The crypto token sale landscape in 2025 has included a number of early-stage launches. Three projects drawing attention are Digitap ($TAP), Tapzi (TAPZI), and BlockchainFX (BFX).

Each represents a different approach: Digitap describes itself as a banking-style app that connects everyday payments with crypto features, Tapzi focuses on Web3 gaming, and BlockchainFX says it aims to build an all-in-one trading app.

As with any early-stage token sale, these projects carry material execution and market risks. Readers should review primary documentation and independent sources rather than treating comparisons as a recommendation.

Source: Digitap (project materials)

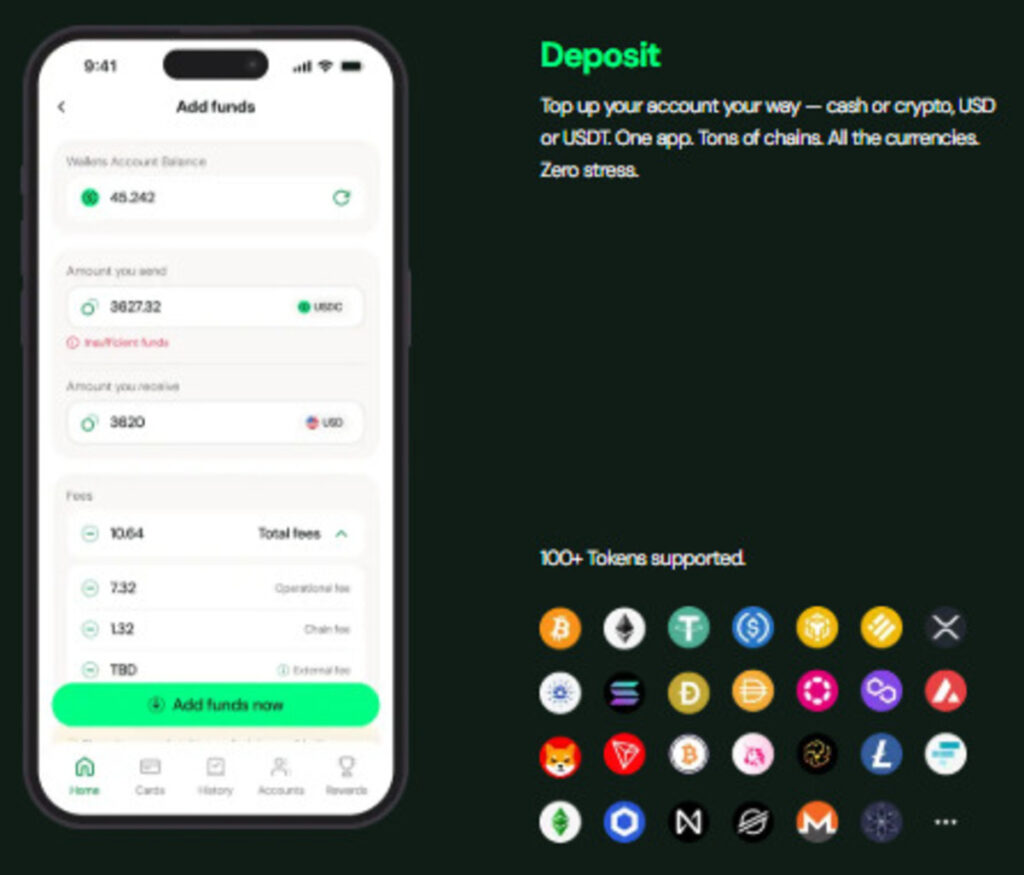

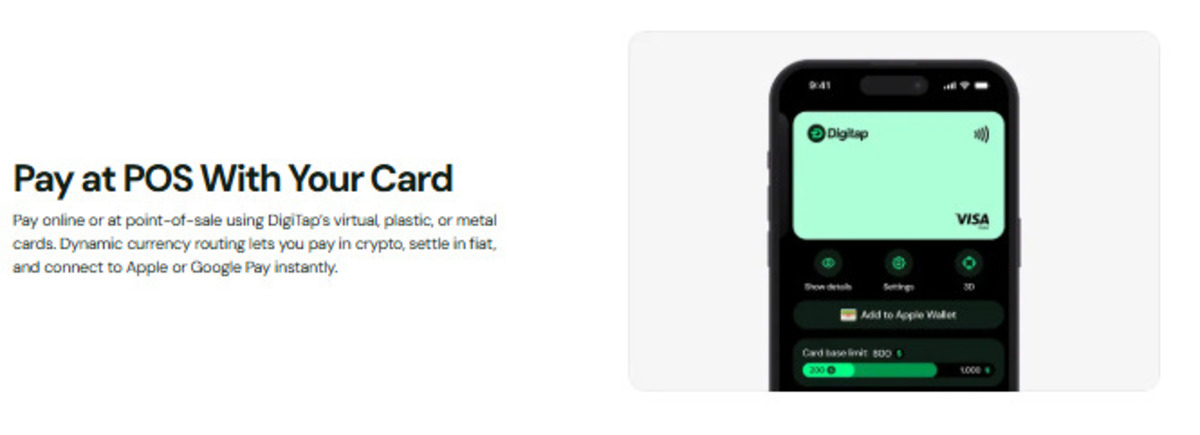

Digitap: Reported product features and use case

Digitap’s “omni-bank” application is described by the project as combining fiat-style accounts, crypto wallets, and card payments in one app. According to project materials, users can transact in multiple currencies, access offshore IBAN fiat accounts, buy and sell a range of cryptocurrencies, and use a Visa-branded card where accepted.

Digitap also says sign-up and identity verification requirements can vary by product and jurisdiction, including options that may not require KYC in some cases. Users should consider local legal and compliance requirements before using any financial app.

The project positions these features as potentially useful for people who are underbanked, including freelancers who may prefer to receive and convert payments across crypto and fiat rails.

Source: Digitap (project materials)

Token supply and buyback/burn claims

Digitap is conducting a token sale for its native $TAP token. The project reports that it has raised more than $1.6 million to date; this figure has not been independently verified in this article.

Project materials also describe a staged pricing structure for the token sale and include statements about potential future exchange availability. Any future price targets, listings, or performance scenarios are uncertain and should not be treated as forecasts.

According to the project, $TAP has a fixed supply of 2 billion tokens and no inflationary minting. Digitap also says it intends to allocate 50% of platform profits toward a buyback-and-burn program and other initiatives; readers should treat these as plans that may change and may depend on financial performance and governance decisions.

Source: Digitap (project materials)

Tapzi: Skill-to-earn gaming model

