Solana investors are watching closely as the SOL price hovers below $160, struggling to regain the $200 mark ahead of the Fed’s upcoming rate decision. Despite reported institutional inflows, near-term momentum remains weak.

Meanwhile, Remittix (RTX) has also drawn attention in some market commentary due to its stated focus on payments and real-world use cases, prompting comparisons with larger networks such as Solana.

Solana Price Prediction Faces Hurdles Ahead Of Fed Decision

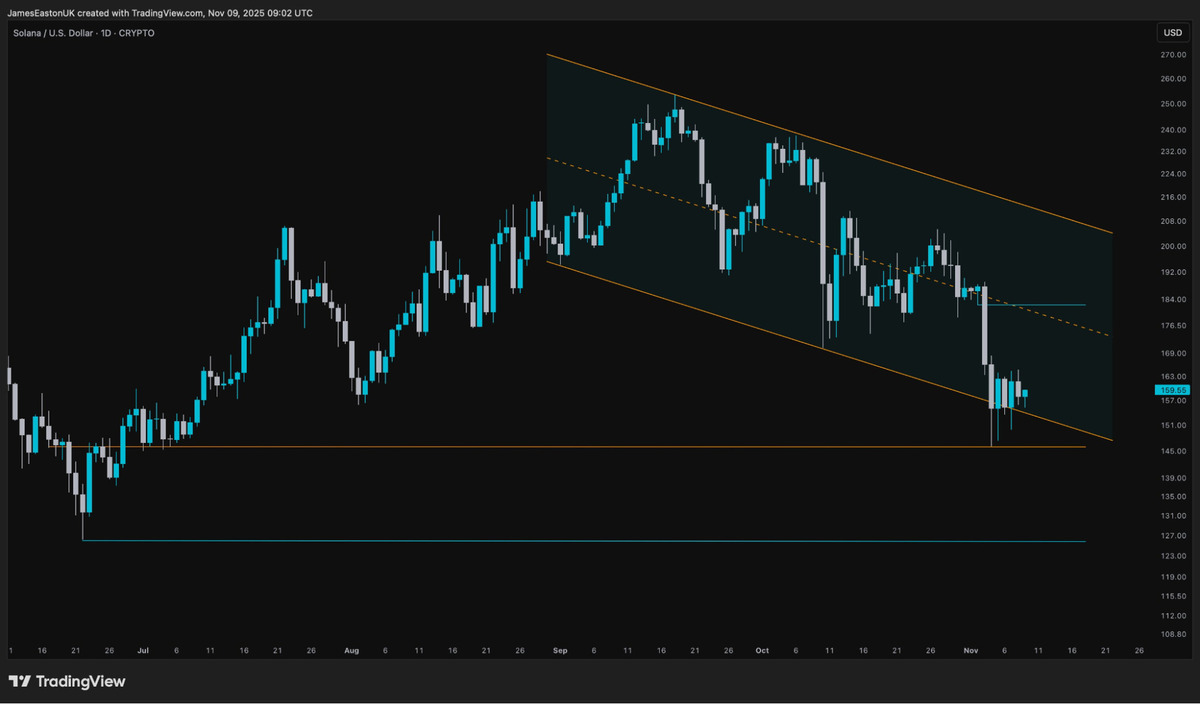

The Solana price remains under pressure, trading near $158.11 as market participants assess whether the token can return to the $200 level before the Fed’s upcoming rate decision. The Bitwise Solana Staking ETF (BSOL) has reported assets of over $545 million since late October, but price momentum has been uneven.

Retail participation appears subdued, and some DeFi participants have raised questions about validator centralization. While the network is often cited for throughput and fees, market indicators can diverge from on-chain narratives. Technical analysis shared by commentators has cited resistance near $178.55 and downside levels around $122.47 if selling pressure persists; such levels are not guarantees and can change quickly.

The Solana price prediction remains sensitive to broader risk sentiment unless buyers reclaim key levels. Some analysts suggest that while institutional demand may be developing, short-term positioning has leaned more defensive.

For now, all eyes are on the Fed, as macroeconomic signals can influence crypto market direction, including SOL and smaller projects mentioned in market coverage.

Remittix Gains Momentum As Solana Struggles To Reclaim $200

Remittix (RTX) is a payments-focused crypto project that has appeared in recent discussions alongside larger assets. In project materials, the team describes its product as a way to move crypto funds into fiat bank accounts in more than 30 currencies, with processing times described as within 24 hours. These claims should be independently verified, and availability may vary by jurisdiction and banking partner.

The project positions itself within the “PayFi” narrative and says it aims to support cross-border transfers. As with any early-stage crypto initiative and token sale, product, regulatory, and execution risks may be material.

Project updates cited in marketing materials include:

- Statements that BitMart and LBank intend to list RTX in the future.

- A wallet beta described as available for community testing.

- References to third-party security or verification services; readers should review any audit or verification reports directly.

- Mentions of marketing incentives (such as referral programs), which may change and are not indicative of investment outcomes.

The project has also stated that it has raised more than $28 million, though fundraising figures and terms should be confirmed through primary documentation.

Project links (for reference)

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

This article contains information about a cryptocurrency token sale. This outlet is not affiliated with the project mentioned. This article is for informational purposes only and does not constitute financial or investment advice. As with any initiative within the crypto ecosystem, readers should do their own research and consider the risks involved.