TL;DR

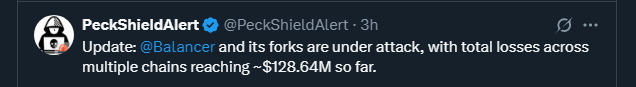

- The Balancer protocol suffered a massive exploit of approximately $128.64M, affecting wrapped ETH and related assets across Ethereum, Arbitrum, Base, Polygon, Berachain, Sonic, and Optimism.

- Despite the breach, DeFi adoption remains strong, with developers reacting quickly to reinforce security.

- The event highlights the value of open-source improvements, agile audits, and user protection tools, enduring advantages that continue to strengthen the sector.

Balancer, one of the most established DeFi platforms, faced a significant exploit that spread across multiple networks and escalated rapidly. Initial estimates indicated losses of $116M, but the latest data shows a total of $128.64M, distributed as follows: Ethereum $99,609,000, Berachain $12,860,000, Arbitrum $6,965,000, Base $4,012,000, Sonic $3,440,000, Optimism $1,580,000, and Polygon $232,350. Attackers targeted wrapped ETH pairs and outdated smart contract functions that had not yet undergone recent audits.

Multichain Impact and Technical Vector

Most of the drained funds (~$99.6M) came from Ethereum, with the remainder spread across other networks. The attacker fragmented the assets into new wallets, likely preparing for future swaps or bridging attempts. Preliminary analysis suggests the exploit originated from obsolete contract permissions, enabling unauthorized minting and misuse of approval functions. The incident underscores the importance of continuous contract updates and smart contract insurance.

BALANCER’S RESPONSE AND OUTLOOK

Balancer confirmed that its V2 pools were the ones affected, while V3 remains operational and unaffected. The team has engaged several leading Web3 security firms to contain the incident and assess recovery pathways. Discussions include potential white-hat negotiations, improved migration incentives toward V3, and enhanced user-side protections to prevent similar issues.

Despite the attack, the BAL token reacted minimally, reflecting its already modest trading activity. Total value locked on Balancer has declined from its 2022 peak of over $3B to under $700M, yet the protocol still maintains a committed base of liquidity providers. Many in the DeFi space view this not as a setback but as another reminder of why open-source collaboration, innovation and rapid iteration continue to drive long-term growth in decentralized finance.