TL;DR

- Pendle’s Innovation: The protocol unlocks yield-bearing assets by separating principal and future yield, creating new opportunities in DeFi.

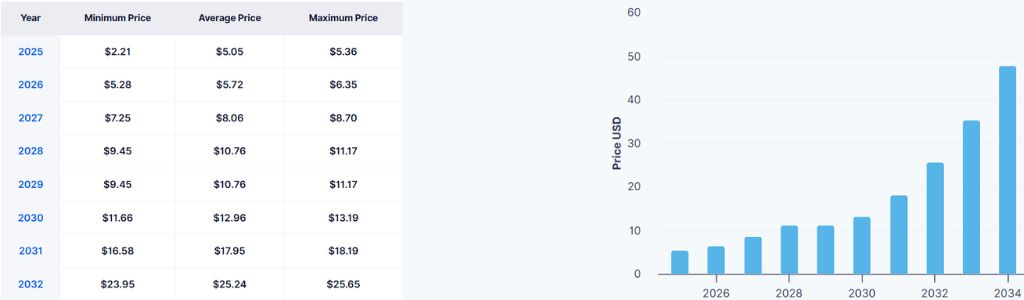

- Price Predictions: Forecasts from 2026 to 2032 show ranges from modest gains near $2.46 to ambitious highs above $81.98.

- Long-Term Outlook: Adoption, regulation, and market maturity could drive resilience, positioning Pendle as a strong player in the decentralized finance sector.

Pendle is a decentralized finance (DeFi) protocol designed to unlock the full potential of yield-bearing assets. By allowing users to tokenize and trade future yield, Pendle introduces a new layer of flexibility to DeFi markets. This innovation enables investors to separate the principal value of an asset from its yield, creating opportunities for hedging, speculation, and more efficient capital management.

The Role of the PENDLE Token

At the heart of the ecosystem lies the native token, PENDLE, which powers governance and incentivizes participation. Holders of PENDLE can vote on protocol upgrades, liquidity incentives, and strategic decisions, ensuring a community-driven approach to growth. Additionally, the token plays a crucial role in liquidity provision, rewarding users who contribute to the protocol’s stability and expansion. Its dual utility, governance, and incentives positions PENDLE as a cornerstone of the platform’s long-term sustainability.

Looking Ahead

As decentralized finance continues to evolve, Pendle stands out for its unique approach to yield management. By bridging traditional financial concepts with blockchain innovation, it has carved a niche in the competitive DeFi landscape. With Pendle’s foundation and utility established, the next logical step is to examine how its native token could behave in the coming years.

Understanding the broader market context, adoption trends, and technological developments will provide a framework for evaluating potential scenarios. This sets the stage for a deeper exploration of Pendle’s price predictions between 2026 and 2032.

Pendle (PENDLE) Price Prediction 2026 – 2032

Pendle Market Outlook for 2026

According to projections highlighted by CoinCodex, the cryptocurrency is expected to trade within a relatively narrow range between $2.44 and $2.46 during 2026. This modest movement would represent a slight increase of 0.72% if the asset reaches the upper target of $2.46.

Other analyses point to a more dynamic scenario, where the coin could sustain its bullish trajectory if it manages to hold above the $5.00 support level. In this case, continuation patterns such as bull flags or pennants might emerge, paving the way for gradual advances toward $6.80.

Evaluating Pendle’s Potential in 2027

CoinDataFlow’s experimental forecasting model indicates that the cryptocurrency could see an increase of 21.95%, potentially reaching $3.00 in the best-case scenario. For the year, the projected trading range is between $1.14 and $3.00, suggesting both upward potential and the possibility of volatility.

An alternative, highly optimistic scenario envisions 2027 as a correction year, with temporary dips followed by recovery. In this case, the coin’s lowest price is projected at $6.57, with an average level around $8.70 and a peak reaching $10.82. Despite the anticipated fluctuations, maintaining an average near $8.70 would signal resilience and sustained investor confidence.

Pendle Token Performance Insights for 2028

According to data from DigitalCoinPrice, there is a strong possibility that the cryptocurrency could nearly double in value during 2028. Forecasts suggest an all-time high between $10.76 and $11.17, though reaching the upper target may prove challenging.

A more moderate outlook envisions the asset testing the $8.20 zone, aligning with measured channel extensions rather than a full breakout. In this scenario, growth in DeFi integrations and steady on-chain activity could help maintain an average near $6.40, with $4.80 serving as a critical support to preserve the broader uptrend.

Anticipated Market Trends Around Pendle in 2029

Insights from Changelly’s crypto experts suggest the asset could trade within a band stretching from $22.18 to $27.55 during 2029. The average level is projected near $23.00, pointing to a year of relative stability with potential for moderate appreciation. This scenario reflects confidence in the ecosystem.

Another projection outlines a different path, with values fluctuating between a low of $8.12 and a high close to $15.93. Under this view, the average price is expected to hover around $11.28, driven by steady cryptocurrency adoption and clearer regulatory frameworks. While less aggressive than Changelly’s forecast, this outlook emphasizes resilience and gradual progress.

Pendle Long-Term Value Considerations for 2030

Forecasts suggest that by 2030, the cryptocurrency could trade within a range between $5.51 and $11.04. If the upper target is achieved, this would represent a gain of approximately 366.21%, underscoring the potential for significant appreciation compared to earlier years.

Another perspective envisions the asset approaching a major valuation zone near $9.50, with market maturity and broader adoption helping sustain an average price around $7.60. In this scenario, support near $5.80 is expected to act as a long-term floor.

Pendle Ecosystem Growth and Price Context in 2031

Findings from the latest experimental forecasting model suggest the asset could experience a rise of 311.17%, potentially reaching $10.11 in the most optimistic scenario for 2031. Throughout the year, values are expected to fluctuate within a range between $4.13 and $10.11, reflecting both upside potential and the possibility of corrective phases.

A more aggressive technical analysis envisions the coin starting 2031 near $17.95 and maintaining that level by year’s end, with additional peaks projected around $16.58. This scenario underscores the significance of the 2025–2031 period as a transformative phase for growth, suggesting that broader adoption and structural developments could elevate the digital asset into higher valuation zones.

Pendle Future Scenarios and Market Position in 2032

Analysts project that by 2032, the asset could reach a maximum valuation of $81.98, while the lower boundary may fall near $67.38. The expected average trading level is around $69.86, suggesting a year defined by strong market positioning and higher valuations compared to prior cycles.

On the other hand, simulation-based models present a more conservative outlook, anticipating a rise of 600.18% with values ranging between $6.94 and $17.22 throughout the year. In this case, the highest potential price is capped at $17.22, pointing to a less aggressive trajectory but still highlighting significant upside relative to earlier benchmarks.

Conclusion

Pendle’s evolving role in DeFi highlights both its innovative yield management and the potential volatility of its asset. Price forecasts from 2026 to 2032 reveal diverse scenarios, ranging from modest gains to ambitious highs. Together, they underscore Pendle’s resilience, adaptability, and long-term relevance in the digital finance landscape.

The Price Predictions published in this article are based on estimates made by industry professionals; they are not investment recommendations, and it should be understood that these predictions may not occur as described.

The content of this article should only be taken as a guide, and you should always carry out your own analysis before making any investment.