October could include updates on several XRP ETF filings, as the SEC is expected to decide on multiple applications. Some Ripple supporters believe approvals could occur, which they say may influence sentiment around XRP into Q4 2025.

Separately, some traders have pointed to newly launched tokens and early-stage projects as higher-risk areas of the market, including DeepSnitch AI. Project materials describe the network as a tool intended to provide real-time analytics for market participants.

Some online commentary has suggested substantial upside for the token, although such projections are speculative and may not reflect eventual market outcomes. Below is a summary of the main narratives cited by supporters of the project.

The XRP price outlook ahead of potential ETF decisions

The crypto market’s recent surge has bolstered XRP’s ongoing recovery over the past few days. Ripple had dropped on September 22, falling below the $3 mark after a market-wide liquidation event. Bitcoin had tanked, sending the rest of the crypto market down.

Some feared that XRP would remain bearish. However, the token’s recent performance is showing signs of improvement. As of September 30, XRP was trading $2.86 following a 0.14% increase over the past week. XRP’s 30-day charts also show a 1.13% increase.

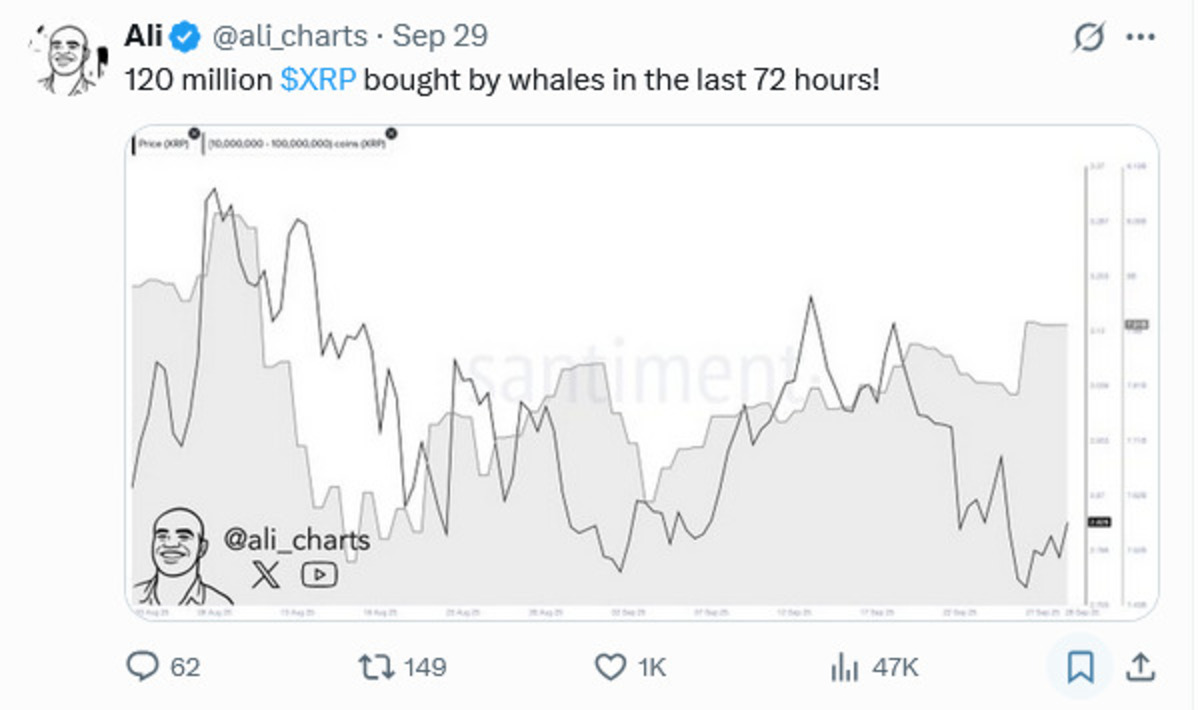

One factor some market participants cite in support of XRP is its whale activity. Between September 26 and 29, whales acquired 120 million XRP tokens. The new acquisition came days after XRP’s price drop, prompting discussion about whether a broader rally could follow.

