TL;DR

- Ethereum whales sold 230,000 ETH, causing a 15% price drop last week.

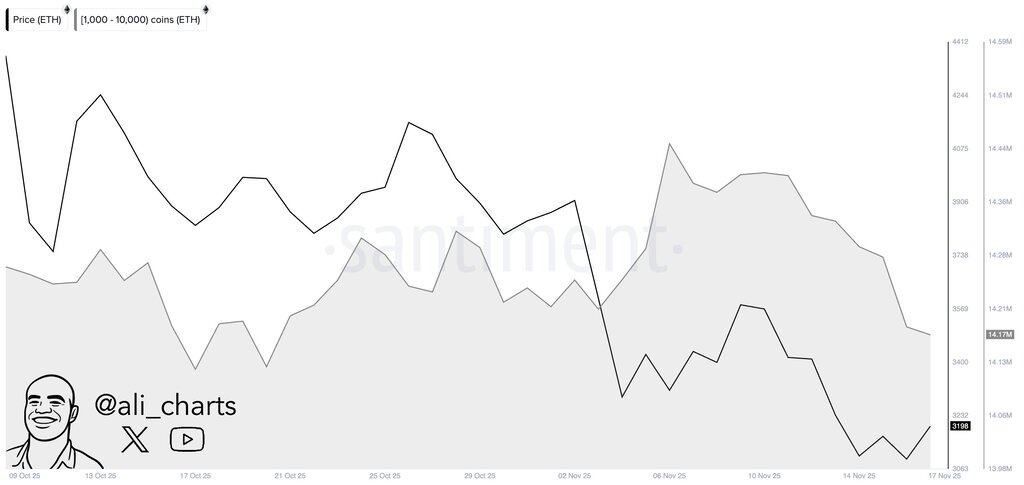

- Large ETH holders sold, reducing balances from 14.4 million to 14.17 million.

- New user growth for Ethereum remains flat, indicating weak retail demand currently.

Ethereum has declined in price over the past week. The value of ETH dropped nearly 15 percent. It now trades just above the $3,000 mark. This price movement followed a week of concentrated selling by large holders, often called whales.

According to data from analyst Ali Martinez, these major players sold approximately 230,000 ETH. The selling occurred between November 9 and November 17. Wallets holding 1,000 to 10,000 ETH reduced their collective balance from 14.4 million to 14.17 million tokens. This activity coincided with the price falling from around $3,600 to its current level. Large sales from a few entities can add downward pressure on an asset’s price.

Meanwhile, new user growth on the Ethereum network remains low. An analyst from CryptoQuant, PelinayPA, reported that new depositor activity is flat. This metric helps measure retail investor demand. The data shows that even when ETH’s price approached $4,000 recently, new user numbers did not increase. Without this broader participation, the market feels top-heavy. Past cycles suggest ETH needs retail interest to support a lasting price increase.

Traders are now watching key price zones for support. The next important level is near $3,000. If whale selling continues, the price could test lower values. A halt in large sell orders may allow for a short-term price recovery. The current situation demonstrates the effect that a small group of large holders can have on market direction.