TLDR:

- The bill seeks to exempt those who do not custody funds from money transmission liabilities.

- The bipartisan initiative by Lummis and Wyden aims to foster technological innovation without legal fears.

- The regulation clarifies that writing code or running nodes should not require complex banking licenses.

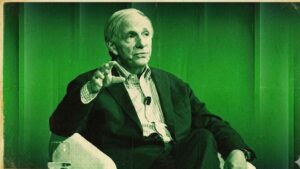

This Tuesday, January 13, the “Blockchain Regulatory Certainty Act of 2026″ was formally introduced. Senators Cynthia Lummis and Ron Wyden were in charge of the presentation.

JUST IN: 🇺🇸 US Senator Cynthia Lummis introduces bill that would protect Bitcoin developers from being classified as money transmitters 👏

— Bitcoin Magazine (@BitcoinMagazine) January 12, 2026

"This bill gives our developers the clarity they need to build the future of digital finance without fear of prosecution" 🙌 pic.twitter.com/rm0SxJh9pc

This is a bill whose main objective is to establish legal protection for Bitcoin developers and infrastructure providers, clarifying that they should not be classified as money transmitters if they do not have control over user assets.

In particular, this proposal seeks to update legal interpretations that are already considered obsolete.

Until now, ambiguity in federal and state definitions has allowed software developers and network validators to be treated under the same compliance standards as traditional financial institutions, which entails costly licenses and reporting obligations.

Innovation Without Barriers: The Impact of the Regulatory Certainty Act

Basically, the project establishes that creating code, running nodes, or maintaining distributed networks does not constitute a money transmission activity.

By guaranteeing legal protection for Bitcoin developers, the goal is to prevent a talent drain caused by the fear of facing enforcement actions or judicial processes simply for contributing to open-source projects.

On one hand, Senator Lummis emphasized that this measure is vital for creative work in the blockchain ecosystem to move forward without unnecessary obstacles.

Meanwhile, Senator Wyden stressed that the bipartisan support reflects an urgent need for clear rules that adapt to the decentralized nature of today’s technology.

This new legal project shares similarities with bill H.R. 3533 introduced in the House of Representatives in 2025, which had already generated a positive consensus among legal experts and industry groups.

If the Senate manages to move forward with this proposal, it would set a historic precedent granting legal protection for Bitcoin developers against the regulatory uncertainty that has hindered investment and infrastructure development in recent years.

In summary, the legislative path is just beginning, but the crypto community is optimistically watching how this legal framework could define the treatment of decentralized technologies over the next decade.