Token sales are often used by crypto projects to raise funds ahead of, or alongside, product development. Four names that have recently drawn attention in this context are Digitap ($TAP), Remittix (RTX), Solaxy (SOLX), and Neo Pepe (NEOP). Project materials and community posts describe different approaches: Remittix has reported raising $26 million, Solaxy has traded lower since launch, and Neo Pepe emphasizes meme culture alongside governance features.

This article summarizes publicly stated claims and commonly discussed features for each project. It is not a ranking and does not imply that any token is likely to perform better than others.

Digitap: “Omni-bank” positioning and stated product features

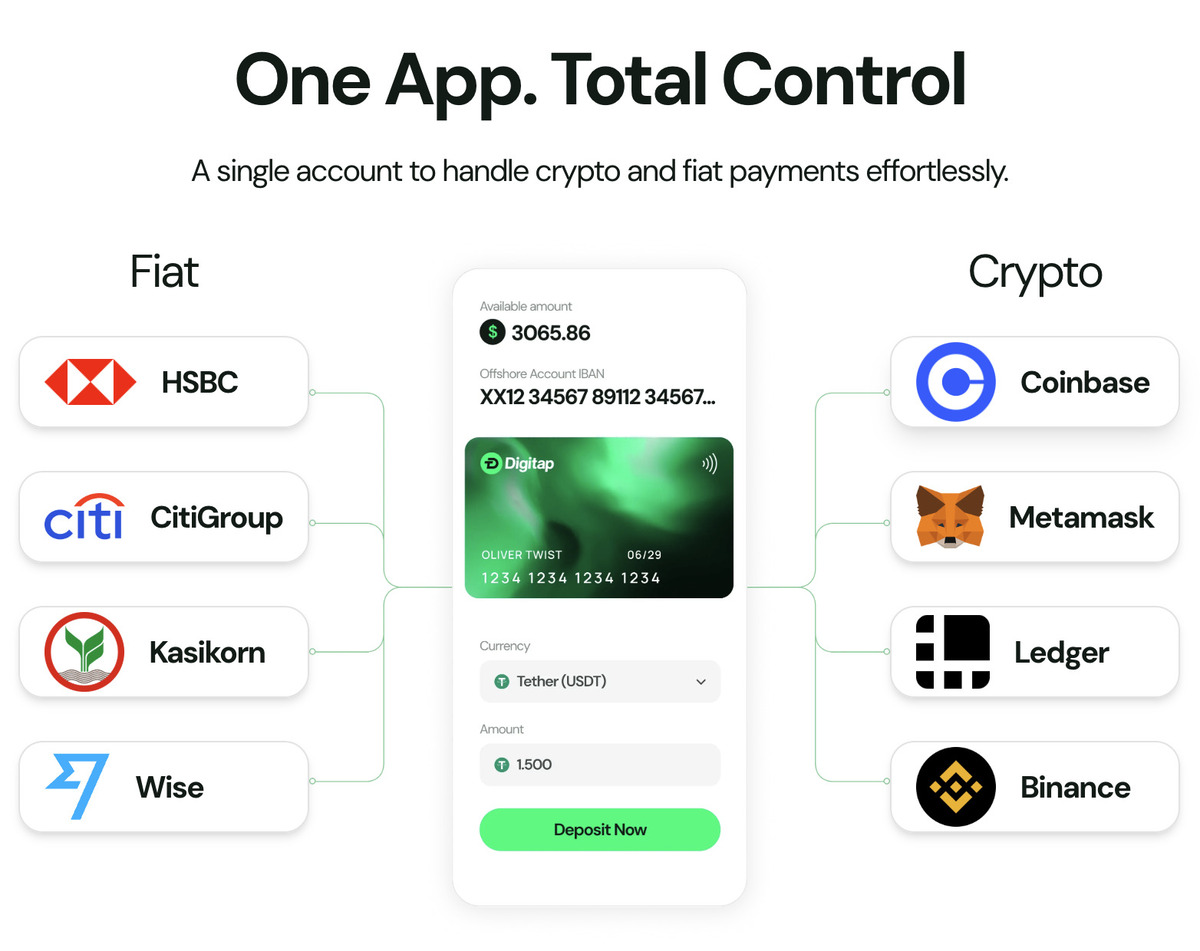

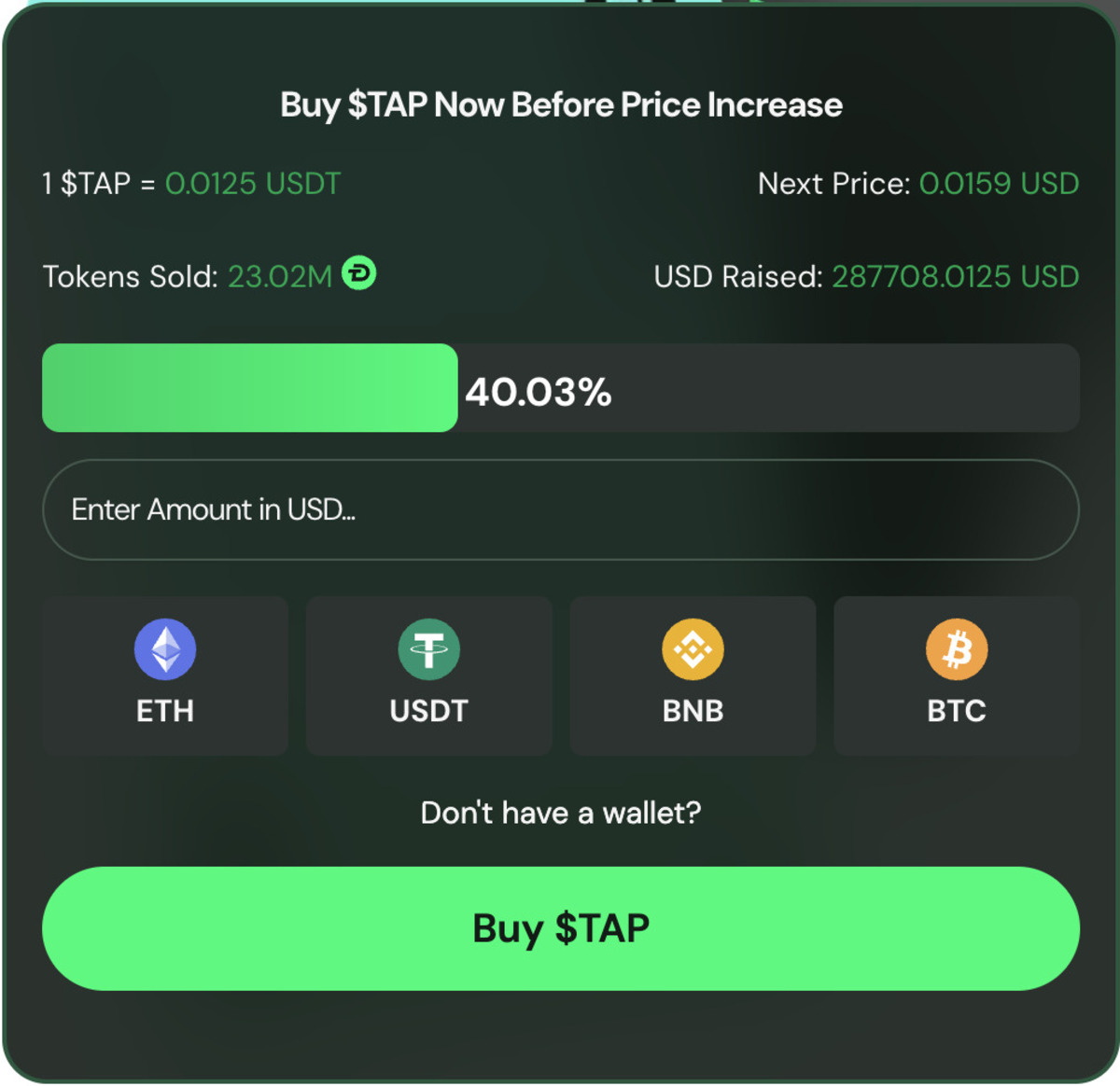

Digitap describes itself as an “omni-bank” intended to bring crypto and traditional currency (“fiat”) functions into a single interface. According to the project, it offers a money app where users can manage crypto and fiat side by side.

