TL;DR

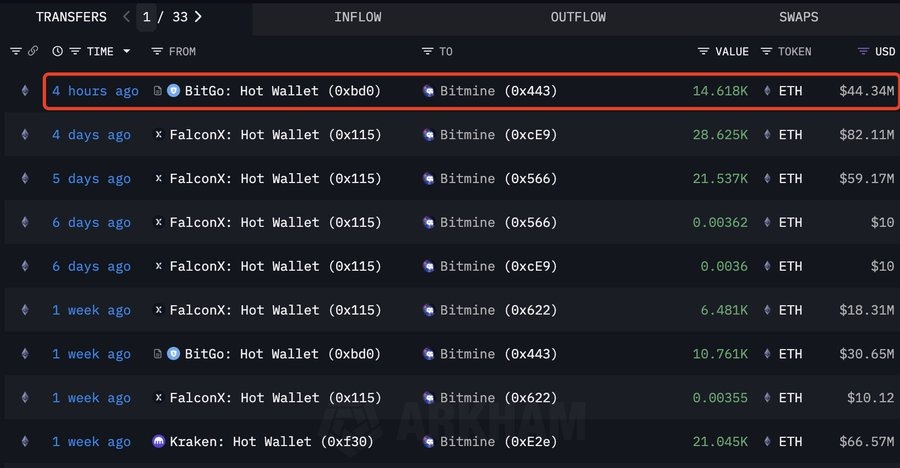

- BitMine adds 14,618 ETH, now holding 3% of the entire Ethereum supply.

- The company aims to eventually control 5% of all ETH in circulation.

- BitMine’s stock rose 9% on the news but is down 37% for the month.

BitMine Immersion Technologies increases its Ethereum treasury again, adding 14,618 ETH valued at more than 44 million dollars. Led by Tom Lee, the company pushes forward with a plan to control 5% of all ETH, a target rarely pursued in the corporate space.

BitMine now holds 3.63 million ETH, equal to 3% of the entire supply. At an ETH price near $3,027, the treasury reaches an estimated $10.39 billion, placing BitMine among the largest corporate holders worldwide.

Corporate buying of ETH continues to rise. Data shows combined corporate holdings near $24.97 billion, equal to 5.01% of all ETH, showing strong interest in staking, yields and tokenized asset activity.

BitMine Adds 14,618 ETH While Market Liquidity Remains Weak

Data from Arkham Intelligence confirms that BitMine executed the purchase on November 28. The addition aligns with a broader plan to accumulate nearly 6 million ETH over time.

Despite the purchase, ETH stays near $3,030. Heavy ETF outflows and thin liquidity hold back any upward reaction. Even aggressive buying fails to create momentum in the current environment.

Broader market pressure also limits volatility, keeping ETH near the same trading range for days.

BitMine Stock Rises 9%, Yet Remains Under Monthly Pressure

Shares of BitMine (BMNR) react strongly to the news. The price climbs 9% to roughly $31.74, outpacing ETH during the same period.

Monthly performance tells another story. BMNR falls about 37% in the past thirty days due to its close link with broader crypto market behavior. With crypto down nearly 22%, BitMine stock absorbs similar selling pressure.

BitMine maintains its approach: increase long-term ETH exposure during weak market phases and continue building a large treasury position in preparation for stronger liquidity and higher institutional demand.

Ethereum (ETH) Technical Analysis – November 28, 2025

As of November 28, 2025, the price of Ethereum (ETH) stands at approximately $3,057.96 USD, showing a +2.01% increase over the past 24 hours, with a daily trading range between $2,995 and $3,065 USD. The market capitalization is valued at $369 billion, with a 24-hour trading volume of $16.1 billion, reflecting strong market activity and sustained buying pressure.

From a technical standpoint, Ethereum remains in a moderately bullish trend, trading above the 50-day moving average near $2,880 USD and maintaining strong support around $2,950 USD. The next short-term bullish target lies at $3,150 USD, a level that coincides with a key resistance area observed in previous sessions. A breakout above this zone could open the path toward $3,350 USD, where the October local high and the 200-day moving average intersect.

Conversely, if ETH loses support below $2,950 USD, a correction toward $2,780 USD could occur — a region where historical buying pressure has reappeared multiple times.