Global finance is changing as banks test blockchain-based payment rails and crypto projects explore more regulated financial services.

Below is a high-level comparison of three projects discussed in this context: Digitap ($TAP), Remittix, and BlockDAG. This overview is descriptive and does not assess suitability for any individual investor.

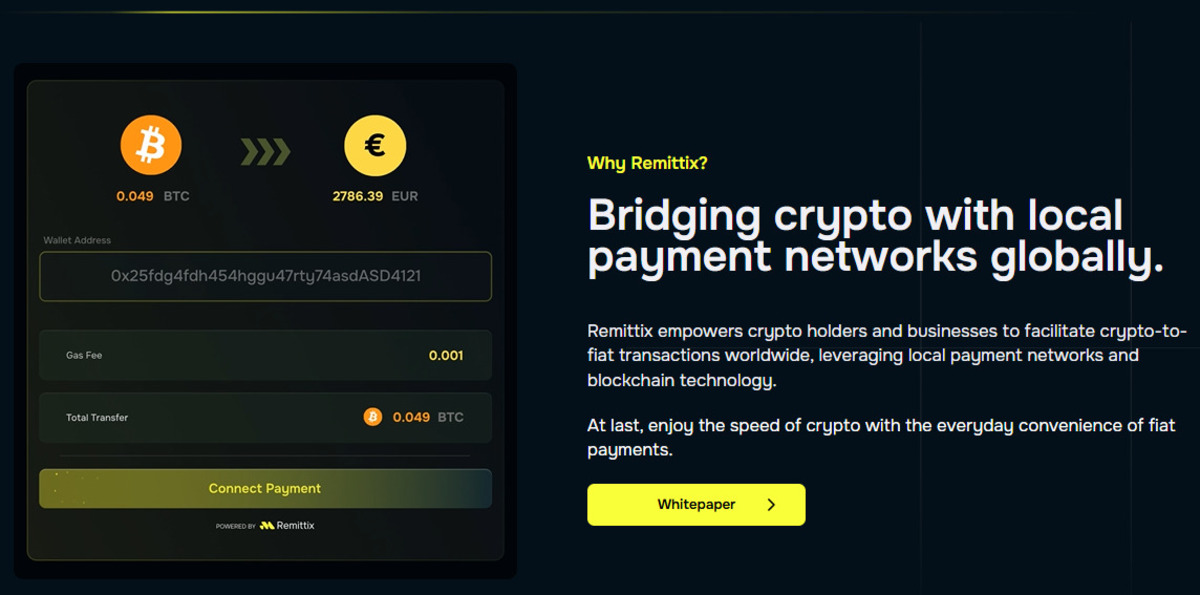

Remittix: Remittances and Crypto-to-Fiat Settlement

Remittix is a payments network targeting the remittance market, which is often cited as exceeding $860 billion annually. Its model, as described by the project, allows users to pay in crypto while recipients receive fiat in bank accounts.

Use cases commonly discussed for this category include migrant workers sending money to families or remote workers paid in stablecoins. In general, services in this segment aim to reduce friction and fees when moving funds into bank accounts. Remittix appears focused primarily on remittances rather than offering a broader suite of consumer banking features.

BlockDAG: Infrastructure for Application Developers

BlockDAG is positioned as an infrastructure layer for building financial applications. According to project descriptions, it uses directed acyclic graph technology rather than a traditional single-chain blockchain design, with the goal of enabling parallel transaction processing.

This is presented as a technical approach intended to improve throughput and efficiency for certain workloads. In practice, infrastructure projects typically depend on developer adoption and the availability of applications and integrations built on top of them, which can affect real-world usage.

