TL;DR

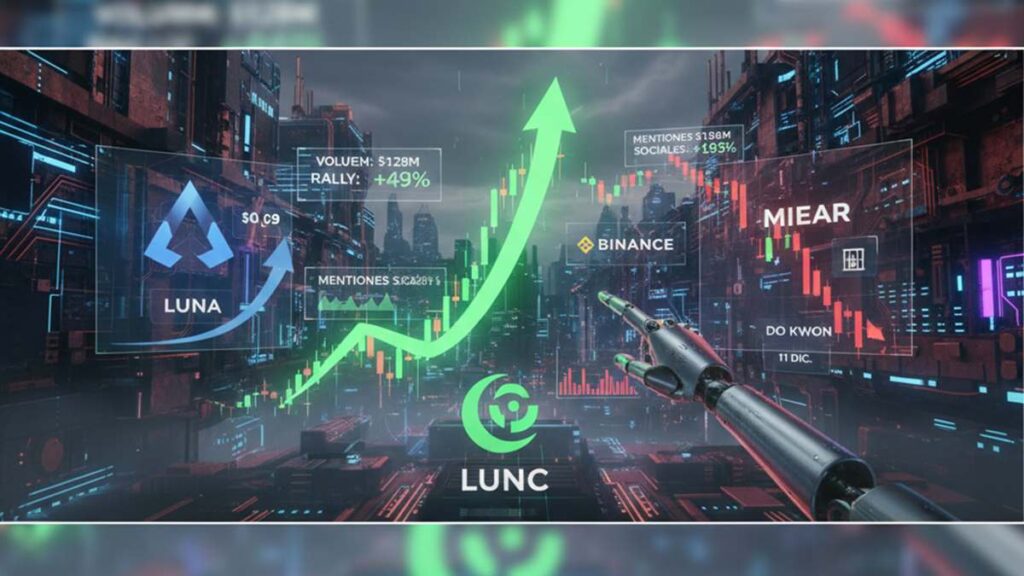

- LUNC surged over 49% to a one-month high, driven by community hype and a marketing event.

- The token’s daily trading volume multiplied by 10, reaching $128 million in 24 hours.

- The sustainability of the LUNC rally Luna Classic resurgence is uncertain; the chain’s DeFi liquidity remains low.

An explosive increase of 49% for the LUNC token of the original Terra Luna Classic chain, reaching its highest point in a month. This behavior, which coincided with a similar rally in its competing token LUNA (from Terra 2.0), has revived speculation about a possible resurgence of the Terra brand. The LUNC asset rose to $0.000040, while LUNA also traded at a one-month high of $0.09.

Community hype was the catalyst for this near-vertical leap. During Binance Blockchain Week, a moderator wore an old Luna T-shirt, a symbolic nod that, despite the Terra collapse, demonstrated the persistence of the brand. This anecdote, coupled with the resilience of the LUNC and LUNA communities that have proposed relaunching the protocol with better risk management, boosted bullish sentiment.

The Sustainability of the Rally and Speculation

The impact of the hype translated into tangible activity: LUNC recorded the highest trading volume level since January, with daily volume expanding 10 times to reach $128 million in 24 hours, up from a baseline of around $10 million.

The sudden interest was also reflected in an increase in visits to the Terra Classic website. Analysts point out that the concentration of trading in the legacy Binance pair, where the asset was not delisted, allowed the hype to be quickly absorbed.

The big question is: Will this rally be sustainable, or is it just another speculation-driven bubble? Based on precedents, LUNC has experienced similar rallies based solely on community enthusiasm. While the Terra Classic chain is preparing for an upgrade that would make it a competitor in the DeFi space, its total DeFi value is currently limited, sitting below $1 million.

An event that could add more hype is the sentencing of Terra founder Do Kwon, expected on December 11th. Although Kwon will no longer have any connection to the project, prediction markets are active, underscoring how the founder’s legal fate continues to influence the sentiment of the residual tokens.

In summary, the LUNC community still needs to demonstrate that the chain can offer lasting value beyond short-term speculation.