TL;DR

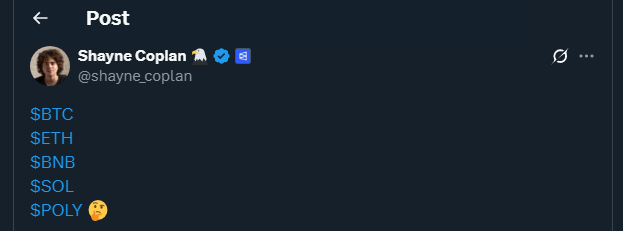

- Polymarket’s founder, Shayne Coplan, posted a mysterious message listing major crypto tickers alongside “$POLY,” igniting speculation about a potential native token.

- The timing coincides with a $2 billion investment from Intercontinental Exchange (ICE), valuing the firm at $9 billion.

- A potential “POLY” token could mark Polymarket’s evolution toward a broader Web3 ecosystem, with enhanced governance and user incentives.

A brief message from Polymarket’s 26-year-old founder, Shayne Coplan, has set off intense discussion across the crypto industry. In a post shared on X, Coplan simply wrote “$BTC, $ETH, $BNB, $SOL, $POLY,” without further context. The subtle inclusion of “$POLY” immediately drew attention, prompting speculation that Polymarket may be preparing to introduce its own native asset.

Market observers were quick to interpret the move as more than coincidence. For many, the addition of “$POLY” among top-tier tokens seemed like a deliberate hint. Traders and analysts have suggested that the rumored token could serve as a mechanism for governance, reward loyal users, or facilitate liquidity within the platform’s markets. The cryptic tone of Coplan’s post only intensified curiosity, amplifying engagement from both retail and institutional participants.

Strategic Timing And Institutional Backing

The speculation comes at a crucial moment for Polymarket. Just days before the post, Intercontinental Exchange (ICE), parent company of the New York Stock Exchange, announced a $2 billion investment in the startup, placing its valuation near $9 billion. This massive endorsement not only strengthens Polymarket’s credibility but also signals growing institutional interest in prediction markets built on blockchain infrastructure.

Founded in 2020, Polymarket has become one of the leading platforms allowing users to trade outcomes of real-world events, from elections to sports results. With over $19 billion in total trading volume reported by DeFiLlama, the company has already achieved regulatory approval from the U.S. Commodity Futures Trading Commission (CFTC), setting it apart from competitors still navigating compliance hurdles.

A Potential Step Toward Web3 Expansion

In addition to ICE’s backing, Coplan revealed that Polymarket previously raised $205 million in two funding rounds led by Founders Fund and Blockchain Capital, with participation from Coinbase and Point72 Ventures. Such deep-pocketed support reinforces the likelihood of further expansion, possibly including a native token designed to empower users.

If a “POLY” token does emerge, it could transform Polymarket’s structure from a prediction hub into a broader Web3 ecosystem centered on community participation and decentralized governance. While the post remains ambiguous, it has already reignited optimism in the crypto sector, proof that even a few words from the right founder can shift market attention overnight.