This article discusses market commentary around Ethereum and references a separate crypto project that some promotional materials describe as an early-stage opportunity. Past trading results mentioned by third parties should not be treated as typical or repeatable outcomes.

Recent discussion around Ethereum has pointed to increased network activity and wallet movements that some analytics firms interpret as accumulation. Claims about specific individuals’ purchases or motivations are difficult to verify independently and should be read as market commentary rather than confirmed fact.

Alongside ETH, some commentators have highlighted smaller tokens in the Ethereum ecosystem as higher-risk assets that could see significant price volatility. high growth tokens are sometimes discussed in this context. Below is a summary of one such project referenced in those materials.

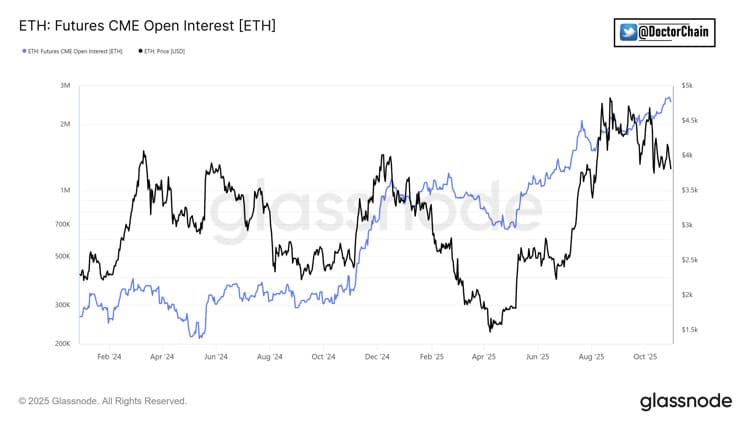

Ethereum Activity and Large-Holder Wallet Trends

ETH has remained a focal point for traders, and some on-chain trackers have reported changes in balances among larger wallets over recent weeks. Figures cited in market posts (including estimates in the billions of dollars over short periods) depend on methodology and may not reflect confirmed buying or selling intentions. ETH also continues to trade around widely watched technical levels, which some analysts interpret as consolidation.

Separately, some promotional content and social-media commentary has pointed to other tokens as having higher upside than ETH. Such statements are speculative, and smaller projects typically carry different liquidity, execution, and regulatory risks compared with established assets.

Remittix: Project Summary Referenced in Promotional Materials

Some third-party commentary has highlighted Remittix as a payments-focused crypto project. The project describes itself as a global payments ecosystem intended to support bank payouts in 30+ countries, emphasizing utility tied to money movement. Project materials also describe cross-chain functionality and a token model designed to reduce supply over time. As with any early-stage token sale, these are claims made by the project and should be evaluated independently.

Why analysts highlight it now:

- Global reach: the project states it aims to support crypto-to-bank transfers in 30+ countries

- Payments focus: the team positions the product as payments infrastructure rather than a purely speculative asset

- Audit claim: promotional materials state the project has been audited by CertiK

- Wallet roadmap: the team describes a mobile-first wallet with real-time FX conversion features

- Token model: the project describes its tokenomics as deflationary

Any token purchase involves risk, including the possibility of total loss, and market prices may not reflect project plans or timelines.

Project marketing incentives and referral program

The project’s promotional materials also mention marketing incentives, including a giveaway and a referral program. Reported figures for participation (such as holder counts or entry totals) and any stated future exchange listings are not independently verified here and may change. Readers should review terms directly from the project and consider applicable legal and tax implications in their jurisdiction.

Project links (for reference):

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

This article contains information about a cryptocurrency token sale. This outlet is not affiliated with the project mentioned. This article is for informational purposes only and does not constitute financial or investment advice.