Tokenized stocks are increasingly gaining mainstream adoption. The recent launch of Coinbase’s tokenized equities platform allows approximately 100 million users to access on-chain stocks, marking a significant development in how equities may be traded and held in the future.

As interest grows, platforms like Edel Finance ($EDEL), Robinhood Stocks, and Coinbase are often highlighted as leading options. Each provides a different approach to accessing tokenized equities, ranging from straightforward buy-and-hold solutions to more complex on-chain financial tools.

EDEL FINANCE: LENDING AND BORROWING TOKENIZED STOCKS

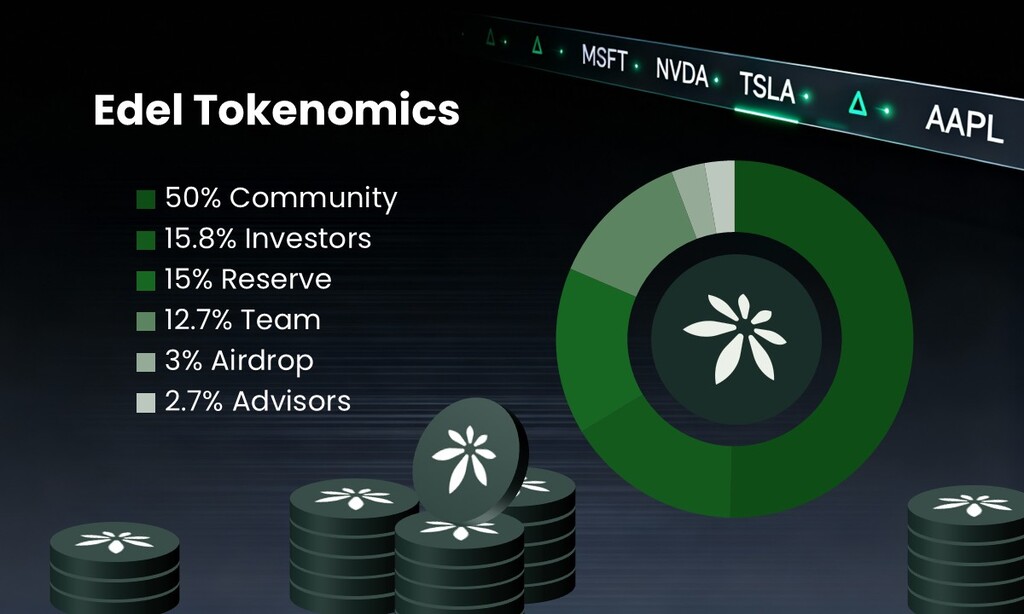

Edel Finance ($EDEL) has attracted attention with its testnet launch, which showcases the platform’s tokenized stock lending, borrowing, and collateralization features. This system enables stockholders to potentially earn yield on tokenized equities—a feature typically reserved for centralized intermediaries.

As Andrés Soltermann, CEO of Edel Finance, stated:

“Securities lending has always existed, but the value has rarely flowed back to everyday investors. By moving this process on-chain, we can make it transparent and allow stockholders to directly benefit from lending activity.”

The platform allows users to interact using assets such as bETH, bUSDC, and the native $EDEL token. The testnet initially attracted over 3,000 users and later expanded to 5,000 due to demand.

For further details, readers can consult the Edel Finance Whitepaper.

Robinhood Stocks: Simple Access to Tokenized Equities

Robinhood continues to serve retail investors with an accessible interface and an expanding set of crypto and tokenized stock products. While the platform is well-suited for newcomers seeking straightforward exposure, it currently does not provide advanced on-chain utility such as lending or borrowing.

Coinbase Stocks: Expanding Market Access

The Coinbase tokenized stocks launch represents a milestone for the sector, enabling users to purchase equities on-chain within the platform. This initiative is part of Coinbase’s broader vision to offer a unified app combining crypto, tokenized equities, and other financial services.

By offering onboarding rails for tokenized equities, Coinbase is expected to raise awareness and encourage adoption of platforms that provide additional DeFi-style functionalities, including lending and borrowing.

Comparative Overview

| Platform | Focus | Key Features | Target Users |

|---|---|---|---|

| Edel Finance | Tokenized stock lending & borrowing | Yield generation, collateralization | Traders seeking on-chain utility |

| Robinhood Stocks | Simple tokenized stock access | Easy buy-and-hold | Retail investors |

| Coinbase Stocks | Broad adoption | On-chain trading & custody | General users |

Each platform addresses different aspects of the tokenized equities market, from functional utility to accessibility and scale.

Final Thoughts

The tokenized stock market is poised for significant growth in the coming years. Platforms like Edel Finance highlight how on-chain tools can provide added utility for users, while Robinhood and Coinbase offer simplicity and scale to attract a wider audience. Understanding the differences in custody, liquidity, regulatory exposure, and available features is essential for evaluating the best platform for tokenized stocks in 2026.

This article contains information about a cryptocurrency presale. Crypto Economy is not associated with the project. As with any initiative within the crypto ecosystem, we encourage users to do their own research before participating, carefully considering both the potential and the risks involved. This content is for informational purposes only and does not constitute investment advice.