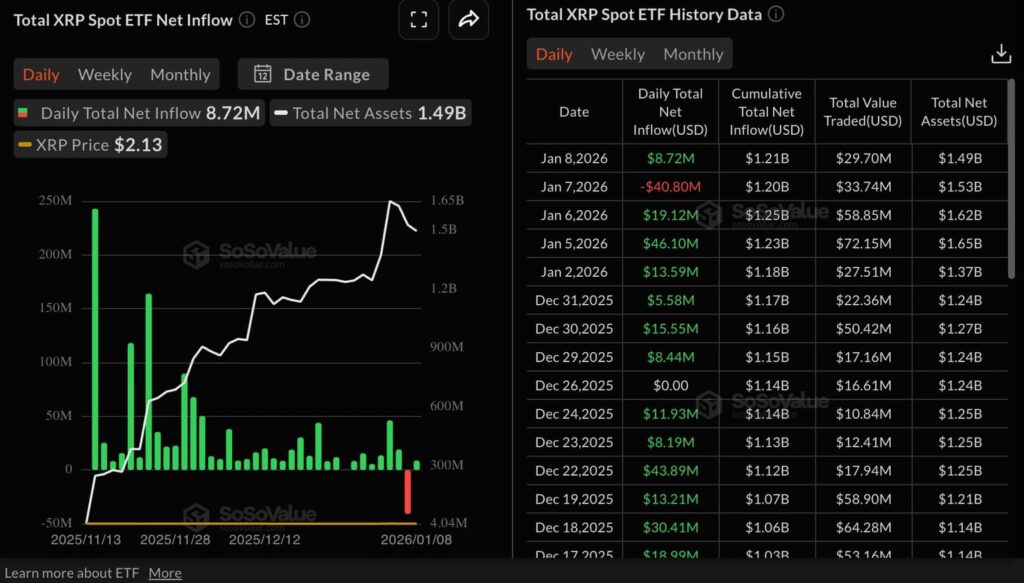

XRP enters 2026 with contrasting signals. Institutional interest remains visible, as U.S.-listed XRP ETFs resumed inflows, adding nearly $9 million on Thursday. Total cumulative inflows now stand at approximately $1.21 billion, with net assets around $1.49 billion. Despite this activity, XRP’s price has struggled to extend its upward momentum and continues to trade near the $2.00 support zone.

This divergence between ETF demand and price behavior is prompting some investors to reassess positioning. Entering XRP near recent highs reflects expectations of a breakout that has yet to fully materialize. As a result, some market participants tracking XRP are also observing early-stage crypto projects that offer alternative exposure models, including utility-driven platforms still in presale phases.

One project receiving attention in this context is Digitap ($TAP), which is currently in its presale stage. The platform combines crypto-enabled payment tools with staking and participation features, positioning itself within the broader digital finance ecosystem.

XRP Price Action and ETF Flows Highlight a Cautious Market

XRP is trading around $2.13, reflecting a weekly increase of roughly 14%. While the rebound suggests renewed interest at the start of the year, price action remains uneven. Trading volume has stayed steady rather than accelerating sharply, indicating participation without strong directional conviction.

XRP/USD 1-Year Chart | Source: TradingView

On the institutional side, XRP spot ETFs recorded their first notable net outflow since launching in mid-November, with approximately $40.8 million exiting on January 7. This movement was largely concentrated in a single product, while most other XRP ETFs remained stable or slightly positive. Overall cumulative inflows remain near $1.2 billion, with total assets around $1.53 billion.

XRP ETF Stats | Source: SoSoValue

In context, early ETF outflows are not uncommon. Bitcoin and Ethereum ETFs both experienced similar phases following their launches. The recent XRP outflow is generally viewed as portfolio rebalancing rather than a structural shift in sentiment. Still, ETF activity remains an important variable, as XRP continues to show sensitivity to institutional flows.

From a technical perspective, XRP is holding above the $2.00 support level but has not yet built sustained momentum toward higher resistance zones. As a result, some investors are exploring diversification into smaller projects where value drivers extend beyond price appreciation alone.

Digitap’s Platform Model Focuses on Utility and Participation

Digitap presents a different approach from traditional price-driven assets. According to project materials, the platform offers staking participation with yields that vary based on network activity and platform performance, rather than fixed or guaranteed returns. A portion of platform-generated revenue is allocated toward staking rewards and token supply management, aligning token mechanics with ongoing usage.

The $TAP token has a fixed supply of 2 billion tokens, with buy-back and burn mechanisms tied to application revenue. This structure is designed to link token dynamics to real platform activity rather than purely speculative demand.

Digitap’s application is already live, supporting crypto-enabled payments, multi-rail settlement, and stablecoin transactions. These features allow the platform to operate independently of broader market cycles, as transaction demand is driven by user activity rather than token price movement alone.

The platform highlights cross-border payment efficiency as a core use case, with stated transaction costs below traditional remittance averages. This positions Digitap within a competitive global payments landscape, where cost efficiency and speed remain key differentiators.

Presale Context and Market Positioning

Digitap’s presale has progressed through multiple stages since launch, with token pricing adjusting incrementally as participation increases. According to project disclosures, more than 185 million tokens have been allocated during the presale, with total contributions nearing $3.9 million at the time of writing. A public listing price has been outlined, though actual market pricing will depend on liquidity, adoption, and broader market conditions at launch.

Unlike many early-stage projects that remain conceptual, Digitap’s platform is already operational, with reported wallet connections exceeding 120,000. Token participation is therefore linked to existing usage, governance involvement, and platform incentives rather than future product delivery alone.

This places Digitap among a smaller group of presale-stage projects that are currently being evaluated based on execution progress and utility, rather than purely on speculative projections.

Comparative Perspective: XRP and Early-Stage Utility Projects

While XRP continues to benefit from institutional recognition and ETF exposure, its near-term price behavior remains tied to broader market liquidity and technical thresholds. For investors seeking diversification beyond large-cap price movements, early-stage platforms like Digitap present an alternative exposure model focused on participation, utility, and platform growth.

Digitap’s presale remains active, with current pricing reflecting its latest stage. As with any early-stage crypto initiative, outcomes remain uncertain and depend on continued execution, user adoption, regulatory conditions, and overall market liquidity.

Project Information (for reference)

Digitap is currently operating with an active platform and ongoing presale phase. Additional information about the project is available through its official channels:

- Presale: https://presale.digitap.app

- Website: https://digitap.app

- Social channels: https://linktr.ee/digitap.app

- Community giveaway details: https://gleam.io/bfpzx/digitap-250000-giveaway

This article contains information about a cryptocurrency presale. Crypto Economy is not associated with the project. As with any initiative within the crypto ecosystem, we encourage users to do their own research before participating, carefully considering both the potential and the risks involved. This content is for informational purposes only and does not constitute investment advice.