TL;DR

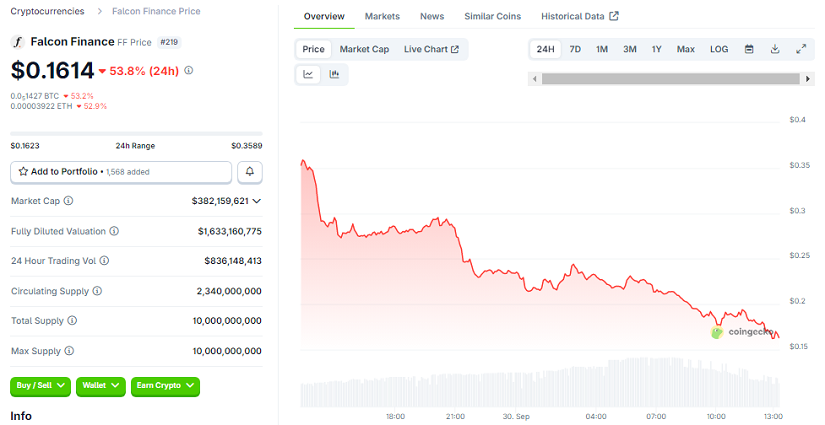

- Falcon Finance launched its FF token amid high expectations, but the debut ended with a sharp 53.8% decline over the past twenty-four hours, currently trading at $0.1614.

- Analysts detected massive sell-offs from influencers and alleged team members, sparking suspicion of a coordinated exit.

- Despite the crash, the project still maintains active fundamentals, holding a market cap of $382 million and a notable daily trading volume of $836 million.

After months of anticipation, Falcon Finance entered the market with its FF token, positioned as the governance pillar of its stablecoin ecosystem. Instead of triggering excitement, early trading turned chaotic, with heavy selling pressure wiping out more than half of the token’s value in a matter of hours. The distribution structure raised eyebrows among traders who expected a broader allocation. While many users reported delayed airdrop claims, a noticeable number of wallets tied to key opinion leaders and ecosystem partners received full access from the start, accelerating price erosion.

Selling Pressure Targets Market Confidence

The suspicion of team involvement in the sell-off came as several large wallets liquidated their positions shortly after listing. With FF briefly touching 0.75 dólares before crashing to 0.17, analysts tracked unusually synchronized exits across both centralized and decentralized venues. Even with market makers active, liquidity on some pools dropped to as low as 8K, allowing aggressive sellers to dictate price direction. The current 24-hour performance of negative 53.8 por ciento has intensified doubts regarding internal coordination, particularly given the sudden shift from optimistic messaging to silent damage control.

Adding fuel to the controversy, the launch deviated from previously announced tokenomics. A smaller-than-expected portion of FF was distributed to early users, while allocations within the Kaito network appeared disproportionately larger. This imbalance left retail participants disadvantaged, unable to access their tokens until much of the initial rally had already been sold off. Despite comparisons to past airdrops like ASTER that saw sustained appreciation, FF holders showed little appetite for long-term positioning.

Long-Term Potential Still in Play

Yet dismissing Falcon Finance entirely may be premature. The project retains backing from influential entities such as World Liberty, which injected 10 millones de dólares earlier this year. Founder Andrei Grachev remains publicly active, recently confirming attendance at the Token2049 event in Singapore. The FF token also underpins USDf, a fast-growing stablecoin that surpassed 2 mil millones in supply during September. If USDf achieves broader exchange listings beyond decentralized platforms, demand for FF could logically follow.

For now, FF sits at 0.1614 dólares with a market capitalization of 382 millones and a daily trading volume of 836 millones. Whether the initial crash marks a classic capitulation or the start of distrust will depend on Falcon Finance’s willingness to address transparency concerns before liquidity dries up further.