Ethereum is showing increasing supply pressure, a trend that could fundamentally change the way investors view the ongoing market deceleration. Although volatility has subsided, exchange data now shows an alarming decline in Ethereum’s free reserves, which suggests that a new phase of accumulation is in the offing.

The same trend has historically been responsible for significant uptrends in the price of Ethereum, and here the setup is even stronger. DeFi and payments projects like Remittix (RTX) have also been gaining momentum as investors keep diversifying into assets that possess real utility and long-term scalability.

Ethereum’s Supply Squeeze Deepens

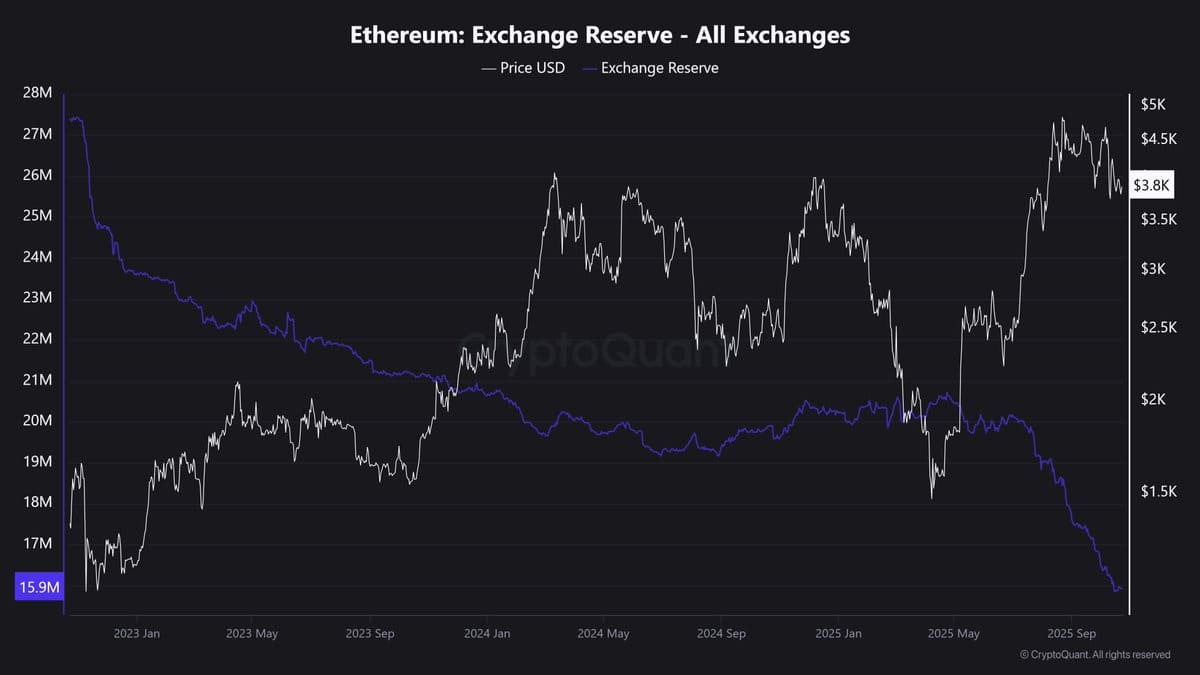

On-chain records from recent times show Ethereum exchange reserves dropping at a drastic rate a signal that typically indicates investors are moving tokens into cold storage.

CoinMarketCap community metrics show Ethereum’s exchange reserve supply is crashing, a label that has become a rallying call among holders anticipating a potential breakout.

Ethereum is currently selling at $3,907 after a significant gain of about 2.37% in the last 24 hours with a market capitalization of $474.41 billion, suggesting a decrease in speculative activity and an increase in holder conviction.

Calm Before Ethereum’s Next Move

Analysts are noting that while near-term selling pressure persists, its consolidation rather than panic. Exchange inflows have risen by around 3,000 ETH, which shows very little sell-side activity. If Ethereum falls below $3,800, analysts are warning that $3,400 will be the subsequent support.

Nonetheless, the overall derivatives market is stable. Open interest is fluctuating around $19–20 billion a good indication after last month’s wave of liquidation.

Further, sentiment indicators indicate that 67% of owners are still in profit, yet without hints at excessive optimism, which means there remains potential to continue growing if demand picks up.

Speculation around T. Rowe Price adding Ethereum to its upcoming multi-coin ETF fueled expectations that long-term adoption is picking pace. This follows the same trend of Bitcoin ETF inflows during the first half of the year that helped stabilize BTC market structure.

Remittix Enters the Real World of Actual Utility

While Ethereum sits at the top in decentralized infrastructure, other tokens like Remittix are taking its principles and applying them to practical conditions. Trading at $0.1166 per token, Remittix has raised more than $27.7 million and sold more than 681 million tokens, which shows aggressive investor interest.

The project has just been CertiK certified and topped CertiK’s Pre-Launch Token leaderboard at #1, ensuring its security and transparency. With imminent BitMart and LBANK exchange listings, Remittix wallet development, and a 15% USDT users’ referral campaign, the ecosystem is developing extremely quickly.

As more confidence is gained in securitized digital assets, tokens with their transparent utility and audited security like Remittix will be starring along with greater networks like Ethereum. These are being looked at by investors increasingly as part of an overarching trend towards responsible adoption of blockchain.

The Road Ahead for Ethereum and PayFi Tokens

Ethereum’s technical configuration suggests a period of tranquil accumulation rather than depletion. While reserves remain thin and institutional products continue to widen exposure, a breakout to $6,500 remains in reach.

Whether the breakout occurs this quarter or the following, Ethereum’s rebalancing fundamentals appear to be falling into place with an overarching narrative of mature market cycles.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250,000 Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway

This article contains information about a cryptocurrency presale. Crypto Economy is not associated with the project. As with any initiative within the crypto ecosystem, we encourage users to do their own research before participating, carefully considering both the potential and the risks involved. This content is for informational purposes only and does not constitute investment advice.