As the crypto market enters early 2026, attention is gradually returning to early-stage projects as regulatory discussions and broader market positioning evolve. Rather than reacting to short-term price movements, many market participants are reviewing presales that present clearly defined utility models and transparent participation structures.

In mid-January 2026, renewed regulatory dialogue in the United States added context to this shift. Lawmakers introduced draft proposals aimed at clarifying oversight of digital assets and spot markets, prompting broader discussion across major financial and crypto media outlets. Historically, periods of regulatory signaling often coincide with increased interest in early-stage blockchain initiatives.

Within this environment, IPO Genie ($IPO) has emerged as one of the crypto presales being monitored by market observers during Q1 2026.

Key Information at a Glance

- IPO Genie ($IPO) is conducting a multi-stage presale with phase-based pricing

- The presale price is listed at approximately $0.00011390 at the time of writing

- The project proposes token-gated access to curated private and pre-IPO opportunities

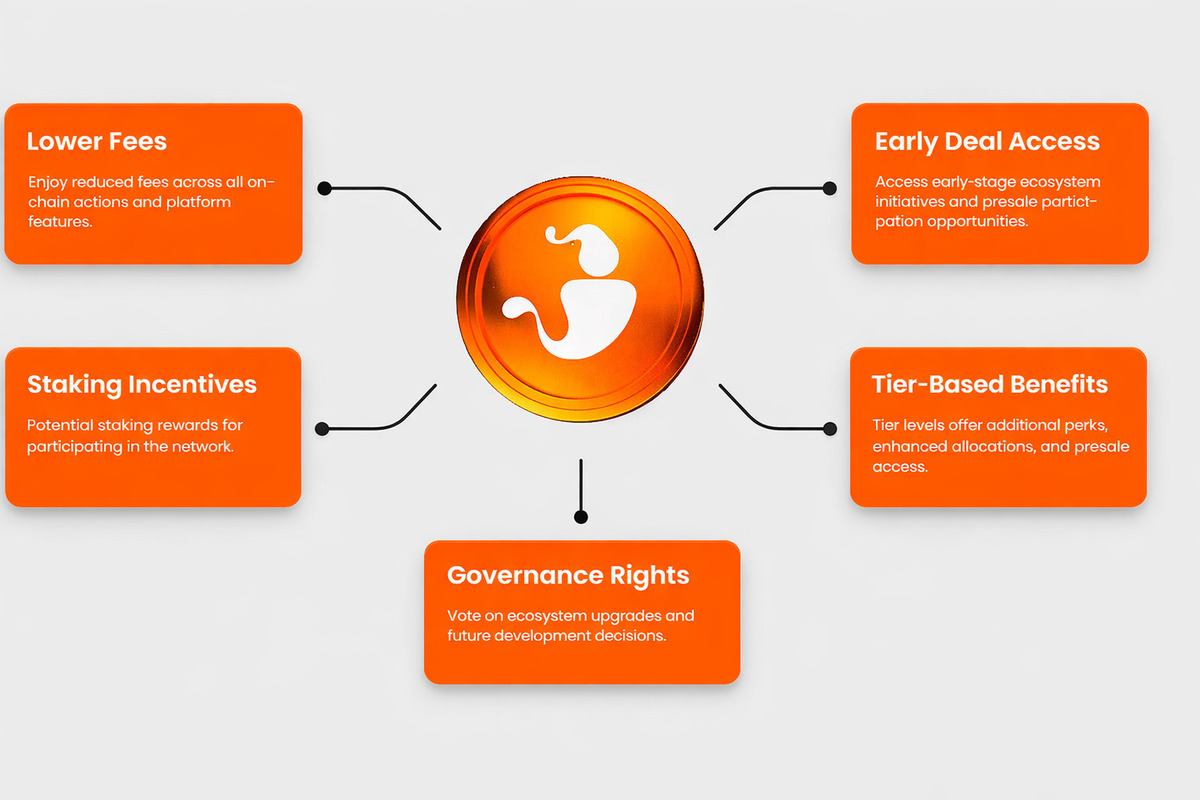

- Utility is structured around access tiers, staking mechanisms, and governance participation

- Presale phases and participation terms are outlined in the project documentation

Why Early 2026 Is Drawing Attention to Presales

Interest in presales is not driven solely by market optimism. In many cases, participants are applying more selective criteria, prioritizing projects that articulate demand, access, or operational relevance beyond speculative narratives.

