Which crypto traders monitor during fast-moving markets is a question that often comes up when volatility increases. This article looks at several projects that are often discussed in the context of short-term price volatility, but outcomes are uncertain and crypto markets can be highly risky.

Some market participants also track early-stage projects or tokens that were first distributed through a token sale before reaching broader exchange trading. Price moves in these situations can be volatile and are not predictable.

Short-term traders often watch factors such as community activity, news flow, and network or product updates that may affect liquidity and sentiment.

Below are four projects that are frequently monitored for these types of short-term dynamics, including one that is currently conducting an early-stage token sale. One example mentioned is Noomez (project details are based on public materials and may change).

4 Crypto Projects Often Watched for Short-Term Volatility

If you’re assessing short-term market moves, it is worth noting that price movement is uncertain and can reverse quickly.

The four projects below are commonly discussed by traders looking at near-term dynamics, but this is not a recommendation to buy, sell, or hold any asset.

1. Noomez ($NNZ)

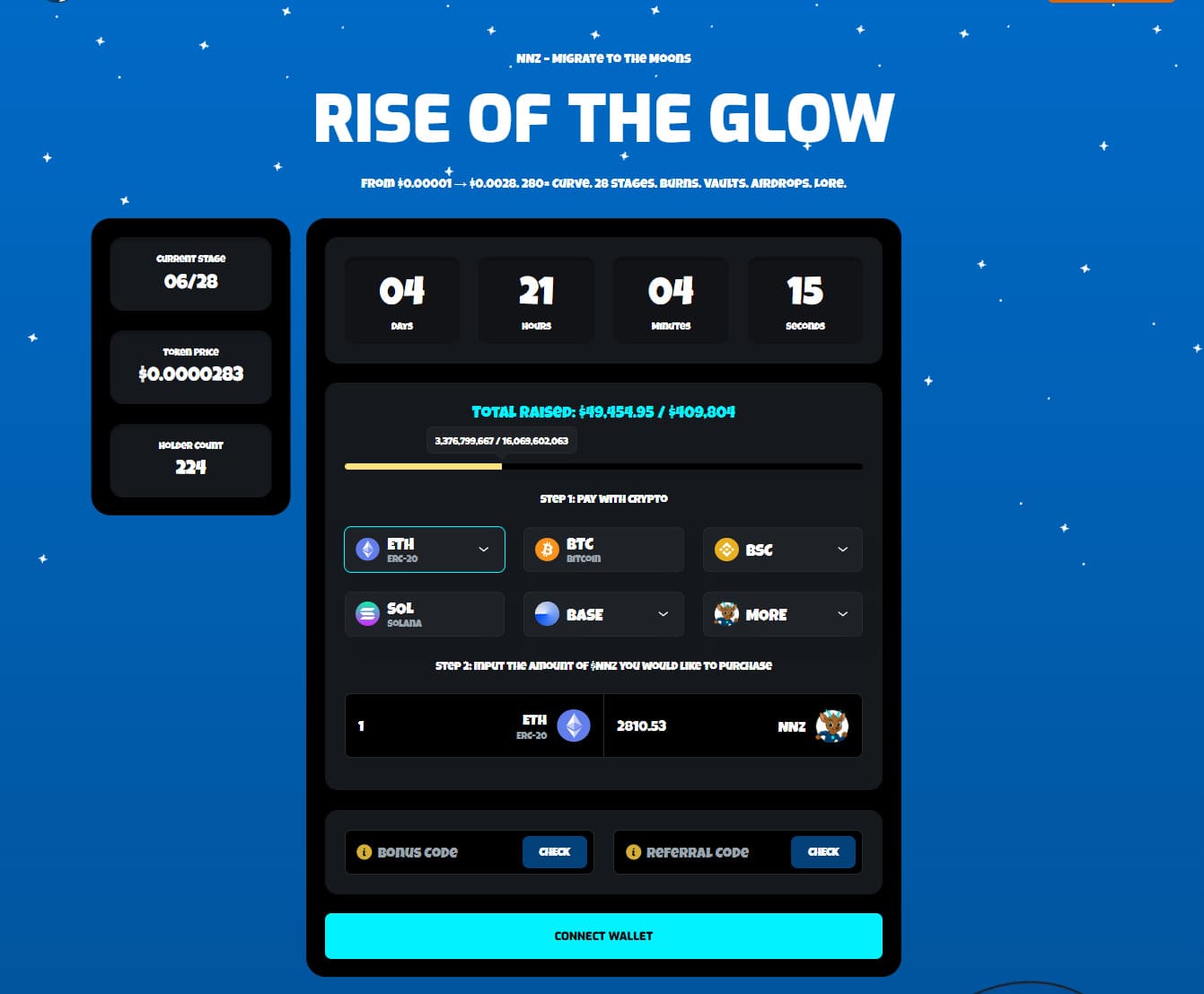

Noomez is an early-stage project running a token sale, which can draw attention from speculative traders. Information below reflects project-reported details and is not independently verified here.

According to project materials, $NNZ uses a multi-stage token-sale structure where pricing changes as stages progress, and the project provides a tracker to show progress.

The project also describes post-launch features such as staking and a token lock-up schedule, though terms and availability may change. The project has advertised staking rewards and vesting timelines; such figures are not guarantees of returns and may not be achievable or sustainable in practice.

Project materials also mention marketing incentives such as a referral program; readers should treat these as promotional mechanisms rather than indicators of investment quality.

The project has also published participation and fundraising figures at different points in time; these numbers can change and were not independently verified for this article.

2. Polygon ($MATIC)

Polygon started as an early token sale before growing into a widely used network in crypto.

Some traders watch it for short-term setups because it can react to protocol updates, partnership announcements, and changes in on-chain activity.

$MATIC also has relatively deep liquidity compared with smaller projects, which can matter for short-term trading. Liquidity and volatility can still change quickly depending on market conditions.

3. Avalanche ($AVAX)

Avalanche also ran an early token sale and is known as a smart-contract network with an active ecosystem.

Some market participants watch $AVAX for near-term moves around network upgrades, ecosystem activity, and broader risk sentiment in crypto.

As with other large-cap assets, liquidity can support active trading, but price gaps and rapid drawdowns are still possible—especially during high-volatility periods.

4. The Graph ($GRT)

The Graph held an early token sale and is used as an indexing layer for various blockchain applications.

$GRT can see short-term price reactions around product updates, integrations, and changes in network usage.

Traders sometimes include it in short-term strategies because it can respond to announcements, though crypto pricing is influenced by many factors beyond development progress.

How Early-Stage Token Sales Can Affect Short-Term Trading

For anyone interested in short term crypto trading, early-stage token sales can create periods of heightened attention and volatility, especially around stage changes, token unlock schedules, and eventual exchange listings (if they occur).

However, these events also carry added risks, including limited liquidity, incomplete product delivery, changing tokenomics, and lockups that may restrict selling. Readers should review primary documentation and consider the possibility of loss.

Note: Short-term price moves can be driven by temporary spikes in attention. Monitoring liquidity, lockups, and verified updates can be more informative than relying on rapid intraday moves alone.

This article contains information about a cryptocurrency token sale. Crypto Economy is not associated with the project. As with any initiative within the crypto ecosystem, we encourage users to do their own research before participating, carefully considering both the potential and the risks involved. This content is for informational purposes only and does not constitute investment advice.