Some traders are also watching the SEC’s timetable for XRP ETF-related decisions. This could include a GrayScale ETF decision on October 18, a WisdomTree XRP fund decision on October 25, and a final decision on the Franklin Templeton XRP ETF on November 14.

Against that backdrop, some commentators have floated higher year-end price targets. These scenarios remain uncertain and depend on multiple market and regulatory variables.

DeepSnitch AI: project claims around AI-driven crypto analytics

Early-stage tokens can be volatile, and access, liquidity, and information can vary widely across projects. DeepSnitch AI is described by the project as an effort to provide faster analytics to a broader set of traders.

According to the project, its AI agents monitor on-chain data in real time, including large-wallet activity and contract deployments. Supporters say these tools could help users identify potential risks such as suspicious contract configurations or weak liquidity conditions, though such monitoring does not eliminate trading risk.

Project descriptions also state that the product aims to convert blockchain activity into simplified signals, rather than requiring users to rely on social-media discussion. The effectiveness of any such signals, however, is difficult to evaluate independently without access to the underlying methodology and performance data.

More broadly, some investors believe AI-related crypto projects may see increased attention, a view reflected in discussion around tokens such as Render, Story, and ICP. Whether that theme persists depends on market conditions and project execution.

DeepSnitch AI is also conducting a fundraising token sale, which the project says is staged. Terms, pricing, allocation, and timelines are subject to change and should be reviewed directly in official project materials.

Bitcoin’s momentum remains high as BTC holds at $113k

Bitcoin has drawn attention following its recent recovery over the past few days. Trouble for Bitcoin started in the fourth week of September as the market crashed. A few days ago, Bitcoin was down to $109,000, its lowest point in five weeks. However, bitcoin’s momentum has picked up, which has improved market sentiment.

As of September 30, Bitcoin was trading at $113,488. Bitcoin’s 30-day chart shows a 4.11% increase.

Some market participants expect continued strength over the next few weeks, although price moves are uncertain. Sentiment has also been linked to the growth of BlackRock’s iBit holdings, which some interpret as supportive for demand. Any price targets, including $120,000 in December, remain speculative.

Cardano holders watch for a potential recovery in Q4 2025

The recent market recovery has done little to undo Cardano’s current bearish momentum. ADA mirrored the general market trend, falling on September 22. Before its fall, excitement around interest rate cuts had spurred a Cardano jump, with many believing ADA would return to $1.

As of September 30, ADA was trading at $0.7911 following a 3.72% jump over the past week. Cardano’s 30-day market charts also show a 4% drop.

Some commentators believe that further interest rate cuts in 2025 could affect broader risk-asset demand, including ADA. Price targets such as $1.2 are uncertain and depend on macro conditions and crypto-market sentiment.

Conclusion

Market focus has included the SEC’s expected decisions on XRP ETF filings, alongside broader shifts in Bitcoin and altcoin sentiment. In parallel, DeepSnitch AI has received attention in some trading communities as an early-stage AI-related project, with the project reporting fundraising activity in its token sale.

Return projections and “stage” marketing claims circulating online should be treated as speculative. Early-stage tokens can carry significant risks, including liquidity constraints, smart-contract vulnerabilities, and rapid price swings.

For reference, the project directs readers to its website: official token sale page.

Frequently asked questions

How do some market participants view XRP?

XRP is among the larger crypto assets by market capitalization, and it remains widely traded. Whether it is suitable for any individual depends on risk tolerance, time horizon, and the broader market and regulatory context.

What is driving interest in AI-related crypto projects?

Some investors cite the broader growth of AI tooling and on-chain analytics as a reason to watch AI-related tokens. However, outcomes vary widely across projects, and “theme” narratives do not guarantee performance.

How certain are XRP price forecasts tied to ETF decisions?

ETF-related news can affect sentiment, but approvals are not guaranteed and market reactions can be unpredictable. Any specific price target should be treated as speculative.

What should readers know about very large return projections?

Claims of extremely large returns are inherently uncertain and often rely on optimistic assumptions. Early-stage tokens can also face dilution, liquidity constraints, and execution risk, which can materially affect outcomes.

This outlet is not affiliated with the project mentioned. This article is for informational purposes only and does not constitute financial or investment advice.