TL;DR

- The integration of CoWSwap into the Aave interface diverted swap fees away from the DAO Treasury.

- Delegates and critics allege that front-end monetization should benefit the DAO.

- Aave Labs defends the separation between the protocol (controlled by the DAO) and the interface (managed by Labs).

The question of “Who controls and who benefits financially from the protocol’s interface?” is being debated internally within the Aave DAO in recent hours. The controversy arose after Aave Labs integrated the decentralized exchange aggregator CoWSwap into app.aave.com, replacing the previous Paraswap routing.

Although Aave Labs assured that the change would enhance the user experience, delegates, such as EzR3aL from Orbit, pointed out that swap fees were no longer flowing to the Aave DAO treasury. Through an open letter, EzR3aL claimed that the integration introduced front-end fees of 15 to 25 basis points that accumulate for an external recipient, potentially amounting to millions of dollars annually in Ether.

The Tension between Protocol and Product in DeFi Governance

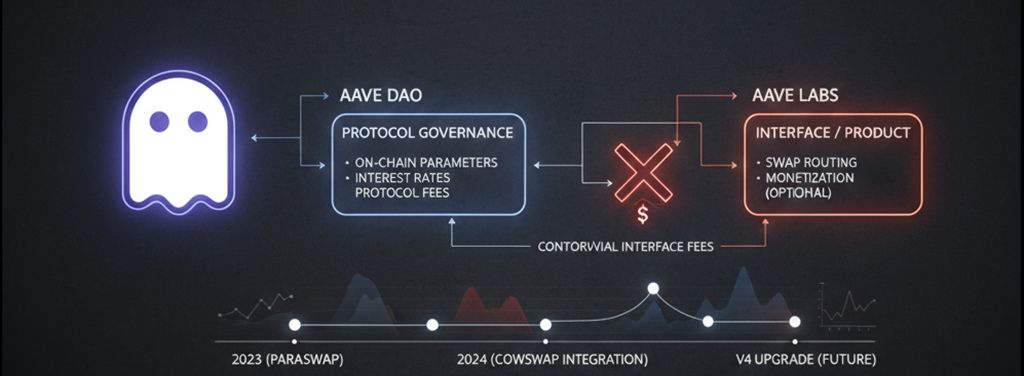

At the heart of the controversy is a distinction that Aave Labs insists has always existed: the difference between the protocol and the product. In an official reply published on the forum, Aave Labs defended that the interface is operated, funded, and maintained independently from the protocol that is governed by the DAO.

Under this model, the DAO controls the on-chain parameters and protocol-level fees, while Labs retains discretion over optional, application-level features, such as interface monetization. The firm emphasized that any monetization applies only to “accessory features,” thus preserving protocol neutrality.

However, critics allege that the practical reality is different. Marc Zeller of the Aave Chan Initiative (ACI) asserted that there was a long-standing expectation that monetization tied to the aave.com front-end, including the swap surplus, would benefit the DAO, given that the brand, governance legitimacy, and much of the underlying development were funded by tokenholders.

The controversy deepened with the allegation that CoWSwap solvers are bypassing Aave’s flash loan infrastructure, further reducing DAO revenue.

In summary, Aave Labs committed to distinguishing more clearly between the economic decisions governed by the protocol and the independently funded product decisions, while the protocol prepares for its upcoming V4 update, which is crucial for Aave Labs interface fees DAO.