TL;DR

- BNB reached a new all-time high of $1,370 as the broader crypto market showed renewed strength, securing its status as the third-largest digital asset by market value.

- Binance allocated $283 million to compensate users affected by the recent depegging of three Earn products, reinforcing confidence in the platform’s resilience.

- Strong momentum indicators, rising volume, and sustained demand have opened the door for a potential move toward $1,500 in the short term.

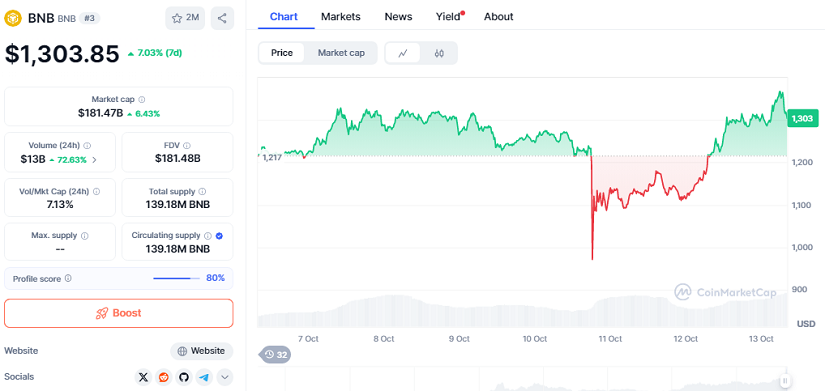

BNB has continued its upward trajectory and briefly touched a fresh all-time high of $1,370, signaling renewed optimism among investors. The token currently trades at $1,303.85 after gaining 6.53% in the past 24 hours and 7.03% over the last week. Its market cap stands at $181.47 billion, while 24-hour trading volume has surged to $13 billion, up 72.63%. Among large-cap cryptocurrencies, BNB has emerged as one of the most resilient assets during the recovery.

A major confidence boost followed Binance’s move to cover losses tied to the temporary depegging of assets in its Earn program. The exchange compensated users with a total of $283 million after issues involving USDe from Ethena, the BNSOL staking token, and WBETH.

The broader market recovery helped fuel BNB’s rebound from the $1,077 support level. Technical indicators underscore sustained buying interest. The relative strength index at around 63 points points to strong demand without showing signs of excess. Meanwhile, the MACD continues to reflect bullish pressure, suggesting that momentum is still intact. Traders have also noted that order book depth on major exchanges has improved, indicating increased participation from larger holders who had stayed on the sidelines.

Institutional Interest And Market Position

BNB’s expanding role in staking services and decentralized applications on BNB Chain continues to attract both institutional and retail inflows. Its utility for network fees and trading discounts further reinforces consistent long-term demand compared to other major tokens. Derivatives data shows rising open interest, hinting that market participants expect further appreciation rather than short-term speculation alone.

Short-Term Outlook And Price Catalysts

If the current momentum persists, BNB could approach $1,500 sooner than anticipated. The sharp increase in trading volume signals that liquidity is returning to top-tier assets. Should a pullback occur, the previous low near $1,077 may serve as support rather than a sign of weakening sentiment. Additional catalysts could emerge from upgrades to BNB Chain infrastructure, new partnerships, or broader macro shifts that continue favoring digital assets.

With liquidity improving, strong on-chain utility, and Binance actively mitigating disruptions, BNB is well positioned to remain a leader in the ongoing market rebound.