TL;DR

- SOL price rises to $132.85 following a cryptic teaser from Solana, gaining 1.58% in the last 24 hours.

- The Alpenglow network upgrade, currently in testing, aims to improve transaction speed, efficiency, and scalability.

- Institutional inflows, including $265 million in Solana-based ETFs, combined with staking incentives, are boosting short-term momentum and supporting investor confidence in the SOL token.

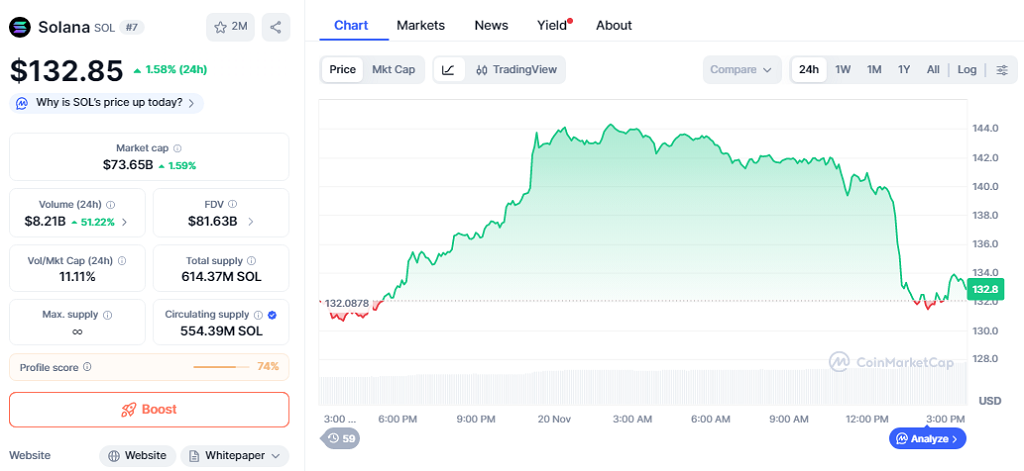

SOL price reached $132.85 after Solana posted a short message on its official X account stating, “Something big is coming.” The teaser generated immediate discussion across social media, with analysts and traders speculating on its potential impact. The price movement occurred amid broader cryptocurrency market volatility, where many leading tokens have experienced minor declines. Over the past 24 hours, SOL gained 1.58%, with trading volume up 51.22% to $8.21B, and its market capitalization is now $73.65B. Some traders noted increased activity in Solana liquidity pools, while others highlighted rising derivatives interest.

Something big is coming 👀 pic.twitter.com/X4ecaMdACw

— Solana (@solana) November 20, 2025

Solana’s Teaser Fuels Speculation And Technical Interest

The announcement coincides with the upcoming Alpenglow network upgrade, currently in its test phase. Alpenglow aims to reduce transaction finality to 150 milliseconds, enhance efficiency, and resolve past congestion issues. Historical trends indicate that major updates from established blockchains can influence token performance, making this teaser especially significant. Solana’s expanding ecosystem in DeFi and NFTs further increases the potential impact of any major development on adoption and network activity. Analysts are also monitoring the performance of Solana validator nodes, which have shown stability improvements, suggesting the network is prepared to handle increased transaction volumes.

Institutional Demand Supports Short-Term Gains

Institutional investors are also contributing to SOL’s momentum. Solana-based ETFs have seen $265 million in inflows over the past ten days, signaling confidence from professional traders. The Grayscale Solana Trust (GSOL) provides staking opportunities with yields near 7%, adding extra appeal for investors. Technical analysis supports the bullish trend, with the Relative Strength Index climbing from oversold levels and SOL trading above its 7-day simple moving average at $138.42, while resistance remains at the 30-day SMA of $168.2.

Outlook And Long-Term Network Improvements

Beyond short-term price movements, Solana’s long-term outlook relies on network enhancements and ecosystem growth. Alpenglow may attract developers and investors seeking faster, low-cost blockchain solutions. Combined with staking incentives and institutional support, these factors create cautious optimism for SOL, suggesting the network could see continued adoption and sustainable growth as upcoming developments are revealed.