Bitcoin’s drop below $90,000 this week reflects more than a routine correction. A broad risk-off shift has hit global markets, and traders are now looking toward two major catalysts: the delayed U.S. jobs data and Nvidia’s upcoming earnings report. With Bitcoin increasingly behaving like a leveraged bet on tech sentiment, Nvidia’s guidance could play a decisive role in defining the next breakout—or breakdown.

Bitcoin declines as tech stocks lose momentum

The latest sell-off pushed Bitcoin into “extreme fear” territory, mirroring the weakness across U.S. equities. The Nasdaq and S&P 500 both slipped under their 50-day moving averages, and high-valuation AI names led the downside.

Bitcoin’s correlation with the Nasdaq 100 has recently climbed back toward 0.80. This relationship explains why BTC reacted so sharply as investors rotated out of expensive tech assets and reassessed expectations for December’s Federal Reserve meeting.

Uncertainty about the timing of rate cuts is adding additional pressure. With a near 50/50 split on whether the Fed will ease in December, markets remain sensitive to any hint of tighter liquidity.

Why Nvidia’s earnings matter for Bitcoin

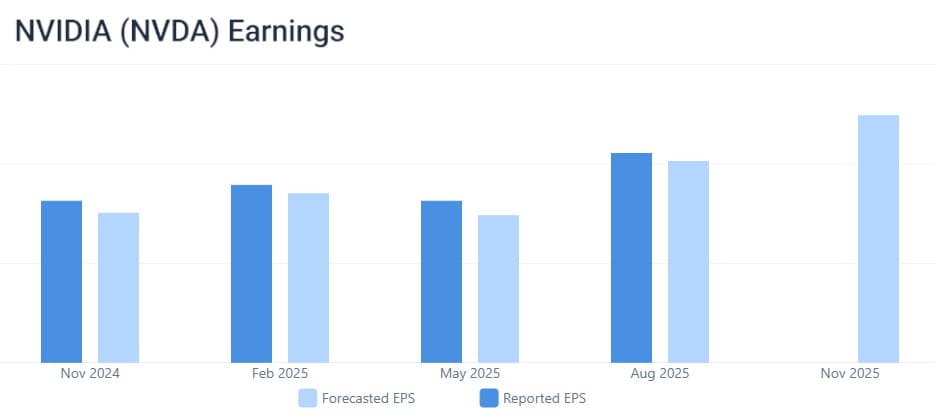

Nvidia (NVDA) sits at the center of the AI cycle, and its quarterly results have repeatedly acted as a sentiment anchor for the broader tech market. Analysts expect over 50% revenue growth year-on-year, but elevated valuations mean the bar is still high—even for the sector’s dominant chipmaker.

Key focus areas from the Nvidia earnings call that can influence crypto markets include:

- Forward guidance from Jensen Huang

- AI infrastructure spending forecasts

- Hyperscaler demand visibility for 2025–2026

- Comments on China-related headwinds

- Capital expenditure trends across the AI ecosystem

Nvidia earnings history. Source: Coincodex

A strong report would support risk appetite and reduce fears of an “AI bubble.” A disappointing one—or guidance that fails to justify recent capex growth—could accelerate downside pressure across both equities and digital assets.

Because of this influence, traders are monitoring Nvidia price prediction models alongside Bitcoin’s technical levels.

Bitcoin technical setup: Bounce signal or bearish continuation?

Bitcoin briefly dipped under the $92,000 zone—an area that has acted as a pivot multiple times over the past year—before forming a hammer candle. Historically, this pattern has indicated short-term reversals for Bitcoin, especially when paired with oversold RSI readings.

Still, the outlook remains mixed:

Bullish signals

- Hammer reversal from prior support

- Oversold RSI in a historically reactive zone

- Short squeeze potential if BTC reclaims $94K–$96K

- Nvidia earnings could improve sentiment quickly

Bearish signals

- Breakdown below $90K opens deeper liquidity zones

- Resistance between $94K–$96K, where shorts are accumulating

- Analyst downside targets near $87K and $81K remain valid

Momentum remains fragile, making Bitcoin particularly sensitive to this week’s macro events.

Macro risks: Jobs data, Fed outlook, and liquidity pressures

The delayed non-farm payrolls report, inflation revisions, and the release of Fed meeting minutes form a dense macro calendar. These updates will shape expectations for the December interest-rate decision.

High interest rates impact the AI sector more than most industries. Rising funding costs affect cloud providers, chip buyers, and startups—creating a ripple effect that feeds directly into Nvidia’s outlook.

If rate cuts are pushed further out, risk assets like Bitcoin may face another leg lower. If liquidity expectations improve, BTC could benefit from renewed inflows into growth-oriented markets.

Bitcoin price prediction: Scenarios after Nvidia reports

Bitcoin’s next move will likely depend on how traders react to Nvidia’s earnings, especially with sentiment already fragile following the recent drop below $90K. From a Bitcoin price prediction perspective, the market appears split between a short-term relief bounce and a continuation of the current downtrend.

Bitcoin 1-year price prediction chart. Source: Coincodex

If Nvidia beats expectations

A stronger-than-expected report would help stabilize risk appetite. In that scenario, Bitcoin could hold above the $92K area and attempt a move toward $96K, $99K, and even $102K if short positions begin to unwind. Strength in AI and tech stocks often spills over into crypto, giving BTC room for a relief rally.

If Nvidia disappoints

If Nvidia’s guidance comes in soft or fails to justify recent valuations, pressure on risk assets could deepen. Bitcoin may retest $90K, with $87K and $81K acting as deeper support zones if selling accelerates. This would likely keep markets cautious heading into the December Fed meeting.

Regardless of the immediate reaction, macro conditions—including rate expectations and liquidity trends—will continue to shape Bitcoin’s broader direction through early 2025.

Bigger picture: Nvidia’s role in crypto through 2026

Nvidia’s long-term guidance carries implications beyond this week’s volatility:

- GPU pricing and supply affect mining economics

- AI spending trends shape risk sentiment

- Capital rotation between sectors impacts Bitcoin demand

- Tech liquidity cycles often precede crypto liquidity cycles

Despite short-term uncertainty, several analysts—including Fundstrat, Bitwise, and Standard Chartered—believe Bitcoin is approaching a cyclical bottom. Many expect improving conditions into early 2026 as liquidity normalizes and ETF flows stabilize.

For now, though, the next move likely hinges on one question: Does Nvidia deliver enough strength to restore confidence in the AI sector?