Discussion around Solana price forecasts has picked up as some on-chain indicators point to continued network activity. Separately, some market commentary suggests that a portion of SOL holders are also exploring newer altcoins, including Remittix.

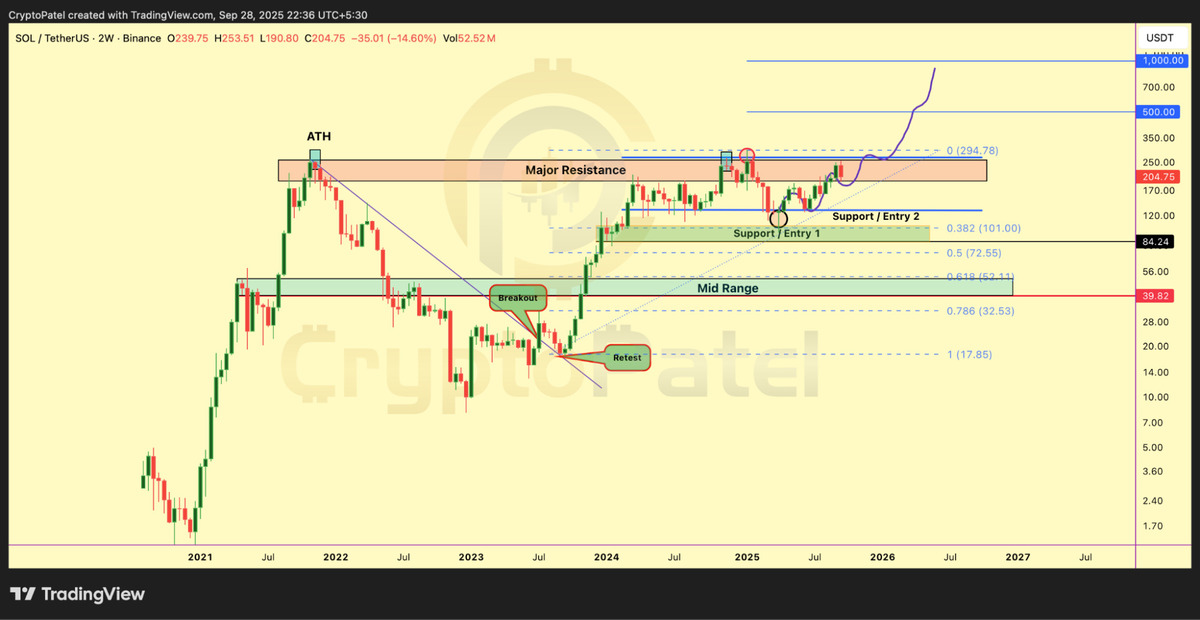

SOL is trading around $210 and has recently moved above prior technical levels. However, on-chain metrics such as active addresses, daily transaction volume and large-wallet activity can be interpreted in different ways and do not, on their own, confirm where capital is moving or predict future price action.

Solana Price Prediction: SOL’s On-Chain Strength vs. Price Weakness

While SOL’s price has struggled to sustain sharp moves, some on-chain metrics indicate continued usage. Transaction volume has increased this month, though comparisons across networks depend on methodology and data sources.

Some analysts tracking large-wallet activity have noted accumulation in the $190–$200 range, which may indicate interest at those levels but does not guarantee support will hold. Total value locked (TVL) and DeFi activity on Solana have also ticked upward in recent reports, even as price remains range-bound.

Solana price forecast models still cite potential headwinds, including resistance around the $200 area, shifting leveraged positioning, and uncertainty around potential regulatory treatment of crypto investment products. Some public forecasts have included scenarios that reach as high as $350 by Q4 2025, but any such figures are speculative and should not be treated as predictions.

Remittix: project claims drawing interest from some SOL holders

Remittix is being marketed as a payments-focused (“PayFi”) project aimed at connecting crypto services with traditional banking rails. Claims about adoption or capital rotation among SOL holders are difficult to verify from on-chain data alone, particularly across multiple chains and venues.

Some commentators have described the project as “XRP 2.0 for payments.” According to project materials, it has a beta wallet and has announced exchange listings, though readers should treat such announcements as project-reported until independently confirmed.

Why Remittix is being discussed

- The project says it is building payment infrastructure rather than a purely speculative token.

- The project claims support for crypto-to-bank payouts in 30+ countries.

- The project states it has undergone audits and references CertiK in its security materials.

- The project has publicized centralized-exchange listing plans.

It is important to distinguish between network-level metrics for Solana and project-level claims from a separate token project; they involve different data, risks, and maturity levels.

Token sale and marketing incentives

Remittix is running a token sale. The project reports that it has raised more than $26.8 million and has more than 40,000 holders, but these figures are project-reported and not independently verified here.

The project also describes marketing incentives such as referral rewards and promotions. As with similar programs, terms can change and participation may involve financial risk.

Project links (for reference):

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

This outlet is not affiliated with the project mentioned. This article is for informational purposes only and does not constitute financial or investment advice.