TL;DR

- Bitcoin is edging toward $117,000 after several days of steady gains, driven by renewed institutional bidding.

- Gold has simultaneously reached fresh all-time highs, prompting traders to interpret both rallies as a convergence between traditional and digital stores of value.

- Analysts warn that a clean reclaim of the $117,500 zone may trigger an aggressive move toward uncharted territory before month-end.

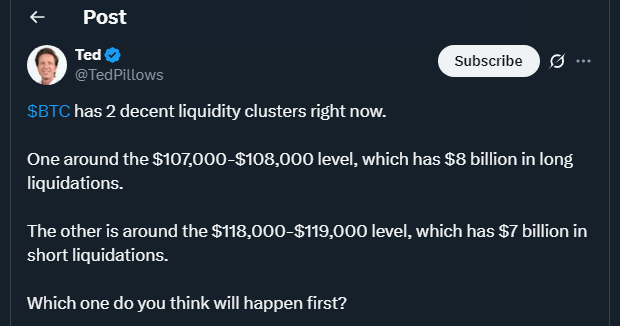

Bitcoin continues to reinforce its status as a digital alternative to gold while the BTC/USD pair advances despite ongoing warnings about pending liquidations across exchange order books. Recent data shows that price action has consistently held key support levels even as retail leverage increases, a structure that often precedes sharp extensions when late-positioned traders get forced out of the market. Some trading desks report that spot buyers are now more dominant than futures participants, a sign of healthier market structure compared to previous speculative cycles.

Multiple chart watchers point to the $117,500 cluster as a technical inflection point. A decisive breakthrough could open the path toward the $120,000 region, historically known for attracting large-scale profit-taking. So far, bearish pressure has remained muted, surprising even those who expected a prolonged consolidation after a strong third-quarter close. Seasoned traders argue that the current setup resembles early breakout phases seen during previous moments, where initial resistance zones eventually gave way to exponential upside.

Derivatives desks note a rapid increase in volume, particularly in contracts targeting prices above $125,000 before month-end. That buildup suggests a portion of the market is pricing in continuation rather than retracement. Should this momentum persist, volatility could accelerate within hours, rewarding early entries positioned for trend expansion. Options traders highlight a growing preference for longer-dated calls, indicating that investors are no longer viewing $100,000 as a distant milestone but rather as confirmed support.

Gold Rally Surpasses Market Projections

Gold’s surge beyond $3,800 per ounce has reignited comparisons between both assets. The long-standing debate over whether Bitcoin can function as a protective asset alongside precious metals gains credibility each time both instruments push upward in tandem, rather than competing for capital flows. Portfolio managers who once dismissed Bitcoin on grounds of volatility now argue that its asymmetric returns justify strategic exposure when inflation expectations remain elevated.

Institutional Rotation Strengthens

Funds dedicated to digital assets report steady inflows since the start of the week, with capital arriving from portfolios typically restricted to physical commodities. If this rotation extends further, markets may witness a phase in which gold holds elevated territory while Bitcoin absorbs the bulk of speculative appetite.