The project states that its app is available on desktop and mobile, with features such as deposits, withdrawals, swaps, and spending functionality. These are project-reported claims and readers may wish to verify availability, supported regions, and applicable terms independently.

Digitap’s token, $TAP, is described by the project as being tied to user incentives such as cashback and discounts, and may also be used in governance processes.

Project documentation also references mechanisms intended to reduce circulating supply (often described as “burn” mechanics). Details and real-world effects of such mechanisms can vary by implementation and are not guarantees of future price behavior.

Digitap also frames its approach as balancing compliance requirements with user privacy. References to offshore accounts and “selective anonymity,” where mentioned by projects, can involve significant legal and regulatory considerations depending on jurisdiction.

Remittix: remittance-focused payments narrative

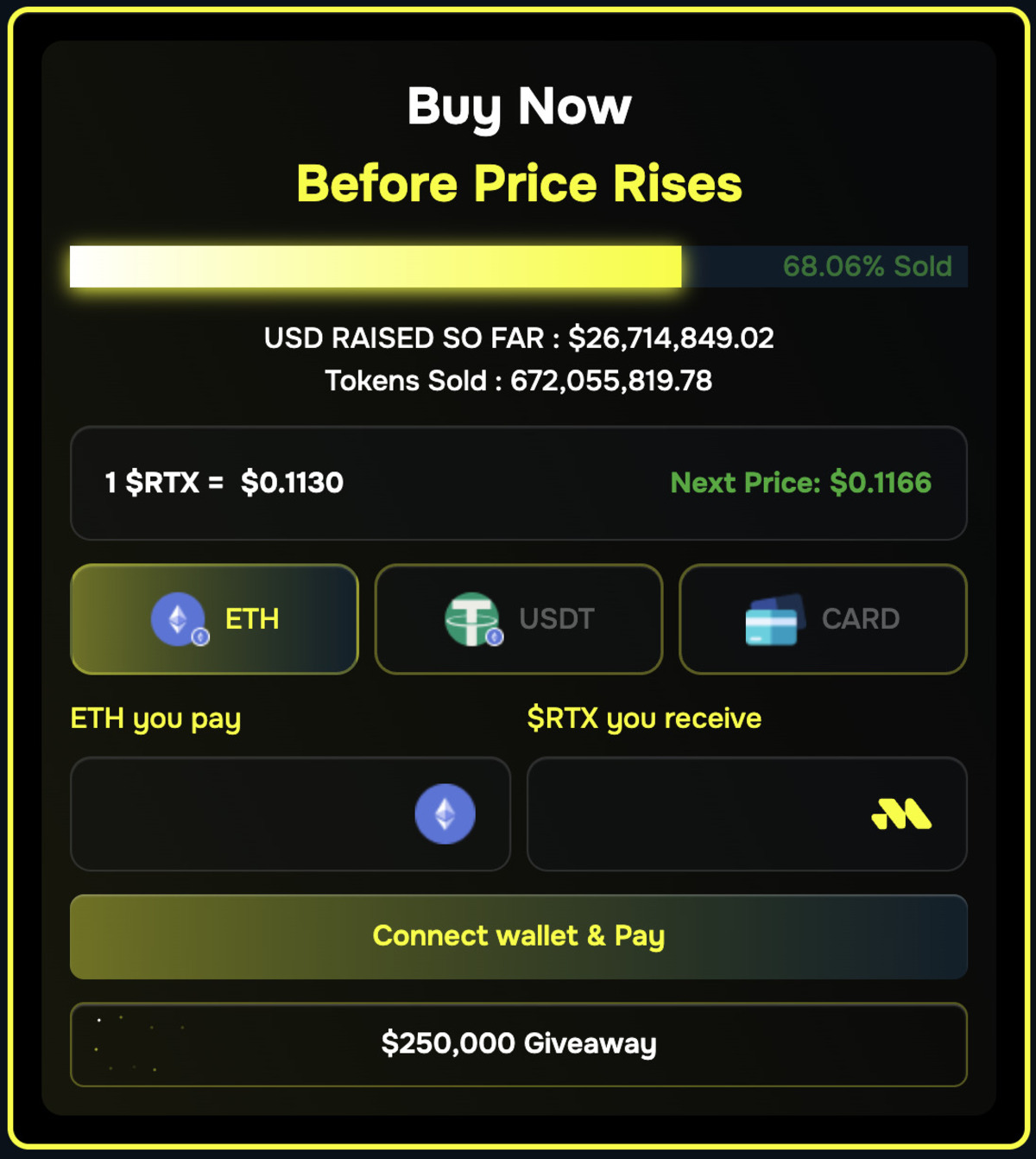

Remittix has reported raising $26 million in its token sale. The project positions itself within payments and remittances, stating that users can send crypto while recipients receive fiat in a bank account, without needing to use an exchange.

Remittix also highlights multi-chain wallet support and fee transparency in its messaging, aiming at cross-border payments use cases.

Remittix and Digitap both describe efforts to connect crypto and fiat rails, but with different scopes in their stated goals. Remittix emphasizes remittances, while Digitap presents itself as a broader consumer finance product.

Remittix marketing materials have referenced staged token-sale pricing. Any token-sale pricing, future rounds, or stated valuations are subject to change and do not indicate future market performance after a token begins trading.

Solaxy: Solana scaling thesis and post-launch price moves

Solaxy is presented as a project focused on addressing Solana network constraints such as congestion, failed transactions, and scaling limits.

The project describes using rollups and off-chain processing to bundle activity, a design that is commonly discussed as a way to reduce costs and increase throughput for certain applications.

Solaxy is no longer in a token-sale phase, and SOLX has traded on exchanges. The article’s earlier reference to an 82% decline reflects a comparison between stated launch pricing and later market prices, which can change quickly in either direction.

As of the referenced snapshot, SOLX hovers around $0.000318. Short-term price changes (including weekly moves) may reflect liquidity, broader market conditions, and project-specific news, and they are not a reliable basis for forecasting.

