Chainlink’s price is back in focus as market commentators debate how far LINK could move in a future market uptrend. After years of building infrastructure for decentralised data and oracle networks, Chainlink remains widely used in crypto applications.

One question raised in 2026 discussions is whether momentum and adoption could take LINK to the $100 level, or whether market attention will continue shifting to newer projects. One example frequently mentioned in promotional materials is Remittix (RTX), which presents itself as a crypto-to-fiat payments project.

Is Chainlink’s Upward Trend Built to Last?

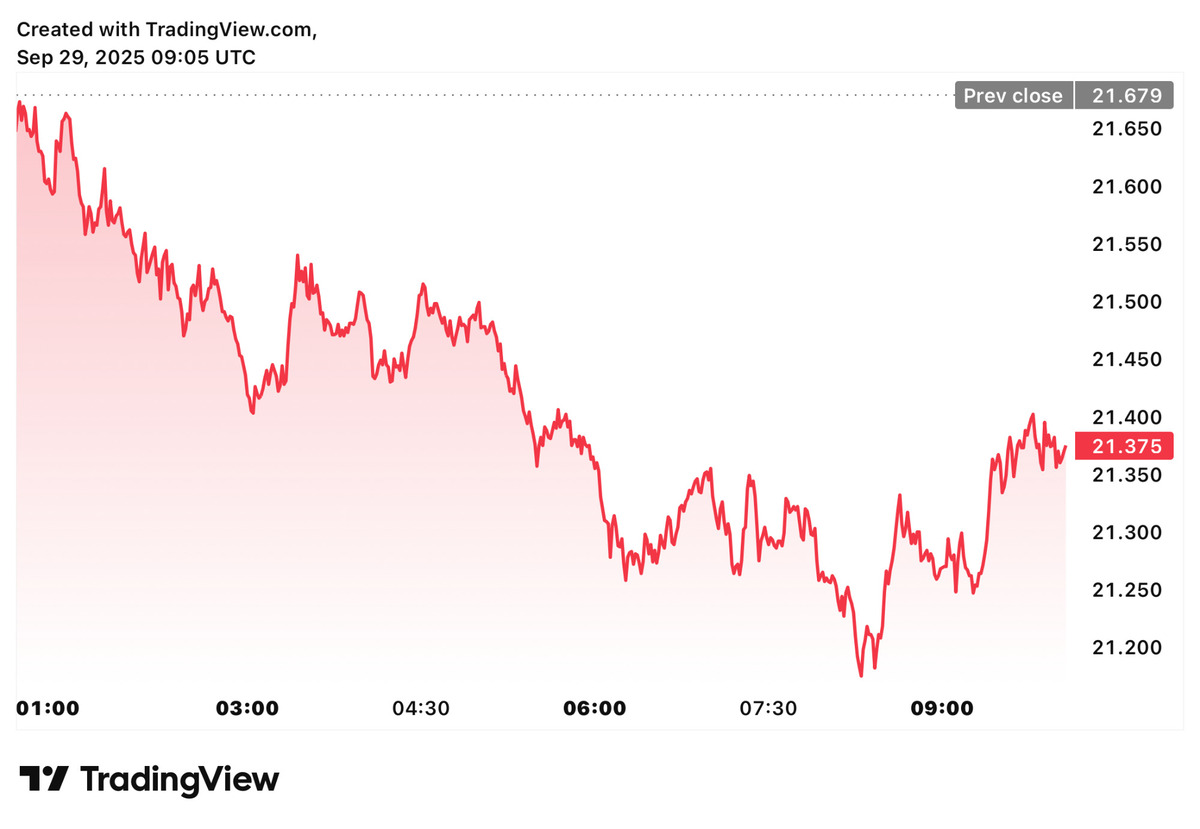

The Chainlink price trades around $21.38, more than double its 2024 low. Chainlink’s push into real-world asset tokenization, increased demand for secure data feeds and a rise in DeFi activity are commonly cited as drivers of this move.

Some analysts have floated scenarios in which LINK reaches $50 by mid-2025 and potentially revisits the $100 level by the end of 2026. These figures are speculative and depend on broader market conditions.

Still, not all commentators are convinced. Some point out that LINK’s upside may be more limited than smaller, early-stage tokens. As a more established infrastructure asset, Chainlink’s growth could be steadier rather than rapid.

Remittix and PayFi claims around real-world payments

Separate from LINK, Remittix (RTX) is marketed as an Ethereum-based PayFi project that aims to route crypto payments to bank accounts in multiple countries, using real-time FX rates and without requiring a centralised exchange for certain steps. The project says it targets use cases such as freelancers, businesses and international transfers.

Project materials highlight the following points:

- A focus on payments as a consumer-facing use case.

- The project says it has raised over $26.8 million (a figure that has not been independently verified in this article).

- A wallet beta that the team says is available for testing.

The project also states that it has undergone a CertiK review and references CertiK Skynet. As with any third-party review, this should not be treated as a guarantee of security or performance. The project has also promoted marketing incentives such as referral programmes.

More broadly, PayFi efforts typically aim to connect crypto rails with traditional payment systems. Whether any specific product achieves adoption depends on execution, regulatory considerations and user demand.

Summary: LINK price scenarios and separate project claims

The Chainlink price outlook is frequently discussed with $100 presented as one possible long-term level in some forecasts, but outcomes remain uncertain and market-dependent. Claims made by newer payment-focused projects should be evaluated independently and with appropriate caution.

Project links (for reference):

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

This article contains information about a cryptocurrency token sale. This outlet is not affiliated with the project mentioned. This article is for informational purposes only and does not constitute financial or investment advice.