 competition narratives. References to ZKP as one of the largest privacy-focused infrastructure efforts relate to its scale of development investment and execution timeline rather than market capitalization.

Zero Knowledge Proof’s Build-First Development Approach

ZKP has followed a build-first strategy, allocating approximately $100 million toward infrastructure prior to public access. This includes foundational systems, privacy layers, and operational frameworks.

Key characteristics of this approach include:

- Significant capital deployed before token distribution, reducing delivery uncertainty

- A multi-layer architecture centered on zero-knowledge computation

- A long-duration distribution framework designed to limit early concentration

- A publicly stated long-term funding target reflecting scope rather than completion

This model shifts risk away from whether the system will be built and toward how adoption evolves over time.

Is Zero Knowledge Proof Worth Evaluating at This Stage?

ZKP is increasingly discussed in structural rather than speculative terms. Observers highlight:

- Privacy as core infrastructure rather than a secondary feature

- Distribution mechanics intended to reduce early concentration risk

- Direct relevance to AI and compliance-driven computation

- Lower execution risk due to capital already deployed

- Long-term demand drivers extending beyond short-term market cycles

As blockchain use cases expand beyond financial speculation, privacy-preserving computation is likely to become foundational rather than optional.

The Bottom Line

Ethereum’s settled staking dynamics reflect a mature network. ETH remains central to decentralized finance, but its price behavior is now shaped more by balance forces, distributed value capture, and policy sensitivity than by scarcity alone.

Zero Knowledge Proof represents a different development trajectory. As market participants increasingly evaluate dilution, insider advantages, and delivery risk, infrastructure projects built around privacy, verifiability, and long-term relevance are receiving closer scrutiny. The contrast between legacy valuation narratives and future-aligned infrastructure models continues to widen in 2026.

Explore Zero Knowledge Proof:

Website: https://zkp.com/

Presale Auction: https://auction.zkp.com/

X: https://x.com/ZKPofficial

Telegram: https://t.me/ZKPofficial

FAQs

Which privacy-focused crypto projects are being discussed for 2026?

Zero Knowledge Proof is frequently referenced due to its privacy-first architecture and focus on verifiable computation.

Why has Ethereum’s staking narrative changed?

Cleared validator queues and yields near 3% have shifted ETH away from scarcity-based valuation models.

Does higher DeFi TVL guarantee ETH price appreciation?

No. Value dispersion across layer-2s and competing networks can dilute direct base-layer value capture.

What structurally differentiates Zero Knowledge Proof?

Its build-first funding model, privacy-centered design, and long-duration distribution framework reduce early execution risk while emphasizing long-term infrastructure development.

This article contains information about a cryptocurrency presale. Crypto Economy is not associated with the project. As with any initiative within the crypto ecosystem, we encourage users to do their own research before participating, carefully considering both the potential and the risks involved. This content is for informational purposes only and does not constitute investment advice.