TLDR

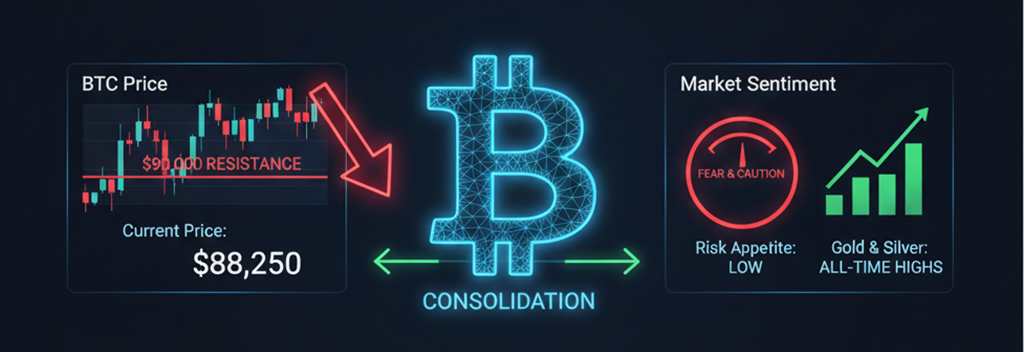

- BTC encountered technical resistance near $89,542 before pulling back to the $88,000 range.

- Recent Federal Reserve rate cuts have failed to reignite bullish market momentum.

- Investors are showing a defensive stance, rotating capital into gold and silver at record levels.

The digital asset market began the week under high technical tension. The Bitcoin price faces stiff resistance in the $90,000 zone, a psychological and technical level that has thwarted all recovery attempts in recent weeks. After reaching an intraday high near $89,542, the pioneer crypto pulled back toward $88,000, reflecting a lack of conviction among buyers.

$BTC having tough time above the $90K resistance!! pic.twitter.com/MfgTsRPAbq

— Shango – 𝕏's Crypto 👑 (@ShangoTrades) December 22, 2025

Despite the drop, there are signs of stabilization. Bitcoin remains oscillating between $87,000 and $88,000, a sideways movement that analysts interpret as a necessary consolidation rather than a massive capitulation. It is worth noting that the asset has been in a downtrend since its all-time high of $126,000 reached in October—a month that, against all historical odds, marked the beginning of the current selling pressure.

Macroeconomic Uncertainty and the Safe Haven in Precious Metals

A determining factor in the Bitcoin price today is the apathetic response to monetary policies. Although the Federal Reserve executed interest rate cuts in both October and December—measures that traditionally boost risk assets—the crypto market has failed to capitalize on this tailwind. Macroeconomic uncertainty seems to outweigh the stimulus, leading investors to seek safety in traditional assets.

This rotation of capital toward “safe havens” has pushed gold and silver to new all-time highs, leaving the Bitcoin price in a secondary position. Risk appetite has diminished, explaining why Bitcoin has fallen more than 8% compared to December of last year.

However, this tight consolidation could be laying the groundwork for 2026. If overall market sentiment improves and a decisive breakout above $90,000 is achieved, Bitcoin could reactivate institutional interest.

For now, the market remains in wait-and-see mode, watching to see if current support levels can contain the pressure before the annual close.