TL;DR

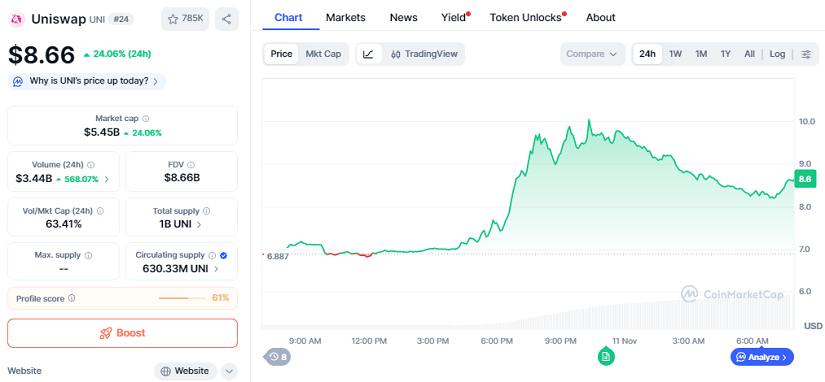

- Uniswap (UNI) jumped 24% in the last 24 hours to trade at $8.66, driven by a governance upgrade proposal focused on enhancing long-term growth and revenue capture.

- Trading volume surged 568% to $3.44B, reflecting strong market confidence.

- With a $5.45B market cap, analysts believe UNI could target $12 if buying pressure holds above key support levels.

Uniswap delivered a strong performance as UNI reached $8.66 with a $5.45B market cap. The latest price rally aligns with a major governance enhancement proposed by Uniswap Labs and the Uniswap Foundation, seeking to modernize how the protocol evolves, captures value, and rewards participation. Market sentiment improved as the plan outlines a more agile and revenue-aligned model that appeals to investors favoring sustainable token economics in decentralized finance.

Many traders attribute the latest price acceleration to the proposal’s combination of reduced token supply pressure and improved protocol efficiency. At the same time, broader strength in DeFi supported the move, with capital rotating into protocols showing real utility, deep liquidity, and transparent development.

Governance Overhaul Aims At Efficiency And Growth

The proposal introduces a streamlined operating structure in which Uniswap Labs would coordinate key ecosystem initiatives with measurable accountability. It includes a potential fee model linked to protocol usage, alongside a token burn element that could gradually reduce UNI’s circulating supply. Supporters argue that this makes UNI more attractive for long-term holding rather than short-term speculation.

A dedicated growth budget is also under review to support innovation, integrations, and developer incentives. Market observers view this as a strategic move to accelerate expansion across multiple networks and strengthen Uniswap’s position as a leader in on-chain trading.

Market Reaction And Analyst Projections

Following the announcement, UNI’s trading volume soared 568% to $3.44B over 24 hours. The price attempted to break above the $9 mark before cooling slightly. Technical analysts suggest that if UNI holds above $8.50, a push toward $10 and eventually $12 remains feasible. Some chart analysts highlight $12 as the next major target, especially if the governance update earns community approval and market conditions remain supportive.

DeFi supporters view this upgrade as a signal of increasing institutional maturity in the sector. If executed successfully, Uniswap could become a reference model for combining decentralization with efficient management. Investors now await the upcoming governance vote, which could determine whether UNI’s strong rally transitions into a sustained growth phase heading into the next quarter.