TL;DR

- ECB official warns stablecoins threaten European financial stability.

- Rapid stablecoin growth may force ECB monetary policy adjustments.

- A digital euro could limit reliance on foreign currency tokens.

Dutch central bank governor Olaf Sleijpen issued a warning during an interview with Financial Times. He argued that a loss of stability in major dollar-linked tokens can trigger rapid reserve sales by issuers, a process capable of intensifying pressure across markets and creating macroeconomic ripples inside Europe. He added that a disruption of large scale can influence financial stability, liquidity conditions and inflation.

Sleijpen explained that the European Central Bank (ECB) now observes growing exposure to dollar-linked tokens. He noted that strong expansion in the sector already alters the financial environment in the region. A sudden need to liquidate reserve portfolios can move prices sharply and tighten liquidity. He acknowledged that an extreme shock may push the ECB to adjust monetary policy, while the direction of any rate move remains uncertain.

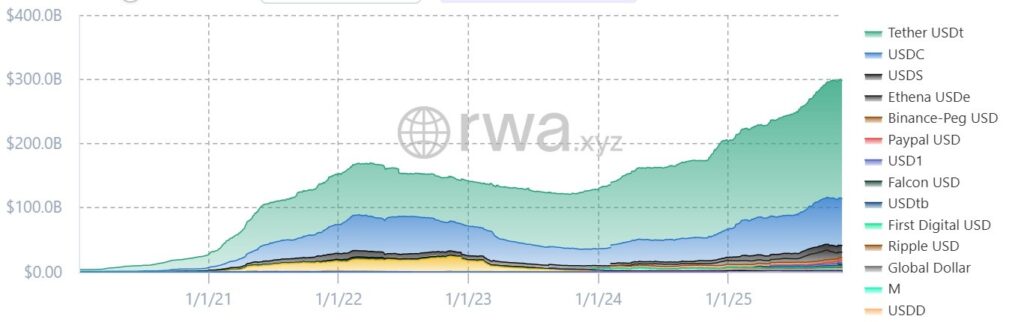

The market shows rapid expansion during recent months. Data from CoinGecko indicates a stablecoin valuation near US$310 billion, an increase of almost fifty percent during the year. Tether (USDT) advanced from US$127 billion in November 2024 to US$183 billion. USDC grew from US$37 billion to US$74 billion over the same period. A report from the US Treasury in April projected that stablecoins may reach US$2 trillion in market value by 2028, driven by broader adoption trends.

European officials voice growing concern about the rising influence of dollar-based instruments. In April, Executive Board member Piero Cipollone argued in an article that a digital euro can protect monetary control inside the bloc, as it limits the use of foreign-currency tokens in daily transactions. Also in April, Italian finance minister Giancarlo Giorgetti stated that stablecoins tied to the US dollar present a stronger threat to financial stability than trade tariffs.

Sleijpen stressed a core risk: issuers can become channels of instability when they unload reserves at speed. Large sales influence liquidity, weaken asset prices and pass stress into the broader economy. In September, Nobel laureate Jean Tirole warned that governments may face heavy fiscal pressure if a major stablecoin collapses and requires public intervention.

The Digital Euro: Sovereignty or Surveillance?

The European Central Bank’s push for a digital euro—framed as a tool to protect monetary sovereignty against stablecoins—could in reality become an unprecedented instrument of financial control.

Far from being a neutral response to private-sector innovation, the digital euro, as outlined by officials like Piero Cipollone, prioritizes surveillance and state intervention over individual economic freedom. By seeking to “limit the use of foreign-currency tokens in daily transactions” the EU isn’t defending stability—it’s enforcing a centralized solution that eliminates competition, reduces payment diversity, and concentrates power in the hands of an unelected bureaucracy. Moreover, in a landscape where transparent, audited, and widely used stablecoins already serve legitimate purposes, the digital euro appears less as public-serving innovation and more as a defensive reaction to the erosion of the central bank’s monopoly.

Worse still, its implementation could enable features like expiring funds, spending controls, or selective account freezes—mechanisms that, while dressed in the language of “stability,” fundamentally undermine financial autonomy and set a dangerous precedent in a region that has historically valued privacy and civil liberties.