TL;DR

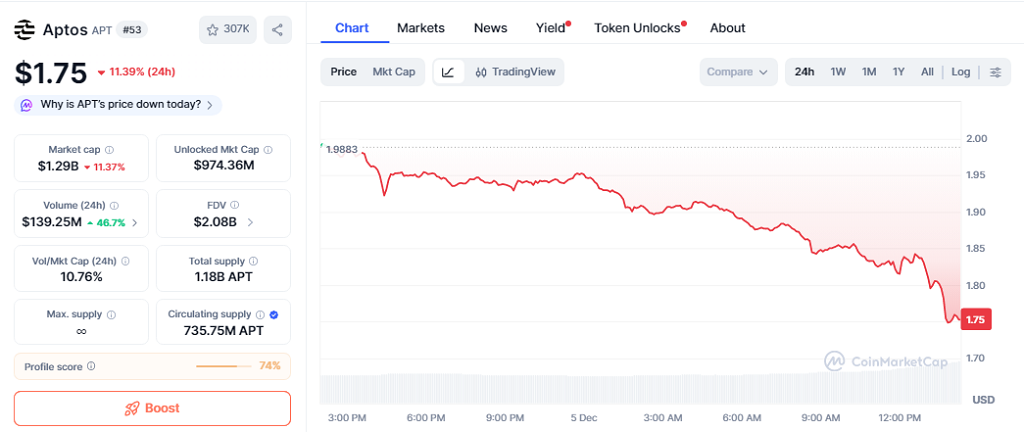

- Aptos (APT) falls 11.39% in 24 hours, closing at $1.75 amid accelerating technical weakness.

- The token breaks critical support at $1.87, signaling increased selling pressure. Trading volume jumps 46% to $139 million, while market cap stands at $1.29 billion.

- Early signs of stabilization appear as a potential double-bottom forms near $1.84, hinting that institutional buyers may be entering at lower levels.

Aptos dropped sharply during Friday’s session, falling from $1.97 to $1.75, marking an 11.39% loss in 24 hours. The token broke through critical $1.87 support on heavy selling, underperforming the broader crypto market, where major indexes recorded modest declines. Trading volume surged 46% to $139 million, highlighting that the sell-off attracted significant activity despite the overall subdued market environment.

Multiple waves of selling pressure drove the token to fresh session lows, confirming the breakdown’s legitimacy. Analysts note that market reactions have been uneven across exchanges, suggesting that localized liquidity may have intensified price swings. Additionally, derivative markets show rising open interest, which could indicate that traders are actively adjusting positions as technical signals shift.

Signs Of Stabilization Suggest Buyer Interest

Technical patterns show a potential double-bottom forming near $1.84, which may indicate that buyers are stepping in at depressed levels. This development offers the first sign of stabilization following several days of persistent weakness.

Key resistance now lies at the former support of $1.87, with immediate psychological resistance at $1.90. If the double-bottom pattern holds, the token could consolidate in the $1.84–$1.87 range, but failure could expose downside risks toward $1.80. Analysts note that light subsequent trading volume suggests that selling pressure may be easing. Some traders are watching the relative strength index (RSI), which has reached oversold territory, possibly signaling short-term relief rallies.

Market Context And Outlook

Aptos’ market cap currently stands at $1.29 billion, while trading activity remains closely monitored by market participants. Despite the sharp drop, technical indicators hint at the potential for short-term stabilization, creating an opportunity for institutional or strategic buyers to enter.

Analysts caution that close attention to key support and resistance levels will determine whether APT can recover or face further declines in the near term. Broader market sentiment remains cautious, with investors balancing concerns over macroeconomic factors and crypto-specific developments. Additionally, upcoming network updates could influence price movements if adoption metrics improve.