TL;DR

- Iran’s crypto ecosystem was valued at over $7.78 billion in 2025.

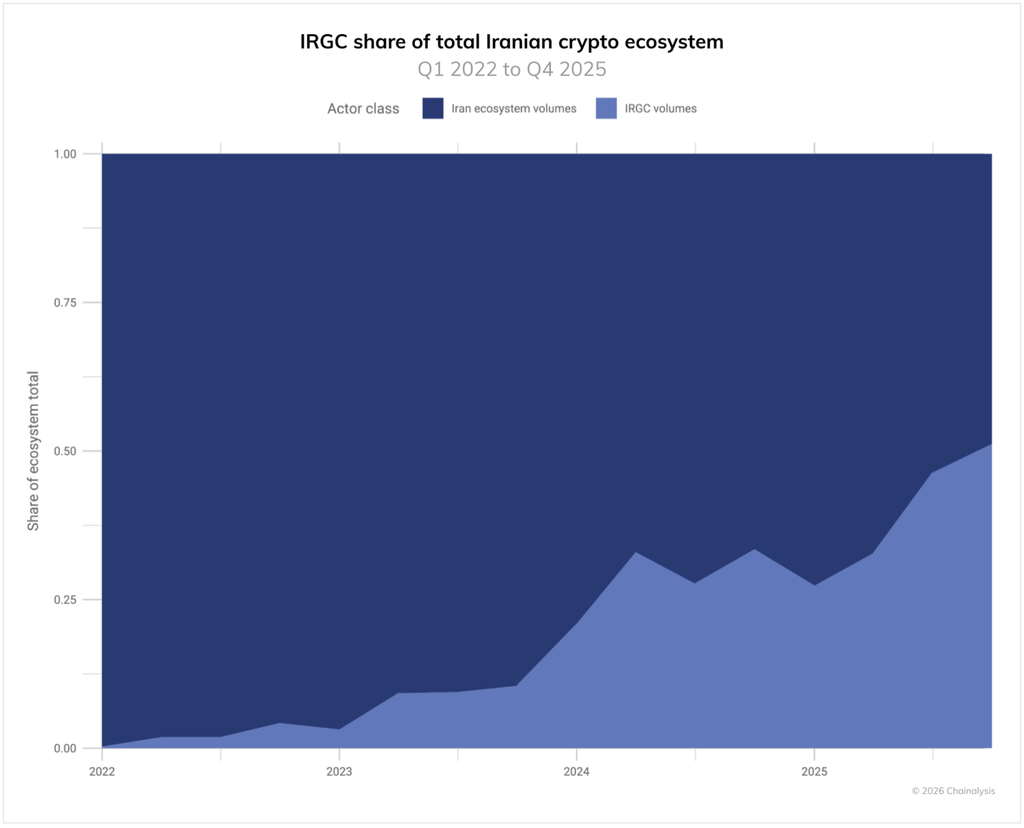

- Wallets linked to the IRGC controlled about half of all transaction volume.

- Citizens increased self-custody of crypto during protests and economic instability.

A new analysis from blockchain forensics firm Chainalysis quantifies crypto activity in Iran. The ecosystem reached a value of over $7.78 billion in 2025. On-chain activity showed sharp spikes during geopolitical events and internal crises, according to the report.

The research indicates that wallets linked to the Islamic Revolutionary Guard Corps (IRGC) concentrated a substantial portion of the volume. In the fourth quarter of the year, these addresses received approximately 50% of the total value moved by Iranian addresses. Chainalysis observed that this share has increased over time, in parallel with the expansion of the group’s economic influence.

Citizen Activity and Behavior During Protests

For citizens, cryptocurrencies represent a critical financial alternative. The report cites accelerating weakness of the local currency, high inflation, and external pressures as driving factors. The blockchain offers a financial lifeline outside the traditional system.

The analysis also detected a shift in retail behavior during recent periods of unrest. Chainalysis observed substantial increases in transfers to personal wallets during the mass protest movement. The most pronounced move corresponded to withdrawals of bitcoin from Iranian exchanges.

The firm describes this pattern as a possible “flight to safety” amid instability. Citizens moved funds to self-custody wallets during times of social tension. This activity reflects the use of crypto assets as a refuge by the general population, separate from institutional activities.

The Chainalysis report adds to a broader body of research on state-level on-chain activity. Its latest crypto crime report estimated that illicit addresses received at least $154 billion in 2025. A key factor was a 694% increase in value received by sanctioned entities.

Other external investigations have examined Iran-linked financing

TRM Labs detailed in a recent case study that two UK-registered entities processed around $1 billion in funds connected to the IRGC. Press reports have also indicated that Iranian authorities are considering cryptocurrency payments to evade sanctions in specific transactions.

Iran’s on-chain activity demonstrates the duality of the technology. It functions as a tool for the population facing a struggling economy and, simultaneously, as a channel for sanctioned actors. The data shows that volumes are growing on both fronts, driven by political and economic events.