With little time remaining before the start of 2026, investor attention is gradually shifting away from purely speculative narratives and toward Payment Finance (PayFi). This segment focuses on a practical objective: enabling crypto to function in everyday financial activity. Two projects currently receiving increased attention are Digitap ($TAP) and Remittix. While both aim to modernize global payments, many investors are beginning to view Digitap as a more comprehensive and scalable platform.

The difference lies less in ambition and more in scope. Remittix focuses on addressing a specific inefficiency within global finance, while Digitap is developing a broader financial ecosystem designed for frequent, real-world use. As market participants look beyond short-term momentum, this distinction is becoming increasingly relevant.

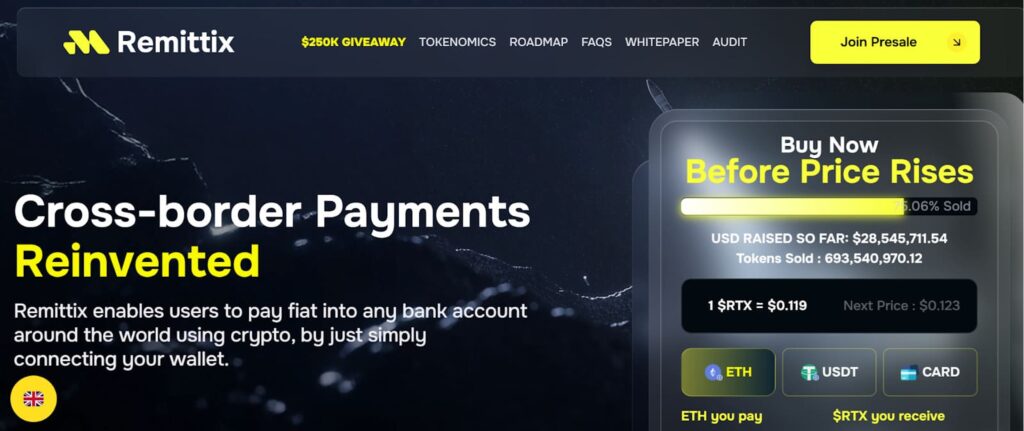

Remittix: Addressing Cross-Border Transfers

Remittix is designed to streamline international money transfers by reducing the cost and time associated with cross-border payments. Its primary audience includes migrant workers and families who rely on remittances. By using blockchain-based rails instead of traditional banking infrastructure, Remittix aims to facilitate faster settlement and lower transaction fees.

The model is relatively straightforward. Users send crypto assets, typically stablecoins, and recipients receive local currency directly into their bank accounts. This approach targets a well-documented issue in global finance, particularly in regions where remittance fees can represent a significant cost.

From an investment standpoint, Remittix provides exposure to a large and established market. However, platform usage is often periodic. Most users interact with remittance services only when sending money internationally, which may occur once or twice per month. This naturally limits engagement frequency and token circulation.

Digitap’s Broader Approach to Payments

Digitap takes a wider view of how individuals interact with money on a daily basis. Rather than focusing on a single transaction type, the platform positions itself as an omni-banking application where users can manage multiple aspects of their financial activity. Within a single app, users can hold fiat balances, manage cryptocurrencies, receive funds, make payments, and spend via an integrated Visa card.

This emphasis on everyday usability differentiates Digitap from remittance-only platforms. Users are not required to rely on separate applications for storage, transfers, and spending. Consolidating these functions into one interface reduces friction and supports higher engagement.

As a result, Digitap is increasingly referenced among projects focused on real-world adoption rather than purely speculative activity. The platform is already operational, offering users direct interaction with its financial services.

Evaluating the $TAP Model

From an investment perspective, differences between Digitap and Remittix become clearer when examining how value is generated within each ecosystem. Remittix primarily earns revenue from transfer fees tied to occasional transactions. Digitap, by contrast, generates revenue from recurring activity such as payments, card usage, asset swaps, and account-related services.

This supports a higher frequency usage cycle. Users may interact with Digitap multiple times per day rather than only during periodic transfers. Increased interaction can contribute to more consistent revenue flows and stronger network effects over time.

The $TAP token is designed to align with this activity model. A portion of platform revenue is allocated toward token buybacks, with tokens subsequently burned or distributed to stakers. As platform usage increases, token supply dynamics adjust accordingly, linking adoption with token economics.

This structure is one reason some analysts reference Digitap when discussing projects focused on long-term utility rather than short-term price movements.

Why Digitap Is Gaining Attention in the Current Presale Market

As the market becomes more selective, investors are evaluating projects based on practical criteria. These include whether a platform addresses everyday needs, whether the product is already live, and whether it can scale without relying solely on speculative interest. Digitap addresses these considerations by focusing on daily financial behavior, operating with an existing product, and aligning token mechanics with platform usage.

For this reason, Digitap is often mentioned among crypto presales being monitored ahead of the next market cycle. It combines infrastructure, usability, and a clearly defined economic framework.

Remittix remains a viable solution for cross-border transfers. Digitap, however, aims to consolidate multiple financial functions into a single application, reducing reliance on multiple services.

As attention shifts toward platforms that integrate crypto into everyday financial activity, Digitap’s ongoing development and user engagement suggest it may play a role in this broader transition.

Learn More About Digitap

Discover more about Digitap’s live Visa card initiative and platform developments below:

Presale: https://presale.digitap.app

Website: https://digitap.app

Social: https://linktr.ee/digitap.app

Promotional Giveaway: https://gleam.io/bfpzx/digitap-250000-giveaway

This article contains information about a cryptocurrency presale. Crypto Economy is not associated with the project. As with any initiative within the crypto ecosystem, we encourage users to do their own research before participating, carefully considering both the potential and the risks involved. This content is for informational purposes only and does not constitute investment advice.