TL;DR

- BNB surged to a record $1,114.67 as a short squeeze and network fee reductions boosted activity on the BNB Chain.

- Over $7.7 million in short positions were liquidated, accelerating the rally.

- The token’s market cap now exceeds $154 billion, with monthly active users doubling to more than two million, while anticipation of a potential U.S. spot BNB ETF further contributed to increased demand.

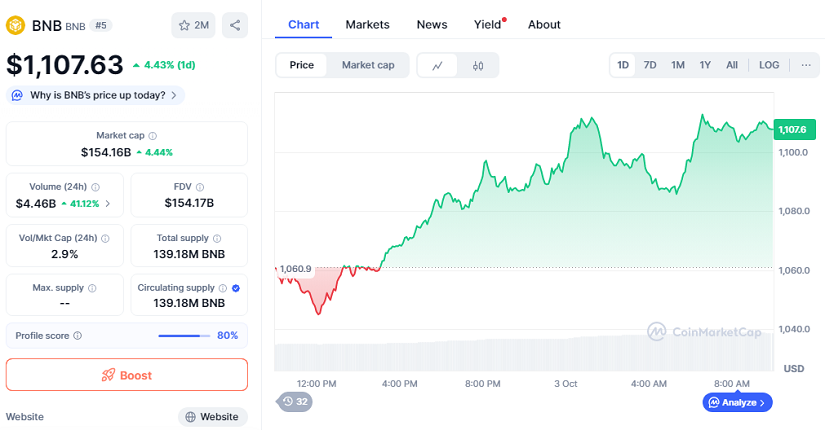

BNB extended its dominance among top cryptocurrencies Friday, reaching $1,107.63 at the time of publication. The rally is supported by a reduction in BNB Chain transaction fees to just $0.005, which has drawn more users and developers. The token’s 24-hour gain sits at 4.43%, with a trading volume spike of 41% reaching $4.46 billion. Social media chatter and community-led initiatives also helped maintain momentum, highlighting BNB’s growing visibility in global crypto discussions.

Market analysts attribute part of the upward move to a $7.7 million liquidation of short positions, which triggered a strong short squeeze. BNB’s weekly performance now reflects a 17.2% gain, significantly outperforming peers including Bitcoin, Ethereum, XRP, and Solana, while Dogecoin experienced minor losses.

Network Upgrades Drive Stronger User Adoption And Developer Activity

Recent initiatives like the Aster perpetual futures exchange and PancakeSwap decentralized exchange have fueled new capital inflows, increasing stablecoin supply on BNB Chain by nearly $2 billion in just two weeks. This surge in activity has contributed to a broader perception of BNB as a valuable digital asset beyond typical utility purposes. Analysts note that the token’s market behavior now reflects both strong technical momentum and growing investor confidence. Market participants are increasingly exploring BNB-based products, signaling long-term engagement across multiple sectors.

Speculation Around U.S. Spot ETF Adds Fuel To Rally

Speculation about a potential U.S. spot BNB ETF has also attracted attention from institutional investors. The combined effect of lower fees, network upgrades, and ETF anticipation is reinforcing BNB’s role as a treasury and investment asset. While the RSI indicator nears overbought territory, suggesting possible short-term pullbacks, analysts remain bullish on the token’s medium-term prospects.

Dean Chen of Bitunix highlighted that market sentiment remains optimistic, especially if BNB can maintain support in the $1,000 to $1,084 range. Long-term performance will largely depend on continued upgrades, developer adoption, and global regulatory clarity, particularly from the SEC.

With strong fundamentals and heightened trading activity, BNB continues to solidify its position as a leading digital asset, attracting both retail and institutional investors seeking exposure to the expanding BNB ecosystem.