Tapzi describes itself as a “skill-to-earn” gaming platform. According to the project, players can stake tokens in games and receive rewards based on outcomes. The project highlights classic games such as chess, where participants use the native TAPZI token and winners receive tokens from a shared pool.

As with other GameFi-style concepts, adoption can depend on user growth, game quality, token distribution design, and regulatory considerations around wagering-like mechanics.

Tapzi’s focus on classic games may lower barriers to entry, but the project would still need to compete for attention in a crowded entertainment market.

Source: Tapzi

BlockchainFX targets one-stop trading amid regulatory complexity

BlockchainFX says it is aiming to build a single platform where users can trade or swap cryptocurrencies alongside traditional assets such as stocks, ETFs, and forex. The project frames this as a way to combine crypto and legacy markets in one interface.

According to BlockchainFX, a beta version offers access to more than 500 different assets. Operating across multiple asset classes can introduce significant regulatory and licensing requirements that may vary across jurisdictions.

The sector is also highly competitive. Any product that offers multi-asset trading would likely compete with established crypto exchanges, brokerages, and FX platforms.

Source: BlockchainFX

Key uncertainties when comparing early-stage token projects

When comparing projects like Digitap, Tapzi, and BlockchainFX, common variables include product readiness, user acquisition costs, regulatory exposure, and whether token demand is tied to real usage rather than marketing.

Web3 gaming remains a challenging segment for sustained user retention, and some research has suggested high failure rates for blockchain game projects; for context, one analysis cited a failure rate estimate as high as 93%. estimating a failure rate as high as 93%.

Multi-asset trading platforms can face additional compliance challenges compared with crypto-only applications. Separately, claims about partnerships, cards, or banking access should be assessed carefully because availability can differ by country and provider policies.

Website (project reference): https://digitap.app

Social (project reference): https://linktr.ee/digitap.app

This article is for informational purposes only and does not constitute financial or investment advice. This outlet is not affiliated with the project mentioned. As with any initiative within the crypto ecosystem, readers should conduct their own research and consider the risks involved.