TL;DR

- Binance has reduced the share of new token supplies listed on its exchange, often to around 5% of the total supply.

- The exchange has implemented clearer listing categories and disclosure rules to improve transparency.

- Market conditions have been harsh, with over 85% of new tokens losing value post-debut.

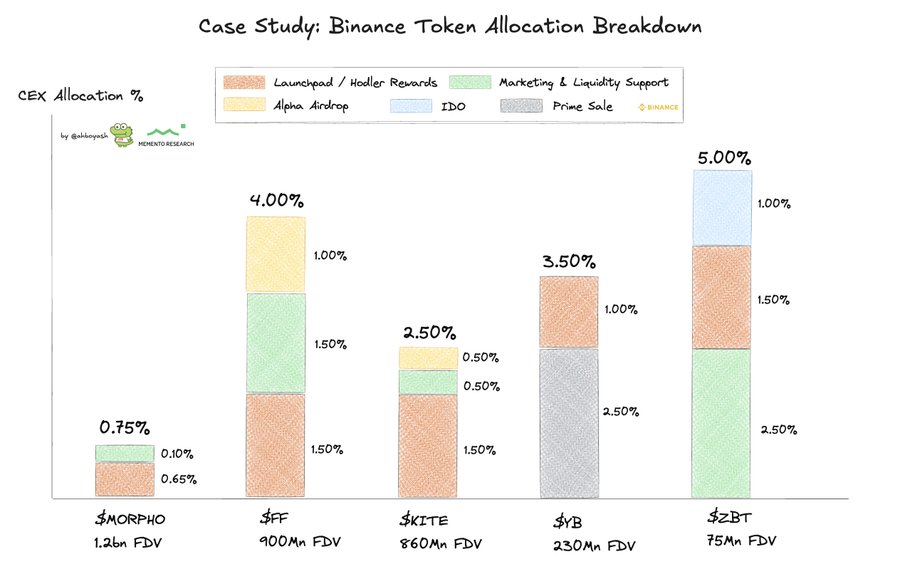

Centralized exchange Binance has reduced the share of new token supplies it distributes on its platform. Recent research shows that CEX listings now represent only a small fraction of the total supply of newly launched tokens, marking a shift toward tighter control of liquidity and transparency across token launches.

Analysts found that most new listings allocate around 5% of the total supply to centralized exchanges, while larger projects allocate less than 1%. The goal is to manage market exposure and avoid oversupply during initial trading. However, criticism has grown as some traders argue that such allocations can still create selling pressure when liquidity pools open.

Binance remains the main venue for high-profile listings in 2025, largely because BNB Chain hosts around 40% of newly issued tokens, competing closely with Ethereum and Solana. According to the exchange, most projects dedicate about 5% of supply to liquidity and airdrops at the time of listing, while high-value tokens restrict the available supply to under 1%. Mid-sized projects tend to distribute more to stimulate activity and attract early users.

Binance expands transparency on listings

Some issuers also provide tokens to market makers under separate agreements. These allocations are not paid to the exchange but are redistributed into user wallets, reward programs, and liquidity pools designed to maintain stable trading conditions. The tokens often flow into Launchpools, airdrops, rewards campaigns, and promotional liquidity initiatives rather than remaining under Binance’s control.

In 2025, Binance introduced a clearer listing structure, dividing its offerings into Binance Alpha, Futures, and Direct Spot categories. Each has defined rules for progression, aiming to clarify supply management and reduce uncertainty for traders. The exchange has also emphasized public disclosure of circulating and locked token quantities to reinforce user trust.

Market conditions, however, have been harsh for most new listings. Research shows that over 85% of new tokens launched this year have lost value after debut, driven by weak demand for altcoins and speculative exhaustion. Decentralized exchange (DEX) listings have shown even higher volatility, with direct influence from large holders and early insiders.

Despite these losses, Binance continues to play a key role in providing liquidity and exposure to new crypto assets. Tokens featured under Binance Alpha Spotlight have generated short-term gains, remaining among the best-performing listings of the year.

The exchange also maintained its Launchpad, Launchpool, HODLer Airdrop, and wallet distribution programs, though with fewer token launches than in previous cycles.

Market analysts interpret Binance’s reduction in token allocations and its push for transparency as a shift toward a more controlled and data-driven model. The approach aims to limit speculation, preserve liquidity stability, and strengthen user protection, reflecting broader adjustments in the crypto market after a volatile year for altcoin launches.