Ethereum has believers again. And calls for ETH to hit $10,000 are being heard again. In a recent interview, Arthur Hayes put that target on the table, and Tom Lee went further, sketching 10,000–12,000 as a reasonable range.

The case is momentum plus fundamentals. The global easing cycle has started, and while markets are still reeling from recent liquidations, most investors forget that QE hasn’t even started yet. But even if ETH hits $10,000 from here, that is not even a 3X.

Bigger and better trades are available for those willing to look. Digitap ($TAP), a product that aims to be the “Ethereum of banking” by turning stablecoin rails into everyday money, is seeing impressive presale traction. And it could become 2025’s fastest grower—here’s what investors need to know.

ETH to $10,000: The Setup

ETF flows have legitimized Ethereum, and TradFi continues to buy the dip. The narrative is clean and simple, ETH is global compute and the access gate to tokenized finance. On Bankless, Hayes framed ETH as the computing reference asset. While Lee argued it’s both money and compute, a foundation for Wall Street and AI.

If that plays out, ETH could easily soar to $10,000 this cycle. And judging from gold’s recent price action, markets are sniffing out further debasement, and increased liquidity has always been bullish for crypto. Arthur Hayes and Tom Lee are both respected figures, and if they believe ETH is going to $10,000, markets have a reason to believe them.

What Happens if ETH Hits $10,000?

An ETH melt-up would lift all boats. This would mean an incredible amount of liquidity for altcoins, and the rallies would be monstrous. Utility projects like Digitap would be first in line, and while DeFi dominated the last cycle, it looks like 2025 belongs to payments.

Traditional finance has adopted crypto, but cross-border payments still crawl along ancient and outdated correspondent networks with fees north of six percent and settlement times measured in days. Stablecoin rails cut both to near zero. The winner is the platform that hides the rails and feels like a bank.

The World’s First Omni-Bank: DigiTap

DigiTap makes money programmable. It is a consumer-first front end where fiat, stablecoins, and crypto live in one account and can be spent anywhere. The interface looks like a neobank, and underneath it is powered by blockchains as well as traditional banking rails.

It is the bridge between traditional finance and crypto. It offers virtual and physical Visa cards, Apple Pay, and Google Pay support, and balances shown in standard currencies. Meaning users can sign up and download the app today and start spending crypto anywhere.

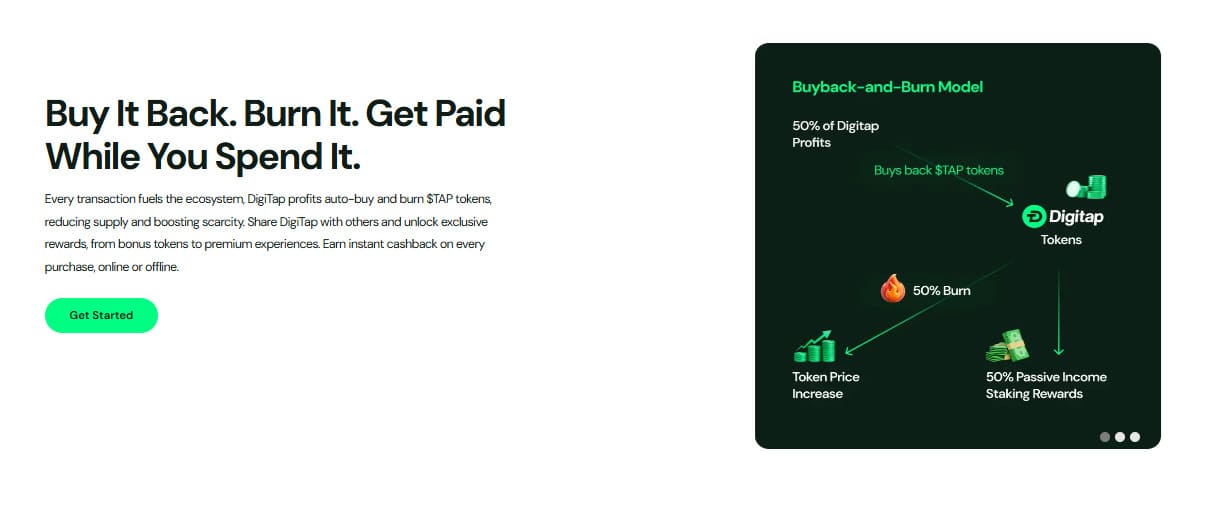

Digitap is an interoperability layer between two worlds, and its network of rails ensures money gets wherever the user wants in real-time. The native token, $TAP, has been designed to capture value, explaining why some call it the best crypto presale of 2025.

$TAP’s Path to $1

Price targets need mechanics. While $1 seems a million miles away from the current price of $0.0194, nobody in crypto appreciates the sheer size of the traditional payments industry. Cross-border payments do trillions of dollars annually. If Digitap captures even a small fraction of that volume, it would catapult into a multi-billion-dollar ecosystem practically overnight.

Assume DigiTap scales cross-border and card flows. Perhaps it hits 2 billion in annual processed volume by next year. Assume $TAP makes 0.5% of that in platform profit, that’s 10 million dollars of buybacks yearly. Imagine if $TAP does 10X that volume.

By 2030, the supply will be much lower, and Digitap’s vision of card distribution, corridor depth, enterprise accounts, and stablecoin throughput will be in full swing. Digitap does have one of the most plausible paths toward a dollar handle over a multi-year horizon compared with other altcoins.

Why DigiTap could become the Ethereum of banking by 2030

Ethereum delivered smart contracts, and then DeFi was born. Banking needs the same moment for money. easy-to-use app that treats fiat, stablecoins, and crypto as one balance while turning blockchains into background infrastructure. That could be Digitap.

By 2030, the likely winners in the PayFi race will look like software companies with card networks for distribution. DigiTap sits in that lane, and its current price of $0.0194 seems incredibly low given its potential market size. Not to mention what could happen if ETH accelerates toward $10,000 by year-end.

Discover how Digitap is unifying cash and crypto by checking out their project here:

Presale: https://presale.digitap.app

Website: https://digitap.app

Social: https://linktr.ee/digitap.app

This article contains information about a cryptocurrency presale. Crypto Economy is not associated with the project. As with any initiative within the crypto ecosystem, we encourage users to do their own research before participating, carefully considering both the potential and the risks involved. This content is for informational purposes only and does not constitute investment advice.