TL;DR

- Astar Network announces its Evolution Phase 2 for 2026.

- It establishes a fixed supply of 10.5 billion ASTR.

- New Burndrome mechanism burns tokens to give rewards.

Astar Network has announced its Evolution Phase 2 roadmap for 2026, outlining a plan that includes a new Burndrop mechanism, Tokenomics 3.0, and governance adjustments aimed at increasing decentralization and community participation.

The network sets a fixed supply of 10.5 billion ASTR. Under Tokenomics 3.0, this cap introduces controlled scarcity and a new value structure for the token. Founder Sota Watanabe explained that the initiative seeks long-term sustainability, positioning ASTR as a multi-purpose asset with broader adoption across applications.

Burndrop and Governance Transformation

The Burndrop mechanism operates as a proof of concept where users burn tokens in exchange for future tokens from the Startale ecosystem. The approach redirects incentives toward contributors who help expand adoption within the network. Implementation will progress in the coming months, according to Astar’s schedule.

Governance is also undergoing a gradual transition. The Astar Foundation is transferring operational roles and decision-making power to the community, giving validators and token holders greater influence. Discussion on the governance forum shows broad support for this decentralization effort and the fixed supply model.

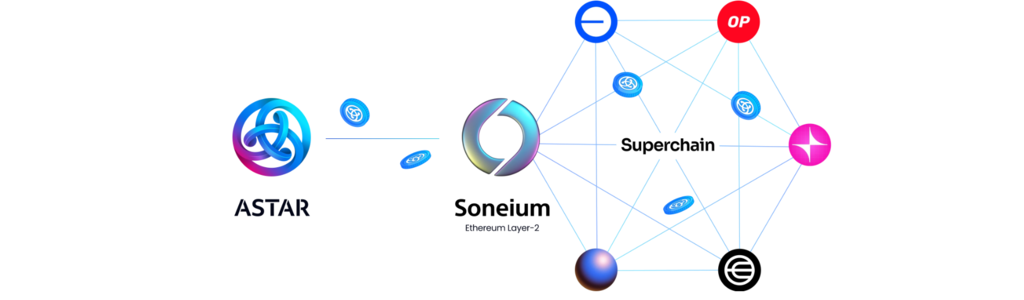

Startale and Plaza are being integrated into the Astar environment to expand real use cases for ASTR. The goal is to increase utility by connecting the token to daily applications rather than limiting it to speculation. Developers and holders have expressed growing interest in the opportunities arising from this integration.

The changes also raise questions about potential effects on Polkadot and other connected networks. Some observers believe the fixed supply and Burndrop mechanism could influence liquidity flows and staking. The technical committee has committed to monitoring these outcomes and adjusting parameters accordingly.