Regulatory discussions often act as a catalyst for this behavior. While legislative processes remain ongoing and uncertain, directional clarity can influence sentiment and encourage evaluation of higher-risk, early-stage opportunities.

At the same time, access to private markets remains limited for most participants. Projects attempting to bridge traditional private investment concepts with blockchain-based access models have increasingly become part of presale discussions in early 2026.

IPO Genie’s Proposed Utility Model

According to project materials, holding $IPO may unlock tier-based participation levels. Higher tiers are associated with expanded access parameters and additional platform features, which may include staking mechanisms and governance participation.

The project does not frame its model around long-term lockups traditionally associated with private investing, instead emphasizing flexibility within its proposed access structure.

Presale Structure and Staging

IPO Genie’s presale follows a staged format, with token pricing adjusting as phases progress. This structure allows participants to evaluate entry points based on documented milestones rather than sudden price shifts.

Current Presale Details (as listed)

- Presale price (current phase): approximately $0.00011390

- Core function: token-gated access to private and pre-IPO opportunities

- Utility components: access tiers, staking features, governance participation, and fee-linked mechanisms described in the whitepaper

This staged approach is intended to provide visibility into how participation evolves over time.

Contextual Comparison With Other Presale Models

Market participants often review multiple projects before engaging in any presale. In this context, IPO Genie is sometimes evaluated alongside projects with different value propositions.

- Some presales focus primarily on infrastructure scaling or network narratives

- Others emphasize mining participation or ecosystem expansion post-launch

- IPO Genie’s model centers on access and participation as the primary holding rationale

This distinction places it in a different category from projects whose demand is largely dependent on post-launch adoption metrics.

Market Timing Considerations in January 2026

January 2026 has not been a quiet period for crypto policy discussions. While regulatory outcomes remain uncertain, market behavior often responds to perceived direction rather than finalized frameworks.

During such periods, presales with clearly described roles and transparent structures may receive increased analytical attention. For observers assessing early-stage projects, the central question often remains whether token utility can be summarized clearly and evaluated independently of market hype.

IPO Genie’s proposed utility is framed around access-based participation rather than short-term price narratives.

Community Activity and Participation Framework

IPO Genie has incorporated community engagement initiatives and tier-based participation milestones within its presale structure. These elements are presented as part of the project’s participation model rather than performance indicators.

Tier thresholds are outlined in project materials and are designed to define access levels rather than guarantee outcomes. As with all presales, participation terms and benefits remain subject to execution and delivery.

Considerations for Prospective Participants

Presale participation involves inherent risk. Market conditions, execution quality, regulatory developments, and project delivery timelines can all affect outcomes.

Before participating, market observers typically review:

- Whitepaper disclosures and utility descriptions

- Token allocation and access mechanics

- Update consistency and transparency

- Personal risk tolerance and position sizing

Even well-structured presales may not meet expectations, underscoring the importance of independent research.

Concluding Perspective

IPO Genie is part of a broader group of crypto presales attracting attention in Q1 2026 due to its access-based utility model and staged presale structure. Rather than emphasizing rapid returns, the project presents a framework focused on participation, tiers, and platform-defined access.

As with any early-stage initiative, outcomes depend on execution and market conditions. For analysts and readers monitoring presales during January 2026, IPO Genie represents one example of how crypto projects are experimenting with alternative utility models beyond traditional token narratives.

Official Channels

- Official IPOGenie website

- Official IPOGenie X (Twitter) account

- Official IPOGenie Telegram community

This article contains information about a cryptocurrency presale. Crypto Economy is not associated with the project. As with any initiative within the crypto ecosystem, we encourage users to do their own research before participating, carefully considering both the potential and the risks involved. This content is for informational purposes only and does not constitute investment advice.