The recent Solana (SOL) price trend and SUI market movement have caught traders’ attention as they track momentum heading into 2025. Solana’s move between $190 and $200 reflects a recovery that some market participants link to ongoing network upgrades and broader interest in the ecosystem. Meanwhile, SUI has traded above $2.50 in recent sessions, alongside continued activity in decentralized trading.

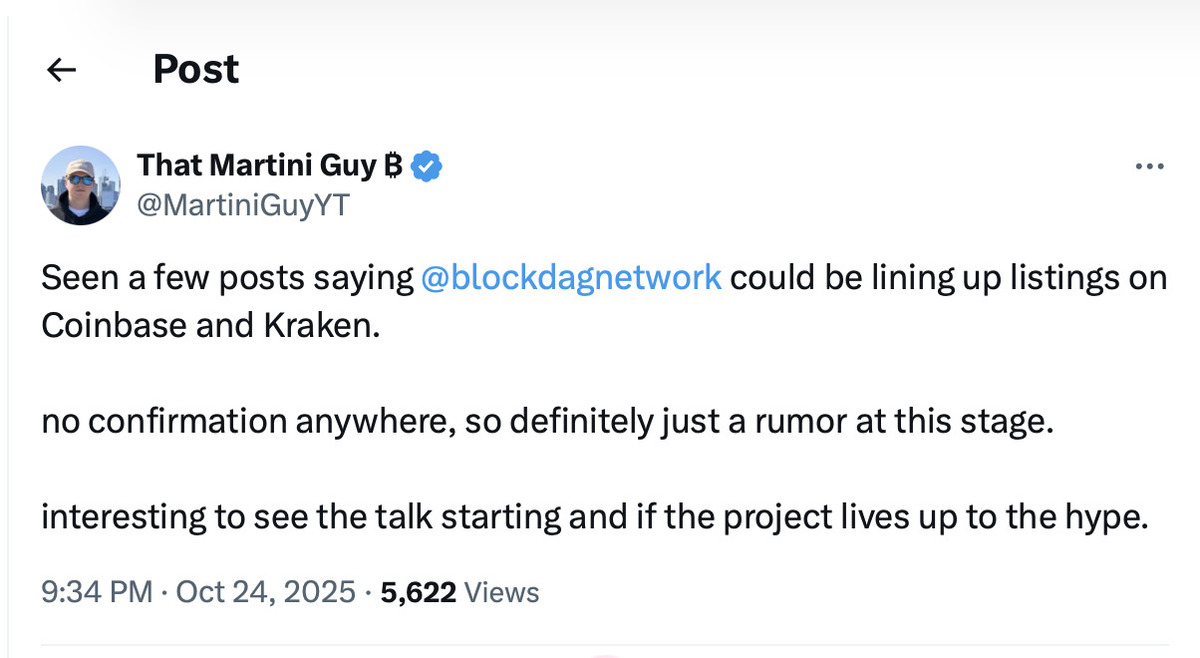

Despite these gains, BlockDAG (BDAG) has drawn attention following online discussion about potential exchange listings. A post from That Martini Guy referenced Coinbase and Kraken, while a document circulating online has been cited in related threads. Neither exchange has publicly confirmed a listing in the materials referenced here, and such outcomes remain uncertain. The project has reported fundraising totals and token supply figures, but these claims are not independently verified in this article.

Market participants often view potential exchange listings as a notable catalyst, but outcomes and timing can change, and any impact on price is inherently uncertain.

BlockDAG listing discussion follows social-media posts

That Martini Guy’s post prompted renewed discussion across crypto communities about whether BlockDAG could be preparing for listings on Coinbase and Kraken. The circulating documentation has been shared as supporting material, though readers should treat unverified files and screenshots cautiously. If listings were to occur, they could increase access to BDAG on centralized venues, but listing decisions ultimately rest with exchanges and are not guaranteed.

In its own materials, BlockDAG states it has raised nearly $435 million across multiple rounds and has onboarded more than 312,000 holders. The project also advertises batch-based token sale pricing and has referenced a future listing price and date; however, these are project-stated targets rather than confirmed market outcomes, and they should not be interpreted as guarantees of returns.

BlockDAG describes its architecture as combining Proof-of-Work and Directed Acyclic Graph (DAG) approaches, and it has published throughput figures for its network and test environments. It also states that security reviews were conducted by CertiK and Halborn, and that mining hardware and app-user milestones have been reached. As with similar early-stage projects, independent verification and ongoing monitoring are important, particularly where performance metrics are self-reported.

Solana price consolidates amid mixed signals

The Solana (SOL) price trend continues to show consolidation as it stabilizes between $192 and $205. Buyers have defended the $184–$190 area in recent trading, and some analysts have suggested that sustained strength above $200 could support a move toward higher resistance levels such as $215–$230. Expectations around potential ETF-related developments have also been cited by market watchers, though timelines and approvals remain uncertain.

On-chain data has shown activity in trading volume and liquidity across decentralized exchanges, which some interpret as a sign of renewed participation in Solana’s ecosystem. As with any technical setup, a breakout is not assured, and price action can shift quickly with broader market conditions.

Downside risk remains if the asset drops below $180, and wider market volatility can affect both near-term and longer-term trends.

SUI trades near recent support levels

SUI’s recent stability near $2.50–$2.55 has been interpreted by some analysts as a period of consolidation after prior liquidity inflows. Some chart watchers point to $2.35 as a support level and $2.60 as a near-term resistance area, though any upside scenarios depend on overall market conditions and follow-through buying.

SUI’s Total Value Locked (TVL) has been cited at $885 million in recent reports, alongside ongoing developer activity and additional decentralized exchange integrations. Technical indicators such as RSI and MFI are sometimes used to assess momentum, but they do not predict outcomes on their own.

Some traders look to assets like SUI for comparatively steadier moves versus smaller, less liquid tokens, but volatility can still be significant in crypto markets.

What to watch into 2025

Solana and SUI continue to show active trading and ecosystem developments, while BlockDAG remains a topic of discussion due to unconfirmed listing speculation and the project’s reported token sale activity. Readers should distinguish between confirmed exchange announcements and community-driven narratives, and treat forward-looking claims—especially around future listings or prices—as uncertain.

Website (for reference): https://blockdag.network

Telegram (for reference): https://t.me/blockDAGnetworkOfficial

This article contains information about a cryptocurrency token sale. This outlet is not affiliated with the project mentioned. This article is for informational purposes only and does not constitute financial or investment advice.