The deepening bear market makes one thing clear: comparing established crypto giants to up-and-coming crypto presale projects is fair game. Ripple’s XRP and Solana (SOL) are two of the most well-known cryptocurrencies and rank within the top 10 cryptos by market cap.

However, Digitap ($TAP), a relatively unknown project and creator of the world’s first “omni-bank,” could potentially beat XRP and Solana in terms of growth and innovation, making it one of the best altcoins to buy. This is because Digitap is targeting a massive market gap that established cryptos haven’t addressed.

Digitap’s Utility Belongs On Altcoins To Buy Lists

One of the longest-standing issues plaguing the cryptocurrency industry is the lack of making crypto spendable in real life. The integration of crypto with everyday banking and spending is now a possibility thanks to Digitap’s bank app.

Digitap’s banking platform enables anyone, globally, to open a digital account that supports multiple fiat currencies and cryptocurrencies side by side. But what truly sets Digitap apart and solidifies its status as a top crypto to buy now is its Visa debit card integration.

While legacy crypto giants are focused on blockchain infrastructure, Digitap is directly solving a real consumer problem. With the Digitap Visa card, a user can swipe a physical card or tap their Apple or Android phone at any regular store. Behind the scenes, Digitap’s system will convert crypto to fiat in real time to complete the purchase.

Why Deflationary Design Could Support Long-Run Value

From an investment perspective, Digitap’s crypto presale status suggests it could offer the type of asymmetric returns that legacy cryptos like XRP and Solana once provided. Digitap’s presale of its native $TAP token has risen from $0.0125 in late summer to $0.0313. The presale is divided into rounds, with the price increasing at each stage. In total, $2.06 million of $TAP has been sold.

The time it takes to sell out each round is shrinking. This is also true for the total fundraising count. The time it took Digitap to scale from $1 million in $TAP sold to $2 million was roughly half the time it took to go from zero to $1 million.

Investors are also drawn to Digitap’s tokenomics, making it one of the top altcoins to buy. First, the token has a maximum supply of 2 billion $TAP, unlike Solana, which has no hard-capped maximum supply.

Second, Digitap boasts a deflationary model: 50% of the platform’s profits are set aside to buy back and burn $TAP tokens and to reward stakers. Solana, on the other hand, has a current inflation rate of around 4.5% that decreases each year until it reaches 1.5%.

XRP’s Bank-First Push Faces Stiffer Stablecoin Competition

XRP, the native token of Ripple’s payment network, is one of crypto’s most hotly debated tokens. It specializes in enabling fast, low-cost international money transfers with a focus on financial institutions. Ripple has forged multiple partnerships with banks and launched its own RLUSD stablecoin to broaden usage.

However, XRP’s vision has proven to be difficult to execute. Ripple mostly serves interbank or cross-currency transfers, meaning it faces heavy competition from rivals looking to capture a share of a market measured in the trillions of dollars.

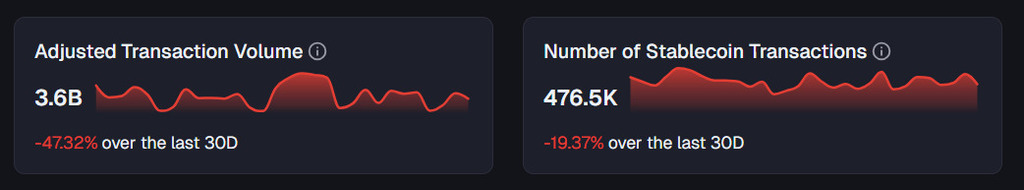

Meanwhile, stablecoin usage is showing concerning signs, such as a 19.37% decrease in stablecoin transactions over the past 30 days and a 47% drop in adjusted transaction volume.

Source: Artemis

Solana’s Fundamentals Hold As Price Tracks Macro Weakness

Solana earned its status as one of crypto’s most important and reputable players by offering one of the fastest and most scalable blockchains in use. However, investor confidence has been shattered, based on the token’s nearly 50% plunge.

Data continues to point to a still-healthy ecosystem. For example, DefiLlama shows total value locked in DeFi stands at $9.275 billion, which is up from around $6 billion in March and trending roughly within this year’s norm. Estimates from ARK Invest place Solana’s Q3 real economic value at the highest of all networks at $223 billion.

Solana’s trading activity is driven more by macroeconomic uncertainty and a broader risk-off trend than by fundamentals. Still, its high-throughput capabilities and robust infrastructure position it well for future adoption.

However, it appears many investors are reallocating capital toward more immediate-use-case projects that aren’t just fast but are directly integrated into everyday financial life.

Source: DefiLlama

Why Digitap’s PayFi Focus Could Outpace XRP And SOL

XRP and Solana both represent important chapters in the evolution of cryptocurrency. XRP gained credit for introducing institutional-grade payments to the blockchain, while Solana’s speed and network made it possible for DeFi, NFTs, and consumer apps to thrive. Yet, their maturity has now come with limitations: growth is slower, and competition is intense.

Both names are blue-chip tokens, meaning their value is more closely correlated with the broader market and macroeconomic factors than with network metrics. As a result, investors hunting for the best crypto to buy now are shifting toward early-stage crypto presale projects.

Digitap is solving problems that traditional crypto giants haven’t addressed. With a working product, Visa-backed spending, and a target market that spans global remittances, banking access, and retail crypto payments, Digitap offers both scale and impact. The market will reward its success over time, instead of punishing it because of factors outside of its control and general market sentiment.

Discover how Digitap is unifying cash and crypto by checking out their project here:

Presale: https://presale.digitap.app

Website: https://digitap.app

Social: https://linktr.ee/digitap.app

Win $250K: https://gleam.io/bfpzx/digitap-250000-giveaway

This article contains information about a cryptocurrency presale. Crypto Economy is not associated with the project. As with any initiative within the crypto ecosystem, we encourage users to do their own research before participating, carefully considering both the potential and the risks involved. This content is for informational purposes only and does not constitute investment advice.