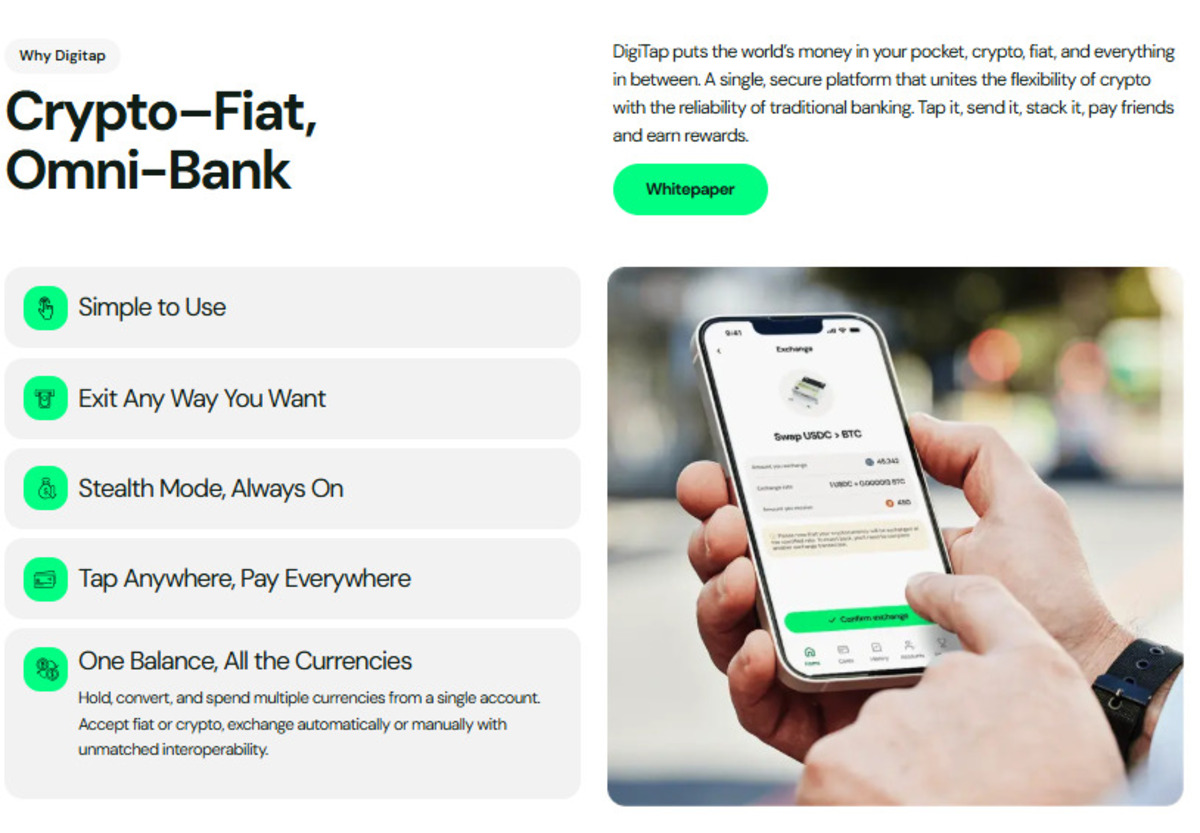

Digitap: A Consumer-Facing Finance App

Digitap is presented as a consumer-facing product that seeks to combine crypto and traditional payment methods within a single interface. In project materials, this is described as an effort to reduce friction between fiat and crypto for transfers and payments.

The project states that its app is available on iOS, Android, and desktop, and that it supports functions such as deposits, withdrawals, transfers, exchanges, and payments. This positioning differs from a remittance-only focus and from infrastructure-first projects that primarily target developers.

Digitap also describes a “multi-rail” approach that can route transfers through established banking networks (such as SWIFT, SEPA, or ACH) as well as blockchain rails. Actual availability, pricing, settlement speed, and geographic coverage can vary by jurisdiction and provider relationships.

Summary: Different Models, Different Risks

These three projects reflect different approaches: Remittix focuses on remittance-style payments, BlockDAG is positioned as an infrastructure layer for builders, and Digitap presents itself as a consumer-facing finance app that integrates multiple payment rails.

Digitap also references a token sale for $TAP in its materials. Any token pricing, sale stages, timelines, and related terms are subject to change and should be verified directly with primary sources and applicable disclosures.

Project website (for reference): https://digitap.app

This article is for informational purposes only and does not constitute financial or investment advice. This outlet is not affiliated with the project mentioned. As with any initiative within the crypto ecosystem, readers should do their own research and consider the risks involved.