TL;DR

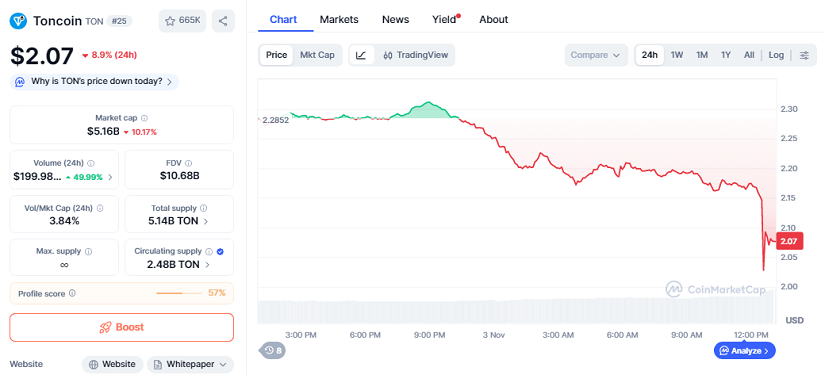

- Toncoin fell 8.9% in the last 24 hours to trade near 2.07 dollars after Nasdaq issued a warning to TON Strategy for breaching listing rules tied to a 273 million dollar token acquisition.

- Trading volume jumped 50% to 199 million dollars, signaling stronger participation from sellers and opportunistic buyers.

- Despite the decline, pro-crypto analysts see the pullback as temporary given Toncoin’s ecosystem growth and rising adoption within Telegram’s user base.

Toncoin extended its downturn on Monday after Nasdaq issued a compliance warning to TON Strategy, a major holder of the token, linked to its recent 273 million dollar purchase of Toncoin. The token traded near 2.07 dollars with a market capitalization of 5.16 billion dollars, marking an 8.9% daily decline. The move came as the market absorbed heightened selling pressure across large-cap altcoins, though Toncoin was among the hardest hit.

The drop followed a filing indicating that TON Strategy issued shares without obtaining the required shareholder approval to finance the acquisition. While Nasdaq did not recommend a delisting, the notice places the publicly listed firm under closer scrutiny. TON Strategy has positioned itself as a long-term treasury builder for Toncoin, currently holding more than 217 million tokens. The company has 45 days to present a plan to regain compliance.

Market Reaction And Technical Outlook

Trading activity rose sharply, with 24-hour volume reaching 199 million dollars, about 50% above the recent average. Technical traders noted that Toncoin broke below several key support zones during the decline. Intraday attempts to rebound saw selling pressure re-emerge near the 2.19 dollar resistance level, a zone that traders will monitor to gauge short-term sentiment.

Despite the setback, several analysts argue that the episode is more procedural than fundamental. They highlighted that Nasdaq’s notice does not question the legitimacy of Toncoin nor the growing adoption of the TON blockchain. Instead, the issue revolves around corporate governance at TON Strategy, a factor that can be resolved without impact on network development.

Broader Adoption And Long-Term Potential

Supporters of the project emphasize Toncoin’s expanding ecosystem, driven by increasing integration within Telegram’s global user base. New applications in payments, tokenized assets and gaming continue to attract builders and users. Some market participants view the current pullback as a chance for accumulation, citing growth in active wallets and on-chain activity.

While short-term volatility may persist, the long-term outlook for Toncoin remains linked to ongoing real-world usage and partnerships. If TON Strategy resolves its compliance issue swiftly, attention may return to ecosystem expansion rather than regulatory noise.