Neo Pepe: meme branding with governance and fee mechanics

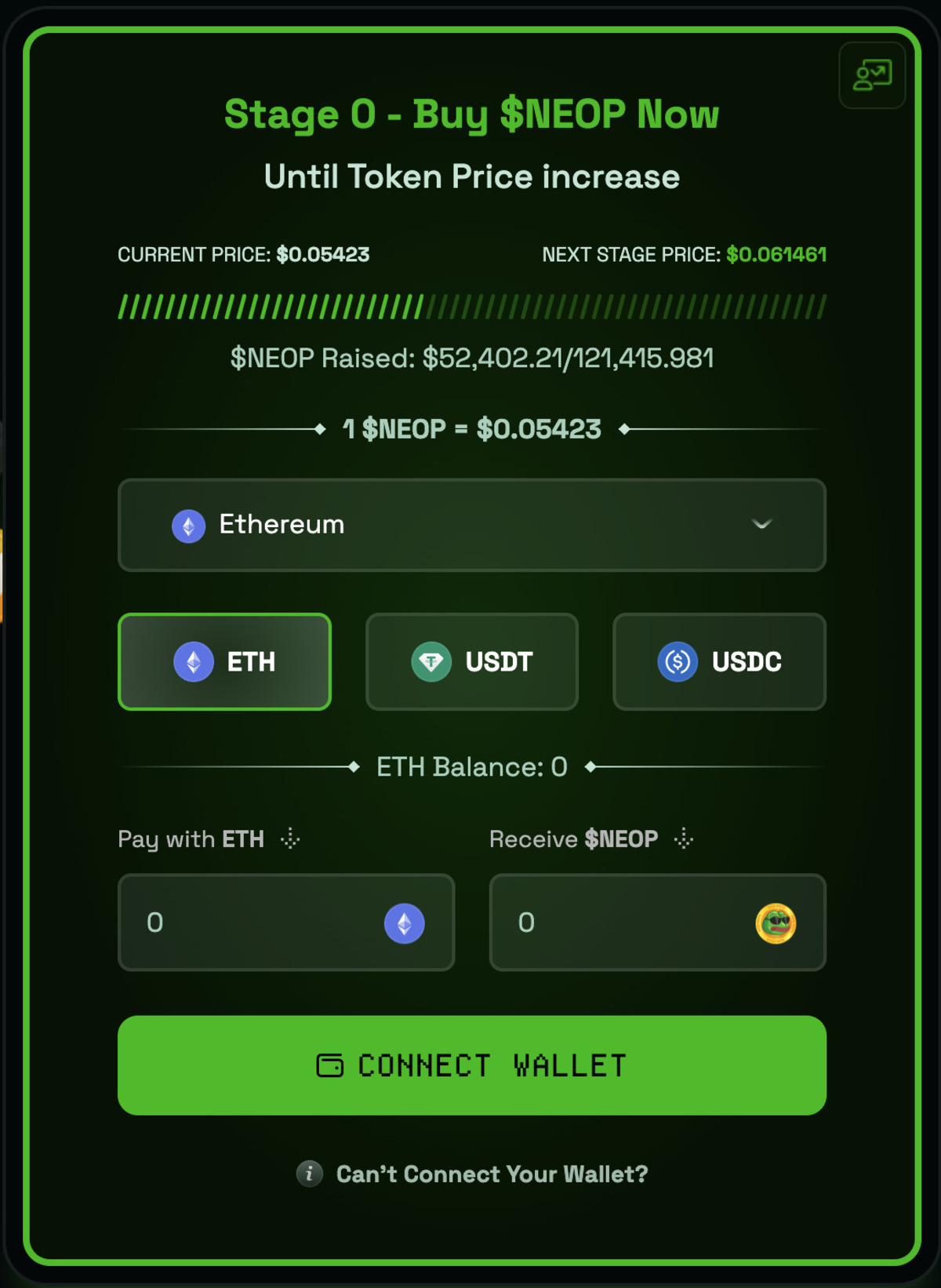

Neo Pepe has described a staged token sale with different price levels per stage, alongside reported fundraising totals and token allocation progress. These figures are project-reported and should be verified via primary sources.

Beyond meme branding, Neo Pepe highlights governance features, stating that holders can vote on items such as listings, treasury decisions, and protocol changes.

The project also references trade fees and liquidity-related mechanics, including liquidity-pool (LP) token burning. These mechanisms can be complex, and their implications depend on execution and market conditions.

Neo Pepe has also discussed cross-chain support (such as Ethereum, BSC, and Base), which can affect accessibility and technical risk profiles.

Key differences discussed by the projects

Across these four names, the main differences emphasized in public messaging are:

Digitap frames itself as a broader consumer finance product connecting crypto and fiat.

Remittix focuses on remittances and payments.

Solaxy focuses on scaling and infrastructure around Solana-related use cases.

Neo Pepe combines meme branding with governance and fee mechanics.

Digitap’s marketing has also referenced token-sale participation levels (such as tokens sold and funds raised). These figures, where cited, are not independently verified here and may change over time.

Where to find project information

Readers looking for primary sources can review the project’s public materials directly:

Website: https://digitap.app

Social: https://linktr.ee/digitap.app

This article is for informational purposes only and does not constitute financial or investment advice. This outlet is not affiliated with the project mentioned. As with any activity in the crypto ecosystem, readers should do their own research and consider the risks involved.